The lynching of financial markets that think they can talk the Federal Reserve into giving them a lifeline continues. Treasury sell-offs pushed yields to their highest level since late June, and the S&P 500 fell nearly 8% from its August highs. With such a favorable environment, the US dollar should not leave a wet spot from its competitors, but EURUSD continues to wander around parity. The euro's resilience is respected and has its reasons.

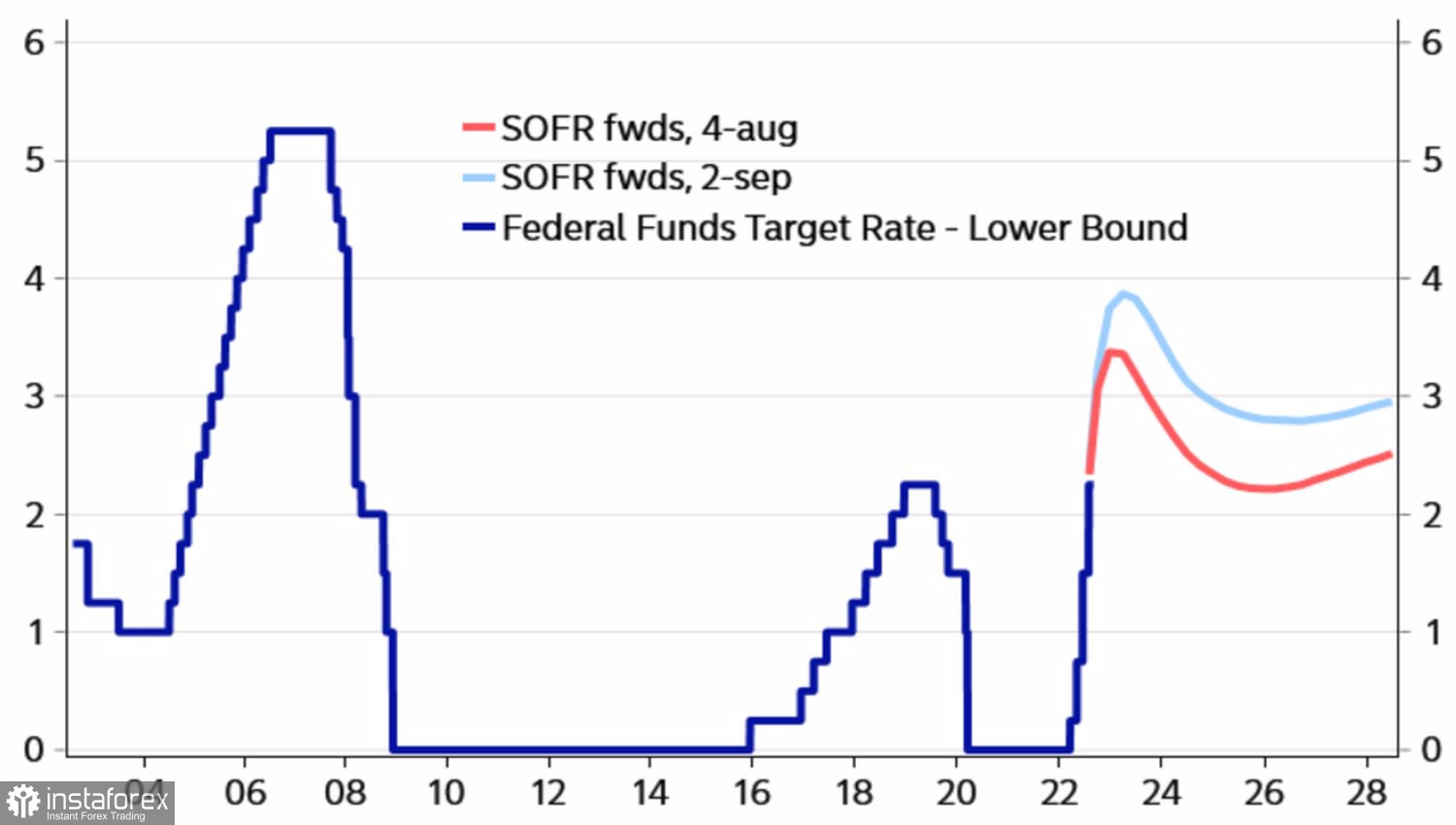

Investors are used to the fact that when the US GDP slows down, the Fed tends to soften its hawkish stance. The so-called Fed coup is a thing of the past. As, however, is the environment in the form of macro-stability and low inflation. The lack of supply of goods and labor will keep prices high, which means that rates should be fixed at a high level. Whereas before Jackson Hole, CME derivatives were expecting a 75 bps cut in the federal funds rate in 2023, then after it they are limited to only one act of monetary restriction per a quarter of a percentage point.

Dynamics of expectations for the federal funds rate

It would seem that a strong tailwind should ensure the continuation of the rally in the USD index. In fact, the decisiveness of the European Central Bank, clearly unhappy with the euro's collapse, which makes imports more expensive and exacerbates the energy crisis, was a pleasant surprise for the EURUSD bulls. It allowed the main currency pair to maintain stability even amid strong statistics on US jobless claims and business activity in the manufacturing sector from ISM.

