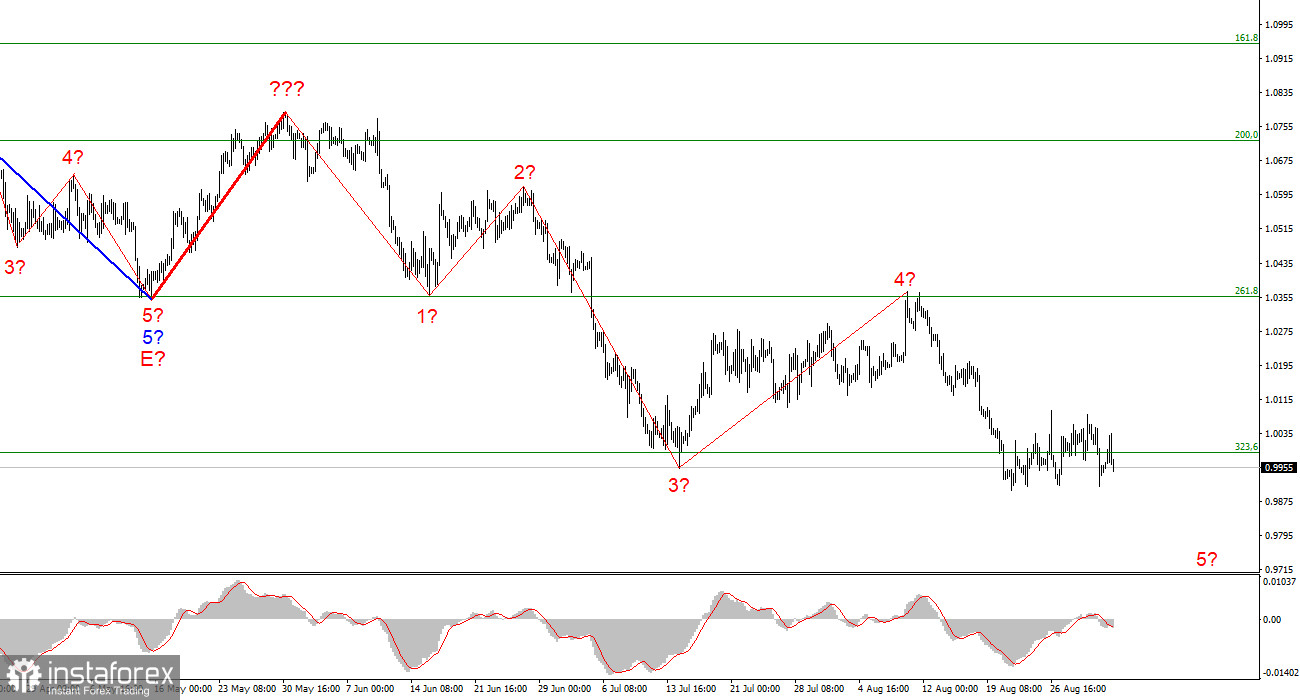

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, although wave 4 turned out to be longer than I expected, and now the construction of wave five is also delayed. The whole wave structure can become more complicated once again, but any structure can always take a more complex and extended form. There are no grounds to assume the completion of the downward trend segment yet. A successful attempt to break through the 0.9989 mark, which corresponds to 323.6% Fibonacci, indicates the market's readiness to continue reducing demand for the euro. I expect the decline in the quotes of the instrument will resume with targets located below the 1.0000 mark within the framework of wave 5. Wave 5 can take almost any length since wave 4 turned out to be much longer than wave 2 – the waves acquire a more extended form as the downward trend section is built. However, I note that the low of wave 5 is already below the low of wave 3, so this wave can complete its construction at any time.

Payrolls and unemployment in the US helped the dollar again.

The euro/dollar instrument rose by 10 basis points on Friday. It's hard to believe since all the most important reports of this week were scheduled for Friday. However, 10 points should not be misleading since the instrument's amplitude during the day was strong. Most of Friday, demand for the European currency was growing, as the market was expecting weak data on unemployment and the labor market. f the unemployment rate rose to .7%, the number of payrolls was 315 thousand. I would not say unequivocally that the increase in unemployment negatively affects the American economy. It should be remembered that unemployment has started and will continue to grow due to the Fed's interest rate hikes, which are aimed at combating high inflation. Thus, the increase in unemployment is only a side reaction. Even 3.7% unemployment is a very low indicator. In the European Union, it is 6.6% and may also grow in the near future.

