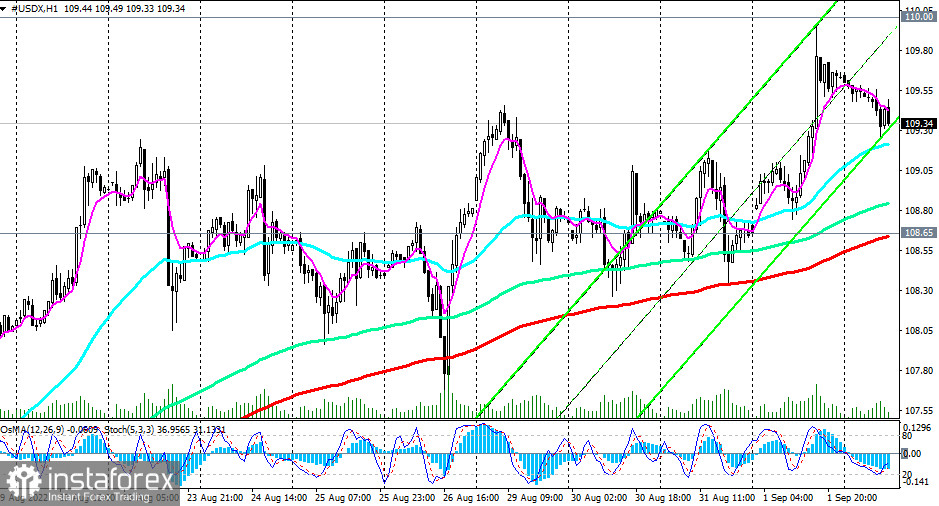

As of this writing, the dollar index (CFD #USDX) is trading near 109.34, down from yesterday's new local 20-year high near 110.00.

Suppose the monthly report of the US Department of Labor, which is expected today at 12:30 (GMT), with data on the main indicators of the country's labor market for August, also lives up to market expectations and comes out with strong indicators. In that case, a breakdown of the local resistance level of 110.00 will be an "easy walk upside" for DXY.

The next target for DXY will be the local resistance level and another "round" mark of 111.00.

In an alternative scenario, and after the breakdown of the short-term support level 109.18, the decline may continue to the support level 108.65 (200 EMA on the 1-hour chart). And to the support levels of 108.00, 107.28 (200 EMA on the 4-hour chart), if today's report of the US Department of Labor turns out to be very disappointing.

A decline to the area below the support level of 106.75 (50 EMA on the daily chart) is unlikely.

The breakdown of the level of 110.00 will be a confirmation signal for increasing long positions on the dollar.

Support levels: 109.18, 108.65, 107.28, 106.75, 103.50, 102.00

Resistance levels: 110.00, 111.00

Trading Tips

Sell Stop 108.90. Stop-Loss 110.05. Take-Profit 108.65, 107.28, 106.75, 103.50, 102.00

Buy Stop 110.05. Stop-Loss 108.90. Take-Profit 111.00, 112.00, 113.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română