After the acceleration of European inflation to a record high of 9.1% and a series of hawkish speeches by ECB officials, the futures market is signaling a deposit rate increase of more than 230 bps until May 2023. Bloomberg analysts' consensus estimate has increased from 1.25% to 1.5%, but they tend to fall behind derivatives. Moreover, most economists predict that the eurozone GDP will sink into negative territory for at least two consecutive quarters. By the way, half of them believe that the recession will end there.

In fact, there may not be a recession. Rumors that Russia will still resume the operation of the Nord Stream, coupled with the high filling rate of gas storage facilities in Europe, contribute to the fall in prices for blue fuel for the fifth consecutive day. This allows EURUSD, if not to float to the surface, then to rise to it after going to depth. Of course, we are talking about parity.

Despite the fact that investors believe that in the current conditions, bad news on US employment will be good for the S&P 500 and bad for the US dollar, and vice versa, I believe that expectations of decisive action from the ECB at the meeting on September 8 will lead to euro growth.

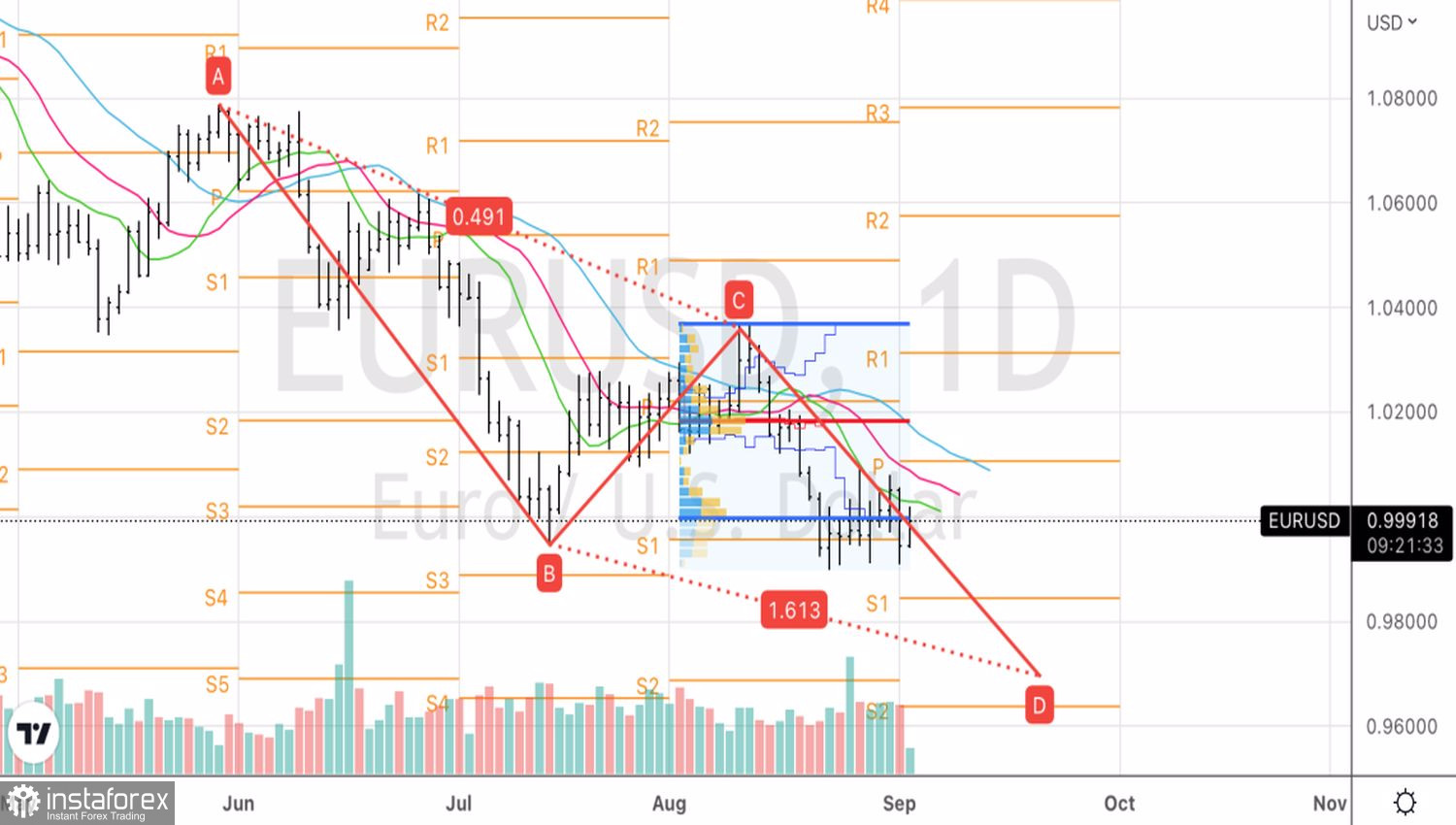

Technically, on the daily chart, the EURUSD bears' inability to restore the downward trend is a sign of weakness. The growth of quotes above 1.002 will be a reason to buy the pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română