The Nonfarm Payrolls report more accurately reflects what is happening now in the labor market. Jobs continue to be created in very decent volumes, above market expectations. From my point of view, the growth in demand for the US currency at the end of Friday accurately reflects the nature of the data received. If the US economy continues to slow down, it is clear to everyone that this is due to the specific actions and tasks of the Fed. It was hard to expect that a large-scale interest rate increase would not negatively affect other economic indicators. But the Fed has outlined the task, so we need to expect further rate hikes, unemployment growth, and GDP decline. But the increase in rates for the market remains the most important factor due to which the US currency can continue to rise in price.

General conclusions.

Based on the analysis, I conclude that the construction of the downward trend section continues. I advise you to sell the instrument with targets located near the estimated 0.9397 mark, which equates to 423.6% Fibonacci, for each MACD signal "down" in the construction calculation of wave 5. So far, I do not see a single sig al that would indicate the completion of this wave.

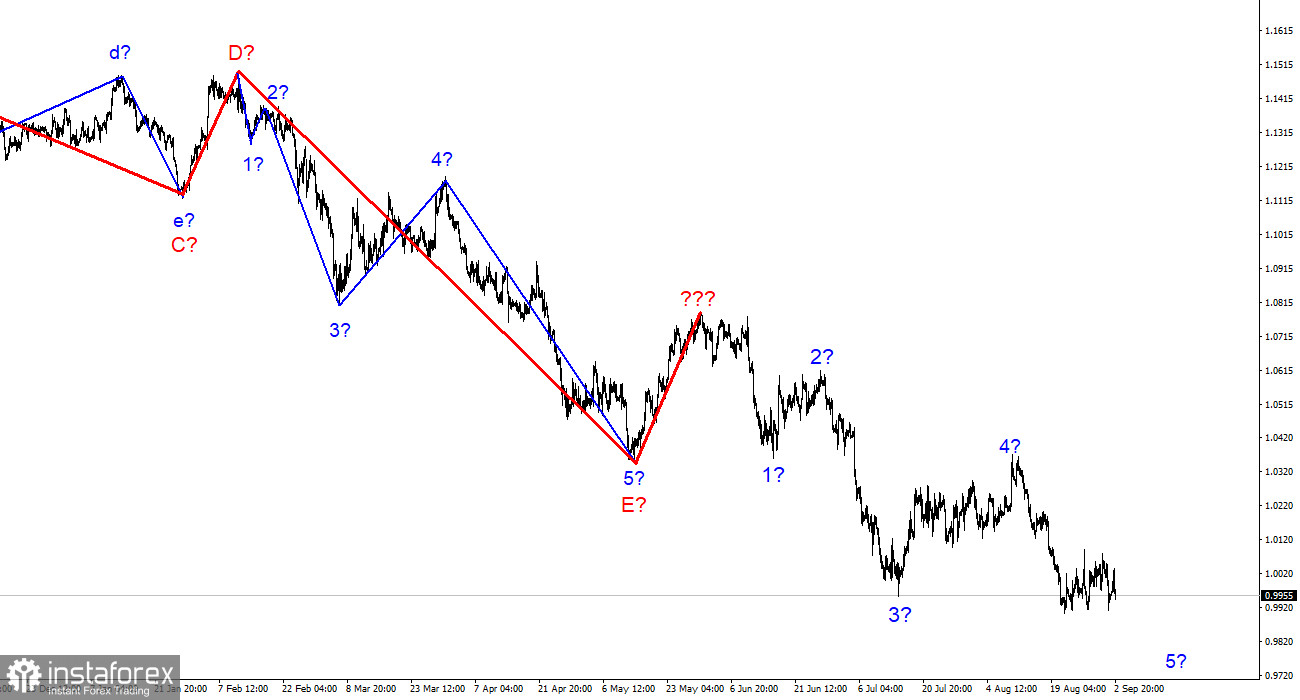

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română