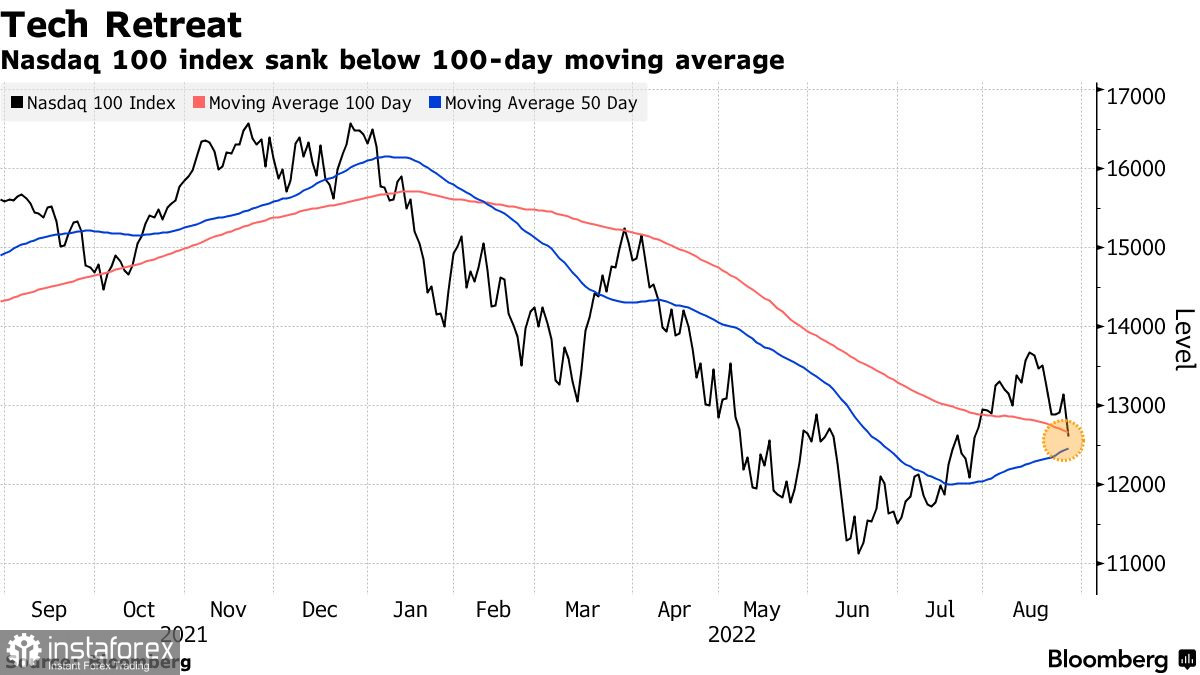

US stock index futures continued to fall in morning trading on Monday, as concerns about further interest rate hikes and monetary policy tightening increased pressure on buyers of risky assets and added fuel to the bear market seen at the end of last week. Futures for the Dow Jones Industrial Average fell by 304 points or about 1%. Shares of the S&P 500 and Nasdaq 100 sank by 1% and 1.3%, respectively. The inversion of the yield curve has also increased, indicating a further risk of recession in the US. The yield on two-year US bonds, sensitive to expectations regarding the Fed's policy, reached 3.47%, the highest since the global financial crisis. The yield on 10-year bonds rose to about 3.10%.

As for European bonds, the yield on German 10-year bonds exceeded 1.5% after several European Central Bank representatives stressed the need to act more decisively to suppress record inflation at the weekend.

As noted above, there was a sharp sell-off on Friday after the brief and sharp remarks of Federal Reserve Chairman Jerome Powell in Jackson Hole, which erased all hopes that the Central Bank would change its aggressive course of raising interest rates in the coming months. The Dow index fell by 1008 points, or just over 3%, which was the worst day since May. The S&P 500 and Nasdaq Composite fell 3.4% and 3.9%, respectively, the worst day since June.

"Restoring price stability will probably require maintaining restrictive policies for some time. History shows that premature rejection and policy easing harm the economy," the Fed chairman said during his speech. "Our decision at the September meeting will depend on the totality of incoming data and changing prospects."

Immediately after the speech, investors again reduced their recent Risk-On positioning, only confirming the theory that the recent risk appetite continues to decline and will cost those who believe in further index growth.This week, there will be quite a few speeches by representatives of the Fed, including Vice-Chairman Lael Brainard, who will have her say before the August report on employment in the non-agricultural sector, which is released on Friday.

As for the technical picture of the S&P 500

Buyers don't have a single chance yet. After Friday's collapse, the main problem for them is the resistance of $ 4,038. Today I advise you to pay attention to this level since the upward correction of the trading instrument depends on its breakdown. In case of further downward movement after the statements of the Fed representatives, the breakdown of $ 4,003 will open a direct road to the areas of $ 3,968 and $ 3,940, where the pressure on the trading instrument may weaken slightly. It will be possible to talk about the growth of the index only after controlling the resistance of $ 4,038. It will open the way to $ 4,065. It is the only way to see steady growth in the $ 4,091, where large sellers will return to the market again. At least there will be those who want to fix profits on long positions. A more distant target will be the $ 4,116 level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română