The market seems to be starting to recover a bit from Federal Reserve Chairman Jerome Powell's Friday speech as the dollar weakened somewhat. But in fact, the reason for the rebound lies in the rumors that the European Central Bank may start raising interest rates somewhat more actively than previously thought. Against this background, the single currency quickly returned to parity, pulling the pound with it.

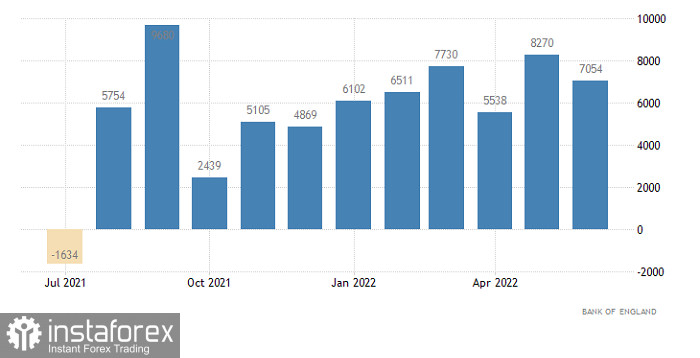

Most likely, the market will hang around the current values for some time, waiting for some specifics regarding the further actions of the ECB. Moreover, today's macroeconomic statistics are unlikely to move the market. Data on the lending market in the UK, although they should be worse than a month earlier, they still fit into the logic of a clear slowdown in economic growth and a gradual slide into recession. That is, they will not show anything new. In particular, the number of approved mortgage loans may reach 62,900 against 63,726 in the previous month. Net consumer lending, which rose by £7.1 billion last month, could rise by £6.5 billion. In other words, there are signs of a slowdown, but the market continues to grow.

Net consumer lending (UK):

Something similar awaits the US statistics. On the one hand, the number of open vacancies should be reduced from 10,698,000 to 10,500,000. However, the changes themselves are extremely insignificant. Moreover, the Fed has repeatedly pointed to signs of overheating in the labor market, and in this case, the decrease in the number of open vacancies rather looks like a positive development. In addition, the real estate price index should decrease from 18.3% to 17.5%. This seems to indicate a further slowdown in inflation, which should force the Fed to reconsider its plans towards a less aggressive increase in interest rates. However, this indicator is rather indirect, and does not directly affect inflation. Now, if there had not been a rebound yesterday, then such data could be the reason for it. Today, they will remain without much attention.

House Price Index (United States):

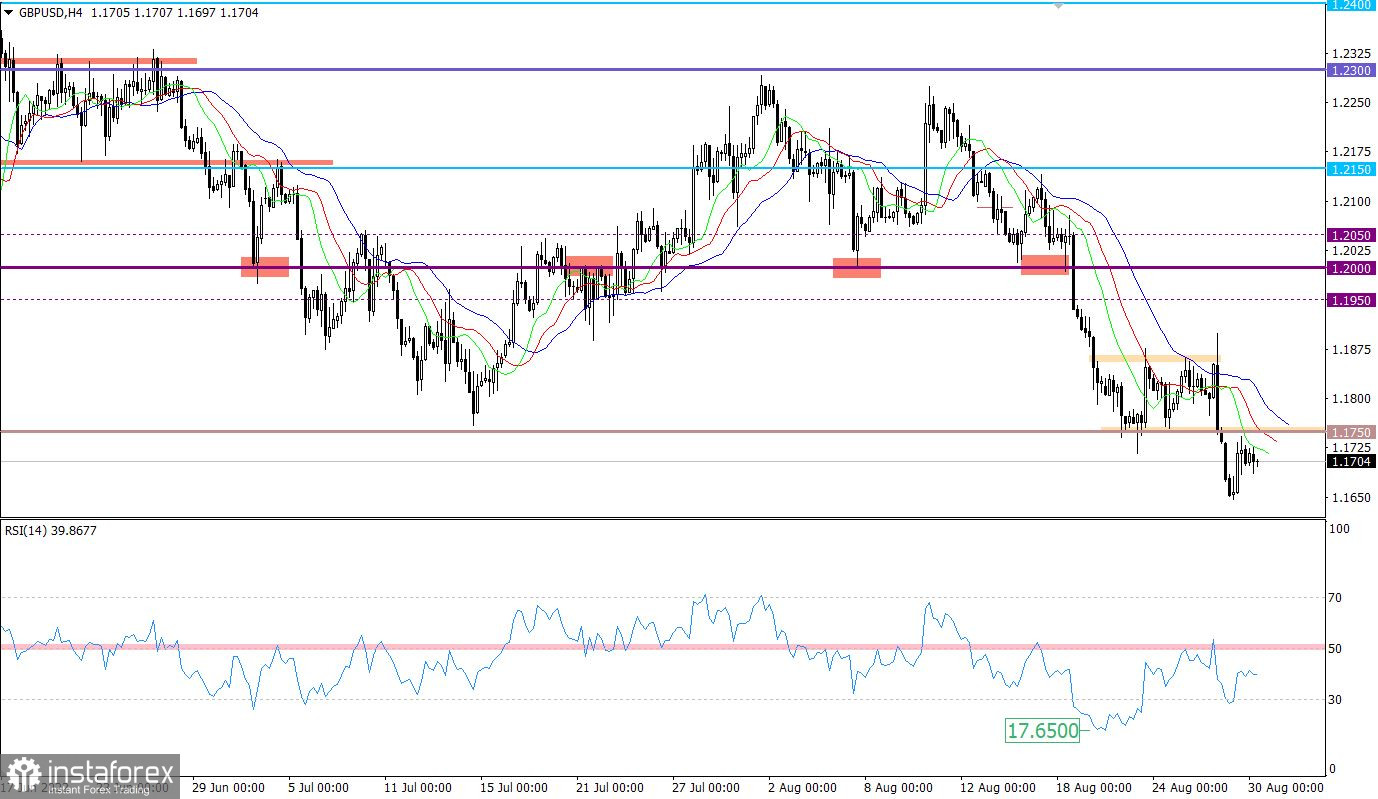

The GBPUSD currency pair, during an intensive downward move, reached the level of 1.1650, relative to which there was a reduction in the volume of short positions, as a result of a technical round.

The RSI H4 technical instrument is moving in the lower area of the indicator, which indicates a continuing downward trend in the market. RSI D1 is moving in close proximity to the oversold level.

The moving MA lines on the Alligator H4 and D1 indicator are directed downwards, which corresponds to the direction of the main trend.

Expectations and prospects

In this situation, the rollback returned the quote to the area of the previously passed level of 1.1750, where the upward cycle slowed down. In order for a subsequent increase in the volume of long positions to occur, which will result in prolonging the rollback, the quote needs to stay above 1.1750 for at least a four-hour period.

Otherwise, we are waiting for the completion of the rollback stage, followed by a price rebound from the level of 1.1750. In this scenario, updating the local low of the downward trend is not excluded.

Complex indicator analysis in the short term has a variable signal due to the slowdown in the rollback stage. Indicators in the intraday and medium-term periods indicate a downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română