How quickly time passes! It would seem that investors have recently discussed the idea of parity between the euro and the US dollar. In early autumn, a new parity with the US currency is on the agenda. This time we are talking about the pound. The event is of great importance because, unlike EURUSD, the GBPUSD pair has never fallen below 1 in its 200-year history. It was only in 1985 that it was close to it, but the agreement in Plaza Accord reversed the processes taking place at that time on Forex. What will happen this time?

Britain is the most telling example of a developed nation whose economy has slipped into stagflation. Consumer price growth is already measured in double digits, and according to the shocking forecasts of Goldman Sachs, it will reach 22% in 2023. In this scenario, the bank expects to see a 3.4% subsidence of the UK's GDP. Andrew Bailey and his colleagues also talk about a long recession for five quarters in a row. How could it be otherwise if the share of household energy expenditures increases from 12% of disposable income in 2021 to 41% in 2023.

Against this background, it is not surprising that investors want to get rid of British assets as soon as possible. Bond sales are proceeding at an accelerated pace, and the rise in yields should theoretically become a crucial growth driver for sterling, especially in conditions of increasing expectations for the repo rate, which, according to the futures market, will jump to 3.25%, if not at the end of this year, then at the beginning of next year.

Dynamics of GBPUSD and British bond yields

Alas, the profitability growing by leaps and bounds does not help the pound. The reason for this is the increase in the double deficit—the current account and the budget, which does not allow the GBPUSD bulls to raise their heads. Indeed, the first indicator rose to a record 8.3% of GDP already in the first quarter against the backdrop of an increase in the cost of imports, primarily due to fuel. But in those days, gas prices were not so high. It's only the beginning.

The intention of Liz Truss, the main favorite for the post of British Prime Minister, to reduce taxes is causing fear due to the widening budget deficit. Grandiose plans need to be funded by something. Most likely, London will be forced to issue more bonds, and problems with financial stability add a headache to the GBPUSD bulls.

Truss could take a tougher stance on the Northern Ireland Protocol to the Brexit deal than her predecessor, raising the risk of a trade war with the EU. Not surprisingly, Scottish Prime Minister Nicola Sturgeon calls her victory in the struggle for the status of leader of the Conservative Party a disaster for the UK. No matter how the risks of a new referendum on the independence of this country grow.

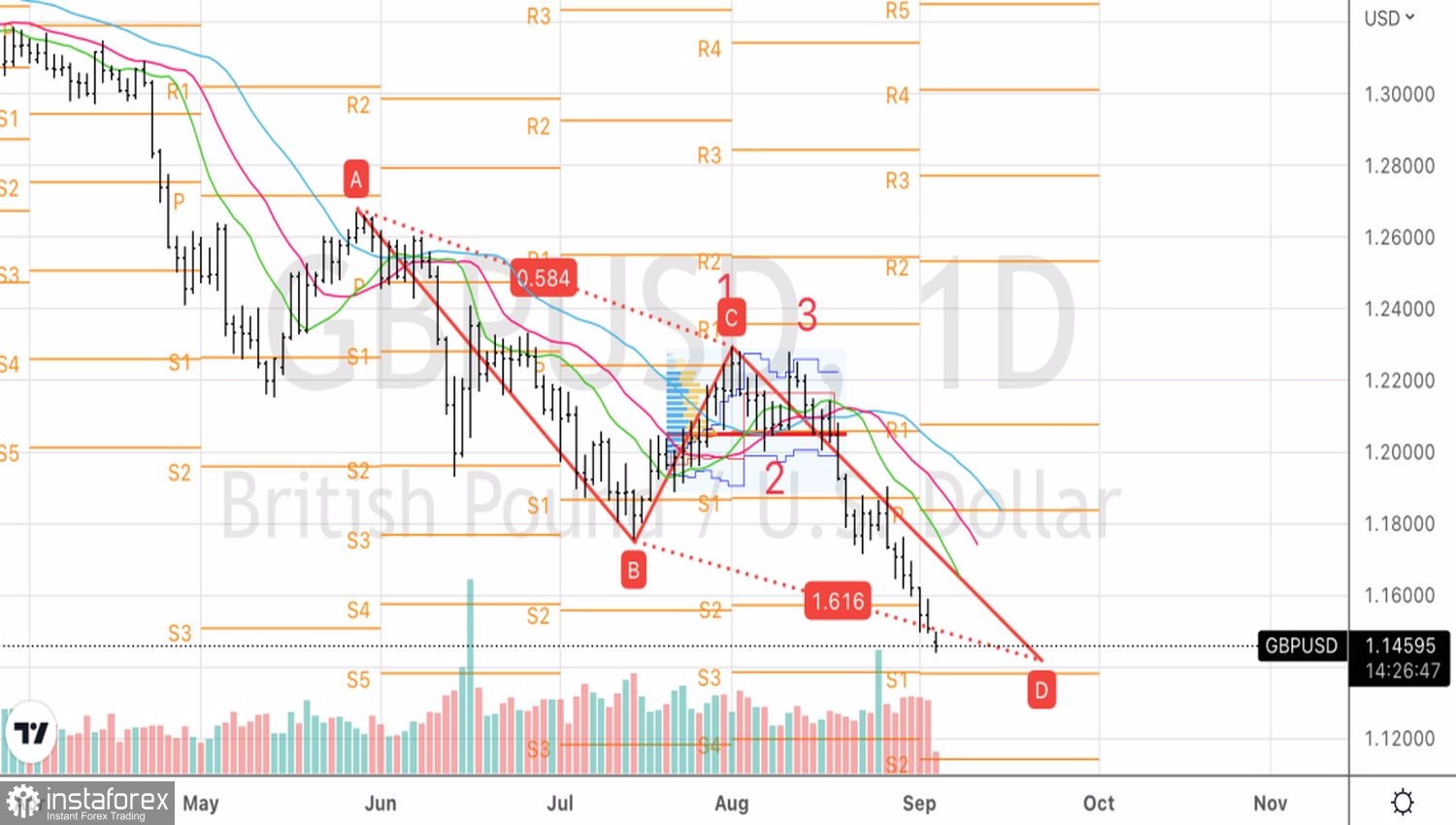

Technically, on the daily chart, GBPUSD quotes approached the previously designated target by 161.8% according to the AB=CD pattern by arm's length. It corresponds to the mark 1.14. As long as the pair is trading below the pivot point 1.158, we continue to adhere to the strategy of selling it on pullbacks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română