Consumer prices in 19 countries of the euro bloc skyrocketed to 9.1% in August from a year ago, surpassing the consensus of a 9% increase.

Excluding highly volatile food and energy prices, the core EU CPI also printed a new historic high of 4.3% annually. It means that inflationary pressure is getting more painful.

The question is whether the ECB has enough proof and arguments to venture into a rate hike by 75 basis points. Previously, the Federal Reserve has already made such aggressive rate hikes twice, though dovish ECB policymakers call on the central bank not to follow the Fed's steps dueto high recession risks on the horizon.

The fastest inflation acceleration since the time of the euro's introduction about two decades agoassures the EU monetary authorities in Frankfurt to strike a balance. On the one hand, interest rates should be raised notably to push inflation down to the long-term target level of around 2%. On the other hand, the ECB should not tighten too aggressively because extreme hawkishness subdues any economic impulse that remains in the cards on the back of fears about irregular energy supplies from Russia this winter.

Governing Council member and Bundesbank Governor Joachim Nagel urged a "strong" reaction to Wednesday's inflation data when policymakers meet next week to decide on how quickly to raise borrowing costs. The EU economy needs an aggressive rate hike in September. Besides, more rate hikes should follow in the coming 6 months. Six members of the ECB Executive Board stated openly that they would vote for a rate increase by more than 50 basis points. Market participants reckon that a chance of a rate hike by 0.75% is measured at more than 60%. Following the release of the EU inflation data, investors retained the forecast of monetary tightening by 166 basis points by the year end.

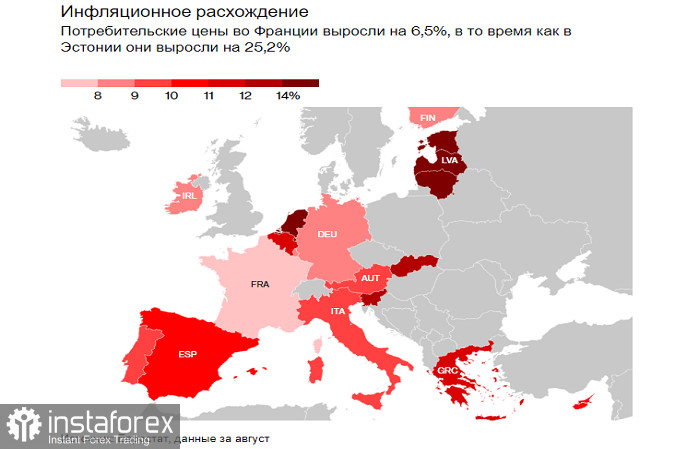

Picture: Inflation deviation

Consumer prices in France climbed by 6.5% while headline inflation accelerated by 25.2% in Estonia in August

At the same time, other ECB policymakers called on the monetary authorities for a cautiousapproach. Senior economist Philip Lane advocated for a steady pace of rate hikes with the aim of minimizing risks of failure. Member of the ECB Executive Board Fabio Panetta said thata weaker economy can subdue rampant inflation.

Recently, economists reckon that a recession in the Eurozone is getting more realistic in the nearest quarters. Indeed, rising costs of living make a dent in demand, thus derailing a fragilerecovery after the pandemic. The ECB will shed light on its forward guidance and economic forecasts at the policy meeting slated for September 7-8.

EU governments tried to offset shocks from soaring energy prices by applying a number ofmeasures, including cutting taxes, direct payouts to households, and subsidies to businesses. According to estimates of Brussels-based think tank Bruegel, EU governments have already spent almost 280 billion euros (that is $279 billion).

Perhaps the EU authorities will agree on extra financial aid. The European Commission statedthis week that it is planning to take urgent measures to stem the rapid growth of energy prices.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română