The main altcoin continued its downward movement following Bitcoin, which broke through the $20k level amid disappointing statements by the head of the Fed. The situation around the altcoin looks more alarming given the presence of fundamental grounds for growth. However, the market is seeing signs of declining trading activity on the ETH network. A lot of questions are raised by the strategy of "whales," who are actively transferring ether coins to crypto exchanges, emptying cold wallets. Market participants regard this as an intention to sell large amounts of ETH and collapse the price.

The fundamental background in the form of the Merge update failed to save Ethereum from a direct correlation with stock indices. According to Santiment data, Ethereum closely follows the S&P 500 stock index. This proves the high level of Ethereum's dependence on macroeconomic events and also indicates that the upward movement of the cryptocurrency is limited by correlation with stock assets. Another negative factor was the announcement of the major crypto mining pool AntPool. The Bitmain subsidiary will not support client assets in Ethereum after the Merge update.

The resonant statement of AntPool is justified and goes far beyond the statement of one mining company. The fact is that the crypto community is seriously concerned about the issue of Ethereum censorship after the transition to PoS. This is largely dictated by the US sanctions policy regarding Tornado Cash. The position of Ethereum as one of the alternatives to the classical financial system, free from outside influence, has been significantly shaken. Investors are evaluating the risks of moving their assets to Ethereum 2.0 due to the chance of being censored and losing their funds. All these factors have become a catalyst for the decline in ether quotes last week.

