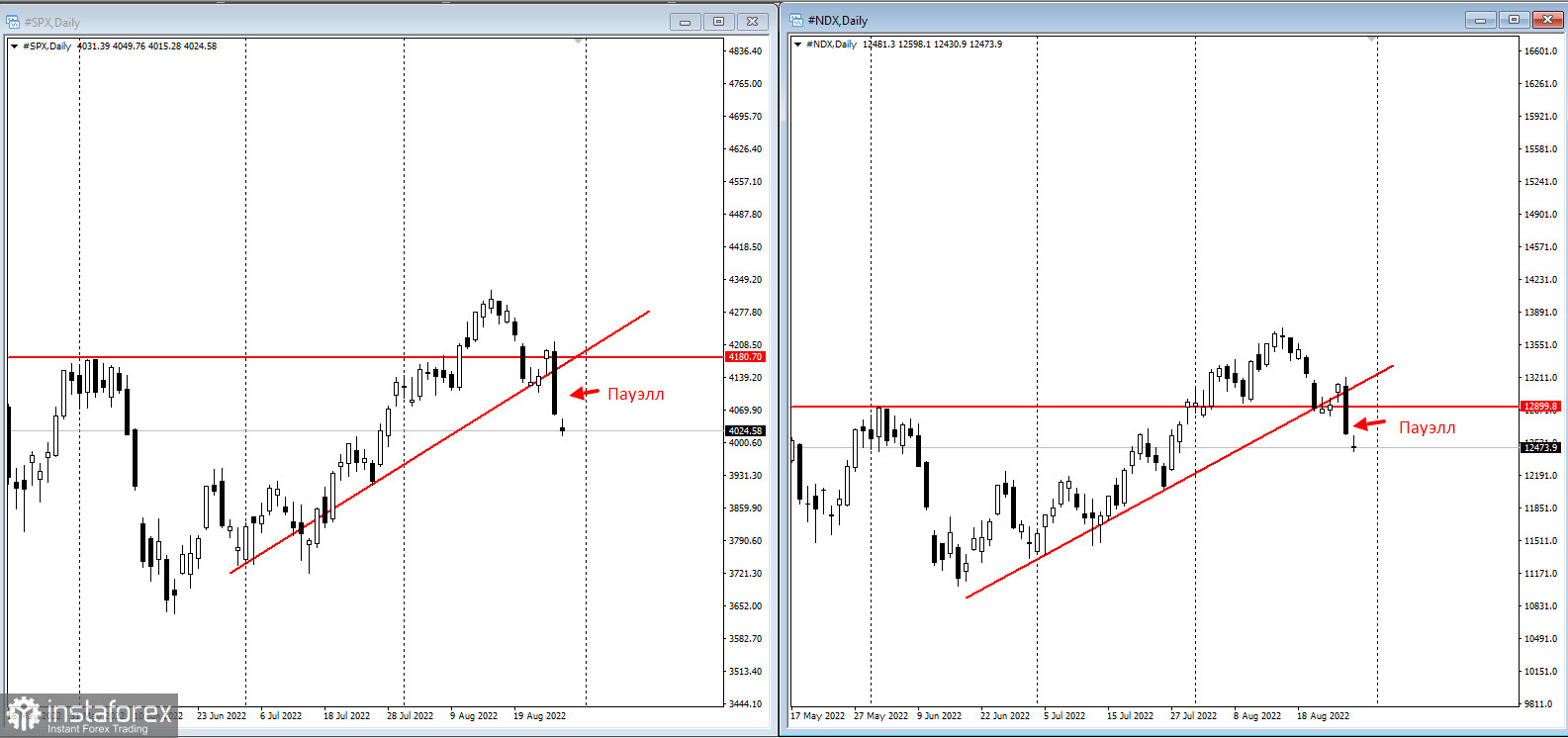

US stocks fell and Treasuries rose as traders digested US Federal Reserve Chairman Jerome Powell's comments. Powell reiterated that the central bank was willing to keep raising interest rates even at the risk of an economic slowdown.

The S&P 500 index and the high-tech Nasdaq 100 fell on Monday, continuing Friday's decline after Powell reaffirmed his hawkish stance. US Treasury yields rose with the 10-year rate hovering around 3.12%. The two-year yield climbed to its highest level since 2007 before declining.

Powell's speech during the Jackson Hole symposium made it clear that expectations for any reversal of the Fed's tightening were unlikely. He also warned of the potential economic danger for households and businesses as the central bank continued to aggressively fight inflation.

