The gold market is in a precarious position. The latest weekly gold survey suggests there is little optimism in the market.

In near-term analysis, Wall Street analysts remain slightly optimistic as they see the US dollar as overvalued; however, bearish sentiment among retail investors rose to a multi-year high.

Bearish sentiment emerged as the US dollar ended the week at a new 20-year high above 109 points.

Darin Newsom, president of Darin Newsom Analysis, said he remains optimistic that the gold market could attract some lucrative hunting. However, he added that the medium and long-term outlook looks bleak. He stressed that despite the increasing daily volatility in the gold market, the broader trend remains.

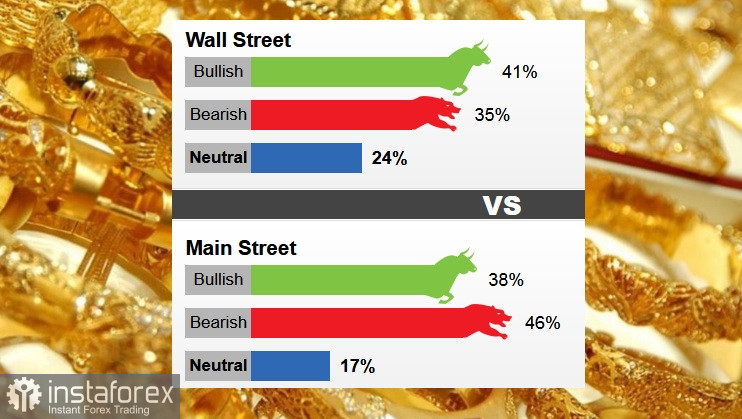

A total of 17 market professionals took part in a Wall Street poll last week. Seven analysts, or 41%, said they are bullish on gold this week. Six analysts, or 35%, said they were bearish. Four analysts, or 24%, said they were neutral about the precious metal.

As for retail, 898 respondents took part in online surveys. A total of 337 voters, or 38%, voted for gold to rise. Another 412, or 46%, predicted a fall in gold. While the remaining 149 voters, or 17%, were in favor of a side market.

However, some analysts are more optimistic. According to Colin Cieszynski, chief market strategist at SIA Wealth Management, the decisions on monetary policy of the Bank of Canada and the European Central Bank this week may focus on the US dollar.

The Bank of Canada will likely raise interest rates by either 50 or 75 basis points. In Europe, there are calls for the ECB to raise interest rates by 75 basis points.

Adrian Day, president of Adrian Day Asset Management, said the sale of gold below $1,700 is exaggerated. And he is optimistic about the prices of the precious metal because the euro may see some short-term bullish momentum.

Day added that in the long term, gold will regain its luster when investors realize that central banks around the world will not be able to bring down inflation. Both the Federal Reserve and the European Central Bank cannot bring inflation down to their target levels without triggering a severe recession. This will benefit gold.

On the bearish side, analysts note that gold is hovering at a very dubious level. If gold prices fall below $1,685, this could signal the end of a multi-year bull run.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română