The EUR/USD pair is moving sideways in the short term. It's trading at 1.0970 at the time of writing. The bias remains bullish in the short term despite temporary retreats. Unfortunately for the USD, the DXY remains bearish in the short term.

Fundamentally, the US Unemployment Claims, Philly Fed Manufacturing Index, Existing Home Sales, and CB Leading Index came in worse than expected earlier today. Tomorrow, the Eurozone and US Flash Manufacturing PMI and Flash Services PMI data should really shake the markets. The USD needs strong support from the US economy to be able to take the lead again.

EUR/USD Under Strong Upside Pressure!

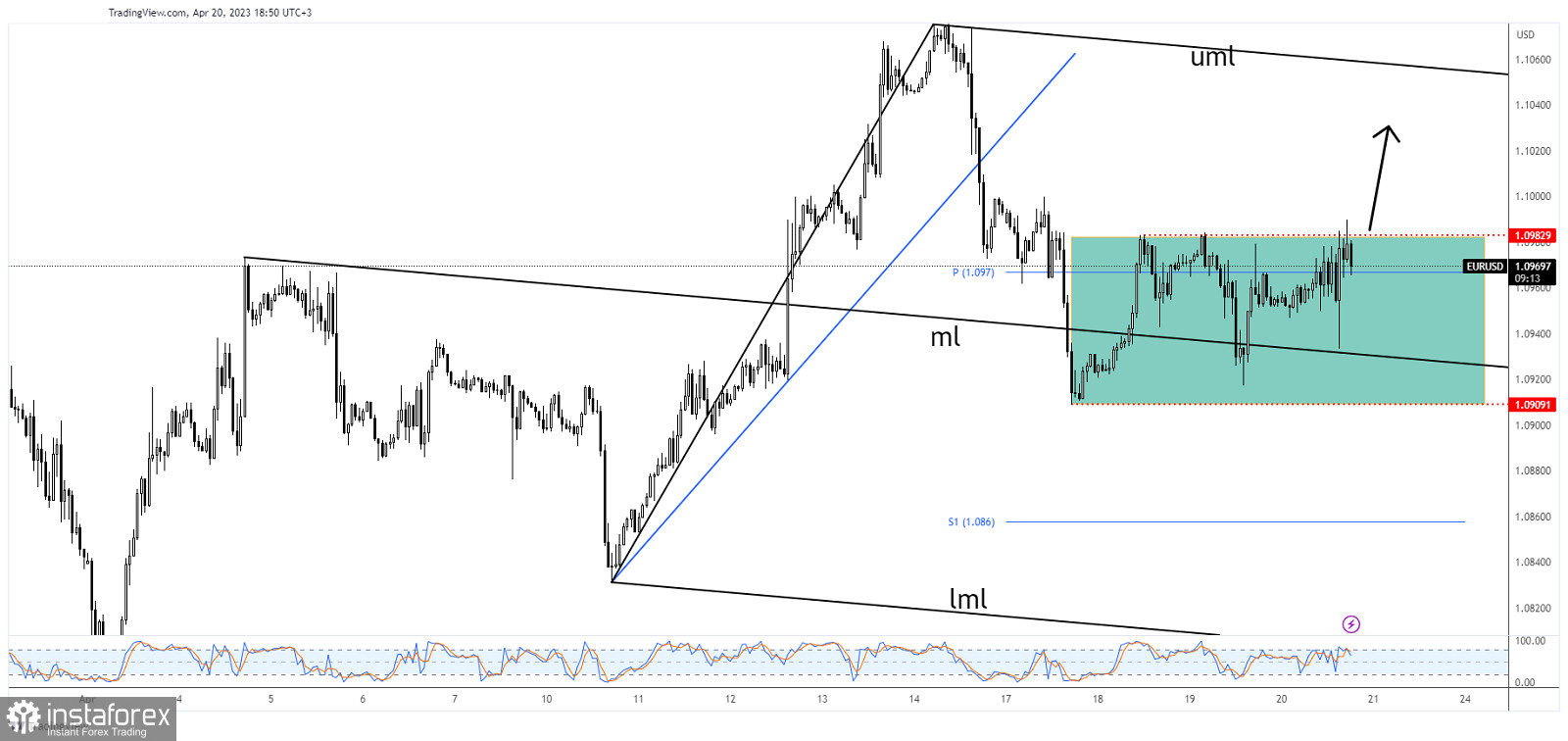

As you can see on the H1 chart, the EUR/USD pair is trapped between the 1.0982 and 1.0909 levels. The rate failed to stay below the median line (ml) of the descending pitchfork signaling exhausted sellers and strong upside pressure.

The currency pair is fighting hard to stay above the weekly pivot point of 1.0970 after registering a new false breakout above the 1.0982 static resistance.

EUR/USD Outlook!

A valid breakout above 1.0982 activates further growth and is seen as a buying signal. The upper median line (uml) represents a potential target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română