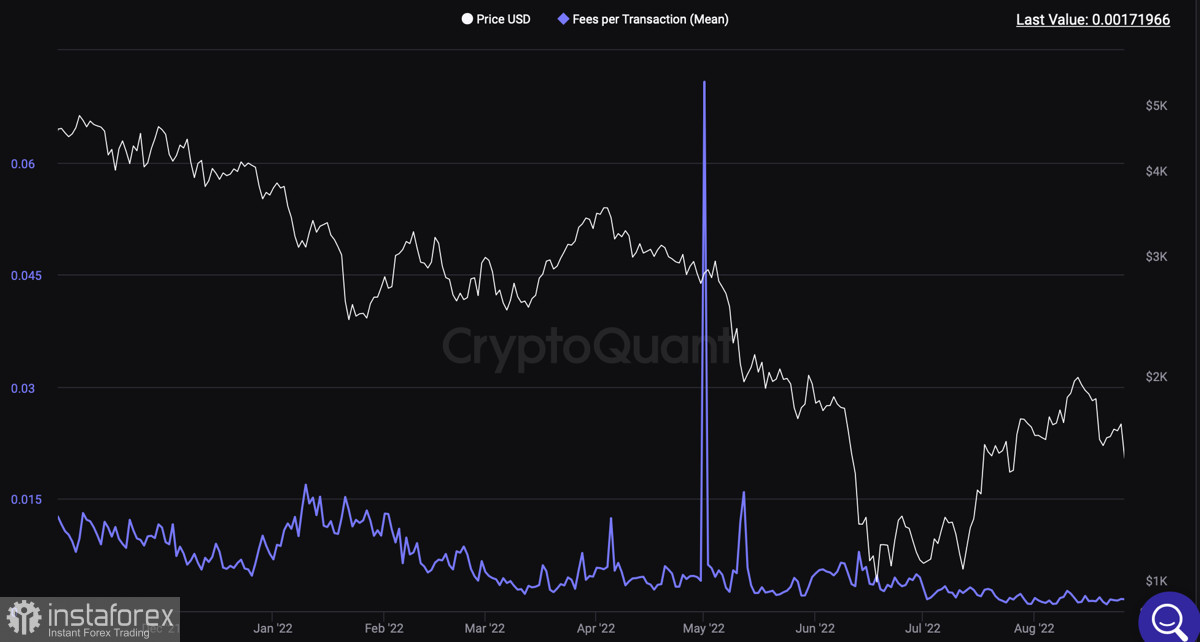

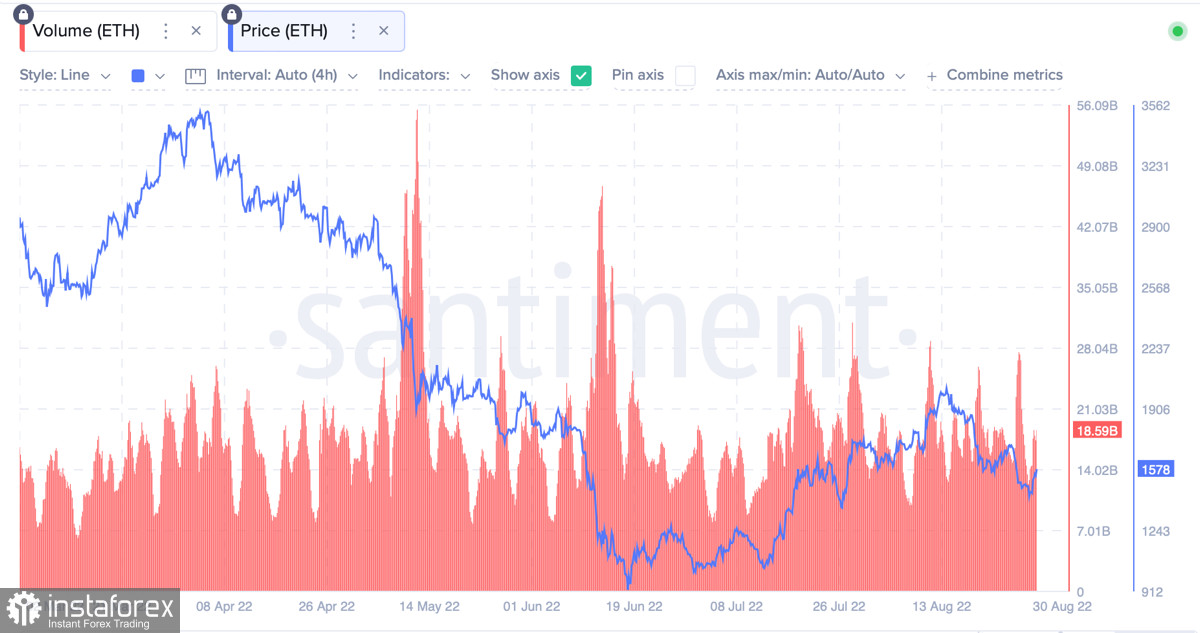

However, the wide discourse around the ETH merger has favorably influenced the current position of the cryptocurrency. A temporary decrease in activity in the altcoin network led to a significant drop in fees. As of August 30, the transaction fee on the Ethereum network is $0.39. This provoked a lot of interest in the Ethereum network, due to which the number of addresses with a non-zero balance reached a new record at around 85,456,864. After a local pause, the Ethereum network also recorded an increase in trading volumes, which fully corresponds to the technical picture of what is happening with ETH.

Technically, Ethereum is showing resilience to selling pressure. The coin again fell to $1,500 but subsequently successfully defended this frontier. Following the results of August 29, a strong buying signal formed on the altcoin's daily chart. After testing the $1,500 level, Ethereum formed a "bullish absorption" pattern, suggesting the activation of buyers. It is important to note that the size of the bullish candle is twice the volume of the red candle for August 28. This is a positive signal that may indicate the emergence of an upward trend.

Just as importantly, thanks to the integrity of the $1,500 mark, ETH keeps the cup and handle pattern relevant. Therefore, the potential for an upward movement with a target up to $2,800 also remains relevant for the coming months. Despite the formation of a strong bullish signal, the technical charts do not look encouraging. The MACD indicator continues its downward movement in the red zone, which indicates that only a short-term upward trend is likely to form. The RSI index and the stochastic oscillator tried to develop an upward spurt during the formation of the "absorption" but subsequently acquired a flat direction.

Ethereum ends the last month of summer in uncertainty. Buying activity and institutional attention remain at a decent level, but this process does not find a significant reflection on the cryptocurrency charts. However, on the daily chart of Ethereum, we see clear signs of a decrease in correlation with the S&P 500. This is an important part of preparing for an upward movement before the confluence, as a drop in the level of correlation makes the altcoin more independent.

As for the short term, ETH is able to reach the $1,700–$1,850 area. However, this week is full of important economic events that directly affect the quotes of ETH, SPX, and Bitcoin. For example, PMI data and non-agricultural employment data in the US economy will be released. These indicators play a key role in shaping Fed policy. With this in mind, we should expect increased volatility, in the coming days, rather than systematic growth towards certain targets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română