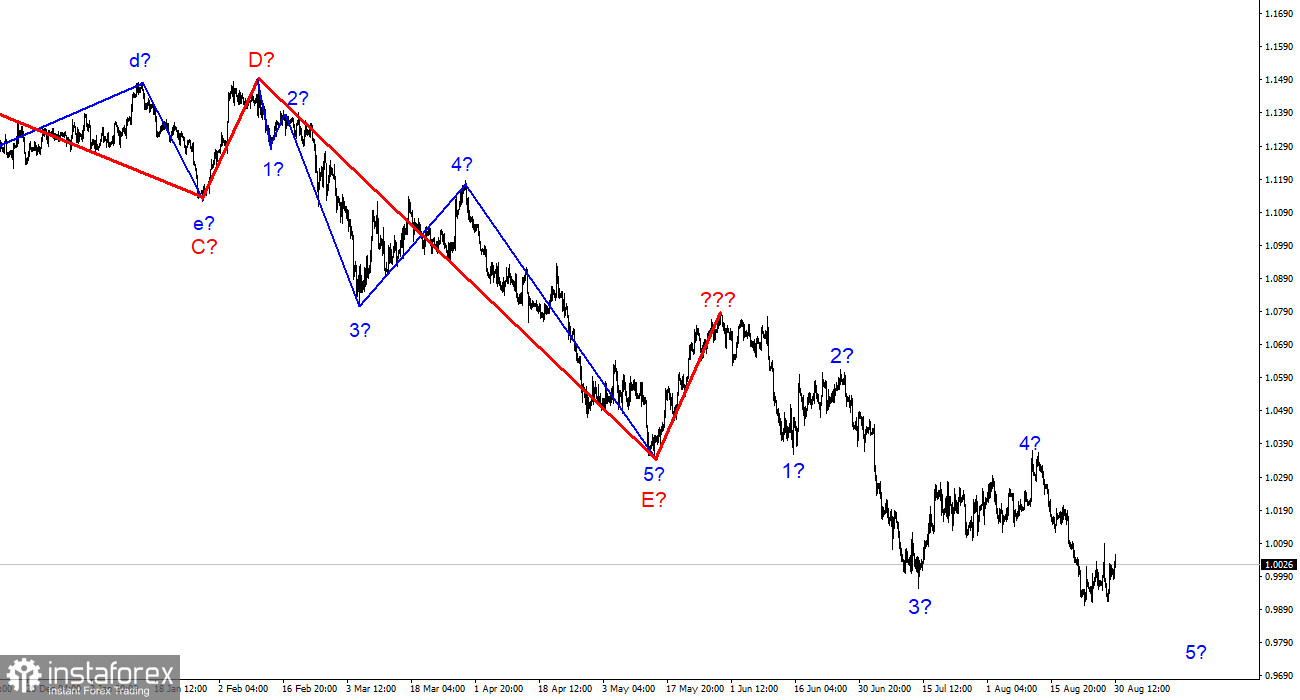

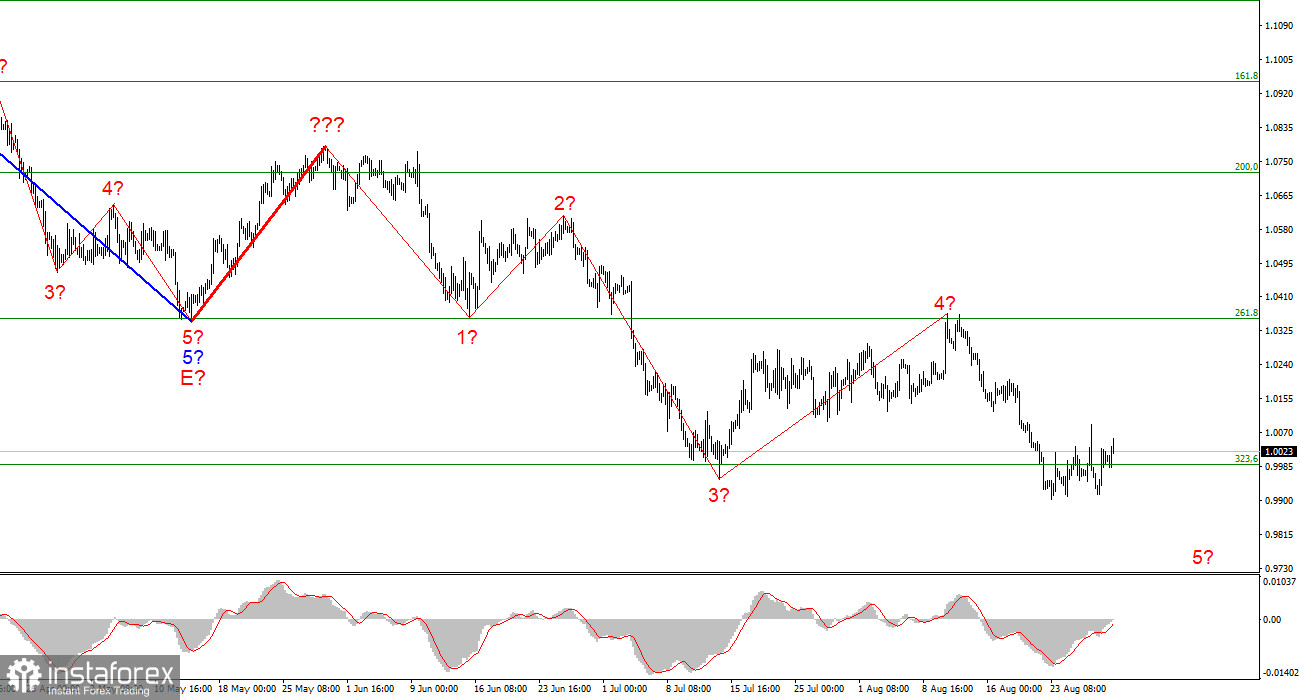

The wave layout on the 4-hour chart for EUR/USD requires no adjustments so far although wave 4 turned out to be more extended than I expected. The whole wave structure may become even more complex and extended which is a usual thing for any structure. At the moment, the ascending wave has completed its formation. We refer to it as wave 4 of the descending section of the trend. If this is true, then it means that the instrument continues to form a descending wave 5. The supposed wave 4 has taken a five-wave corrective structure. Yet, it should still be considered a wave 4. Currently, nothing signals that the descending section of the trend is nearing its completion. A successful breakout of 0.9989, which coincides with the Fibonacci level of 323.6%, will indicate that the euro is losing ground. I expect the pair to resume its decline towards the targets located below 1.0000 within wave 5. The latter may be different in length since wave 4 turned out to be much longer than wave 2. Waves are becoming longer as the descending section of the trend is being formed.

Uneventful Tuesday

EUR/USD went up by 25 pips on Tuesday although its upward dynamic was already weak. Apparently, market participants were not ready to act after robust trading on Monday and amid today's empty news background. They preferred to wait for more news. Tomorrow, the EU will publish the data on inflation. This will happen amid speculations that the ECB is ready to raise the rate at the pace of 75 basis points instead of 50. As I see it, these are just rumors. First, we need to see how the inflation rate has changed. If it continues to rise despite a long-awaited rate hike, then the ECB may consider further monetary tightening. Actually, the European central bank should have taken action a long time ago. Now, it seems like the regulator is trying to catch the last train.

Anyway, better late than never. A faster pace of monetary tightening may be of great help for the euro and may boost the demand for it. Hopefully, this rate hike won't be the last one in 2022. Yet, at the moment of writing, I can't see any signs of approval in the market. The euro was rising in the course of the day but a rise of 25 pips can hardly be called an impressive result. Consequently, I think that wave 5 will continue to form for some more time. The current wave layout suggests that both wave 5 and the entire descending trend section may soon be completed. At the same time, the wave pattern may become more and more complex. Everything will depend on the news background and actions taken by the ECB and the Fed at the upcoming meetings.

Conclusion

Based on the analysis above, we can conclude that the descending section of the trend is still being formed. I would recommend selling the instrument with targets located near the estimated level of 0.9397, which coincides with 423.6% Fibonacci, following each sell signal of the MACD indicator and bearing in mind the formation of wave 5. There are currently no signals indicating the end of this wave.

On a higher time frame, the descending trend section is getting longer and more complex. This wave can be of any length, so it is better to find and work with 3- and 5-wave structures.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română