Contradictory Nonfarm data failed to support the US currency. EUR/USD bears made another downward breakthrough on Thursday, falling to the base of the 99th figure. However, bulls were able to pull the price above the parity level on Friday. According to the results of the two-week confrontation, the parties were satisfied with a draw: bears could not enter the area of the 98th figure (and even consolidated the support level of 0.9950), and bulls could not develop corrective growth, having stalled in the area of the 1.0080 mark. Since August 23, the pair has been trading within the 100-point range of 0.9950-1.0050, periodically trying to break through its boundaries – both from above and from below. But in the end, who is still there?

For sure, many traders had high hopes for Nonfarm companies. Under certain conditions, this release could theoretically rescue EUR/USD from the trap of a 100-point flat trap. But only if the published figures had an unambiguously negative or positive connotation. The latest report can be interpreted in different ways, both in favor of the dollar and against it. And judging by the reaction of most traders, market participants came to the conclusion that the glass is half empty.

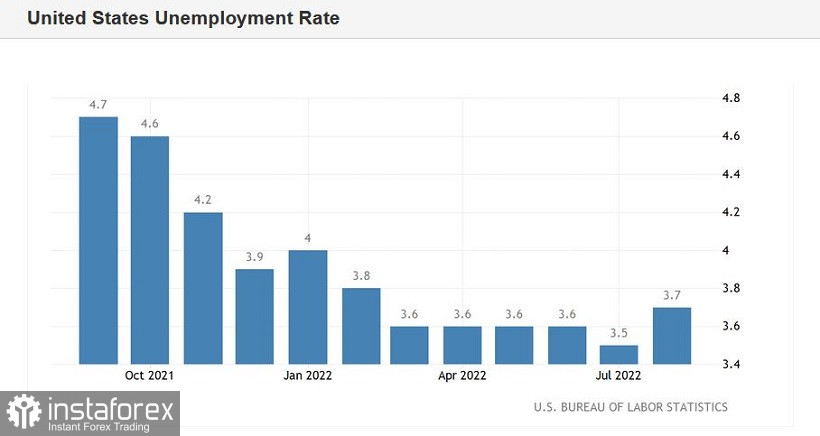

First of all, the capital indicator was disappointing. The unemployment rate rose to 3.7% in August, while most experts expected to see it at the same level (3.5%). The increase is minimal, but formally this is the worst result since February of this year. Salary indicators also came out in the red zone. On a monthly basis, the average hourly wage increased by only 0.3%, with a 0.5% growth forecast. In annual terms, the indicator came out at 5.2%, as in the previous month. But since analysts predicted a stronger dynamics (5.3%), this component received a "red color".

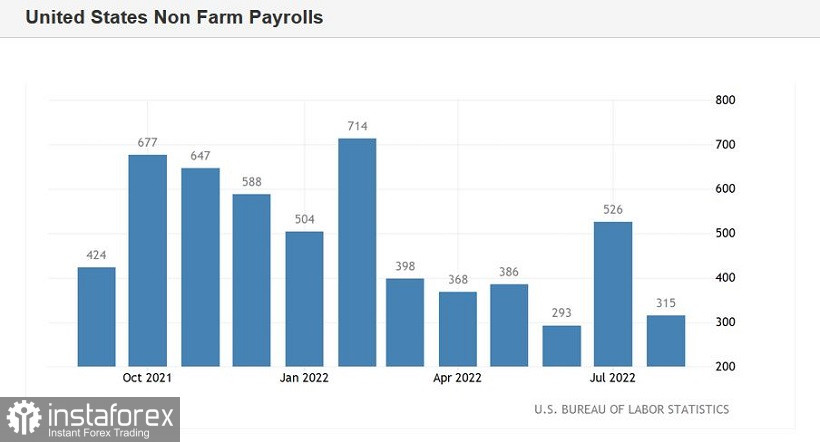

But the number of people employed in the non-agricultural sector increased by 315,000 in August, while experts expected to see this figure at around 280,000. The structure of the indicator suggests that a significant increase in the number of jobs was observed in the areas of business services, as well as in the areas of healthcare and retail trade. On the one hand, here we can say that the pace of job growth has slowed down somewhat (the July figure was at 526,000), but, on the other hand, the 300,000th increase is strong enough for the current phase of the business cycle. Moreover, speaking at an economic symposium in Jackson Hole, the head of the Federal Reserve warned that the tightening of monetary policy could have a negative impact on the dynamics of the labor market. But at the same time, he assured that the Fed would not turn off the hawkish course anyway.

In this context, it can be noted that the figures published do not contribute to weakening the hawkish position of the Fed. The negative reaction of dollar bulls is more of a reflex nature – this is how traders reacted to the unexpected increase in the unemployment rate, which from March to June was at 3.6%, then it unexpectedly fell to 3.5% in July, and also unexpectedly rose to 3.7% in August.

At the same time, all other components of the release (except salaries) came out in the green zone: the number of people employed in the private sector of the economy increased by 308,000, and the share of the economically active population increased to 62.4% (the strongest result since March of this year).

Thus, the latest report did not strengthen the position of the US currency, as expected by the EUR/USD bears. But at the same time, bulls can only count on a "standard" corrective pullback, within the range of 0.9950-1.0050, within which the price fluctuates for the second week in a row.

In general, the pair's traders will repeatedly "return" to Jackson Hole, recalling the resonant speech of Fed Chairman Jerome Powell. He made it clear that the Fed would not look back at the side effects and would increase the interest rate with the knowledge that this could harm households and businesses. After his speech, the scenario of a 75-point rate hike at the September meeting returned to the agenda. And in this vein, it should be emphasized that the "centrists" of the Fed will not be able to take advantage of the moderate slowdown in employment growth in August as an opportunity to raise the key rate by only 50 points in September. The 75-point scenario remains basic, and this fact will provide background support to the dollar.

All this suggests that short positions on the EUR/USD pair are still a priority. However, it is advisable to enter short positions only on corrective upward pullbacks (in the area of 1.0050-1.0070 marks). The downward targets in this case are the 1.0000 and 0.9950 marks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română