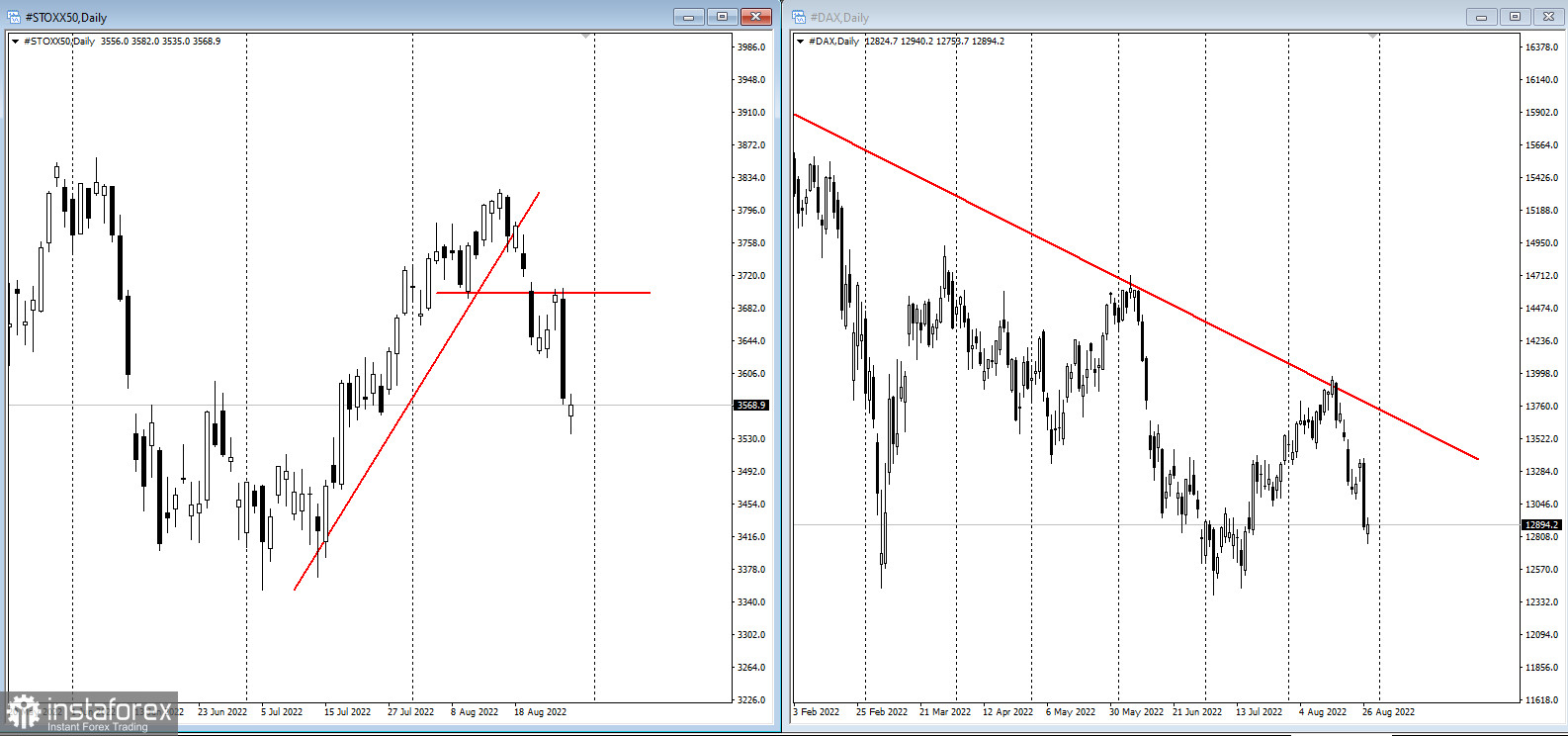

European stocks also opened below Friday's lows:

"The process of a Fed funds hike cycle, especially in the early days of such a cycle, is never easily digestible for the markets," chief investment strategist at Oppenheimer John Stoltzfus wrote. He added that that process was often accompanied by periods of heightened anxiety and volatility for market participants.

According to Stoltzfus, the current rate-hike cycle is "particularly rough to manage" as it involves policy tightening combined with sky-high, which the Fed has been unable to slow significantly so far.

Going forward, weaker earnings, not higher interest rates, could pose the largest threat to US stock prices, Morgan Stanley strategists led by Michael J. Wilson said in a research note on Monday. The bank's leading earnings model, which projects a steep fall in earnings per share growth over the next several months, confirms that view.

"The path for stocks here will be determined by earnings, where we still see material downside," the strategists said. "As a result, equity investors should be laser focused on this risk, not the Fed."

ECB officials favor the same scenario as Powell. Austria's Robert Holzmann and his Dutch counterpart Klaas Knot would discuss the prospect of an unprecedented three-quarter-point hike at their meeting in September. European Central Bank Executive Board member Isabelle Schnabel warned that inflation expectations would most likely remain unsupported.The Moscow Exchange Index has broken through technical resistance of 2,200 and continues to rise:

Some key events to watch this week:

US Consumer confidence, Tuesday- New York Fed President John Williams due to speak, Tuesday.

- ECB Governing Council members due to speak at event Tuesday through Sept. 2

- China PMI, Wednesday

- Euro-area CPI, Wednesday

- Russia's Gazprom set to halt Nord Stream pipeline gas flows for three days of maintenance, Wednesday

- Cleveland Fed President Loretta Mester due to speak, Wednesday

- China Caixin manufacturing PMI, Thursday

- US nonfarm payroll, Friday

- UK leadership ballot closes Friday. Winner announced Sept. 5

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română