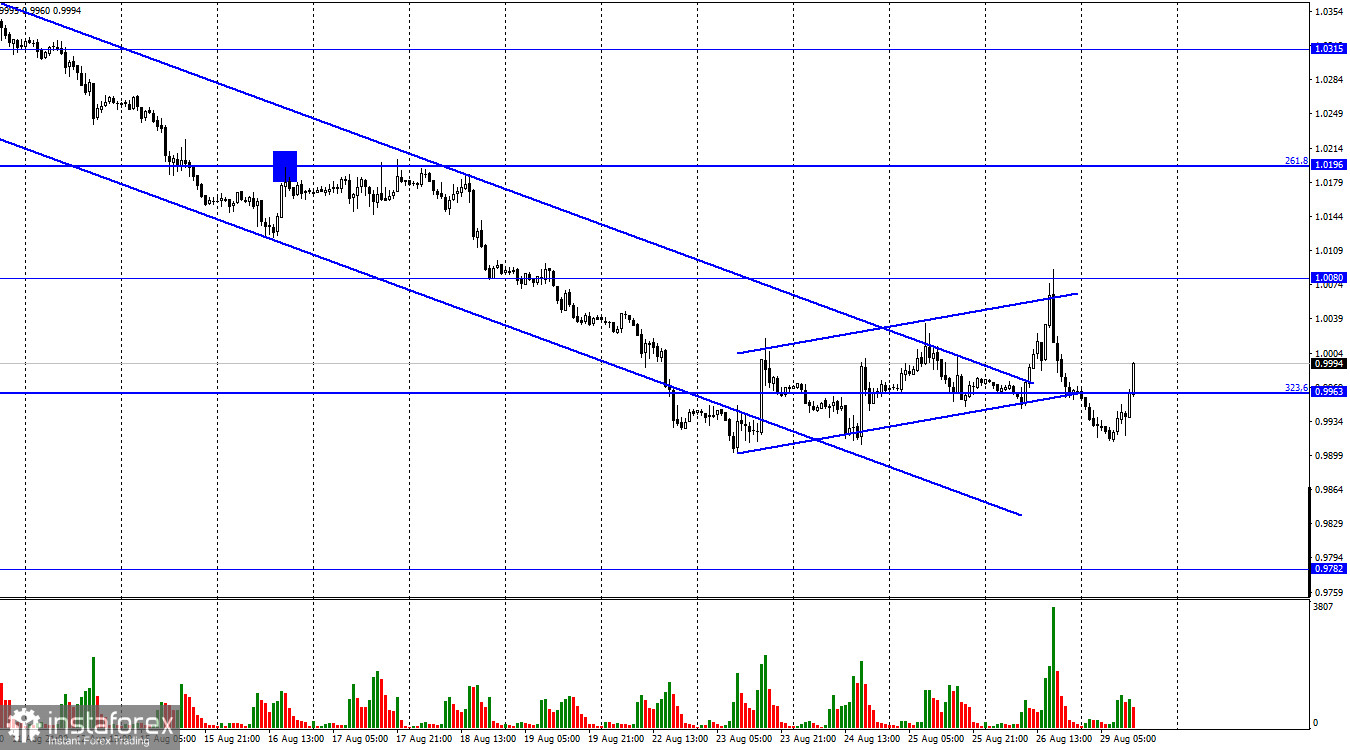

After my last article, the EUR/USD pair on Friday performed a rebound from the level of 1.0080, a reversal in favor of the US currency, and a fall under the corrective level of 323.6% (0.9963). On Monday, a reversal was made in favor of the EU currency, and the growth process began. The quotes are in a very specific area for the last five days, including today. This area is extensive, so I can't characterize it as a side corridor. Literally, on Friday, an upward trend corridor was still in effect, but at the junction of Friday and Monday, the quotes performed a consolidation under it. They did not continue the process of falling for long. Thus, the downward trend has not been restored, and the pair begins to sway from side to side, gaining strength and momentum. It is quite difficult to determine the direction of movement now. However, I still assume that the fall of the European currency will continue since the key event of last week, according to most experts, can be unequivocally recorded in favor of the US currency.

On Friday evening, a symposium was held in Jackson Hole, which is an economic conference. However, Jerome Powell spoke at this conference and made some very important statements. Last week, traders were no longer confident that the Fed would remain aggressive about monetary policy. However, all doubts were dispelled on Friday when Powell confirmed that the regulator would continue to raise the interest rate and keep it at a high level for a very long time. All for inflation to return to 2%. It was even decided to sacrifice economic growth and low unemployment, which Powell openly stated, causing quite a lot of criticism since it is not just about economic indicators, but about business, people, layoffs, and bankruptcies. Nevertheless, the PEPP will continue to tighten, which is good for the US currency.

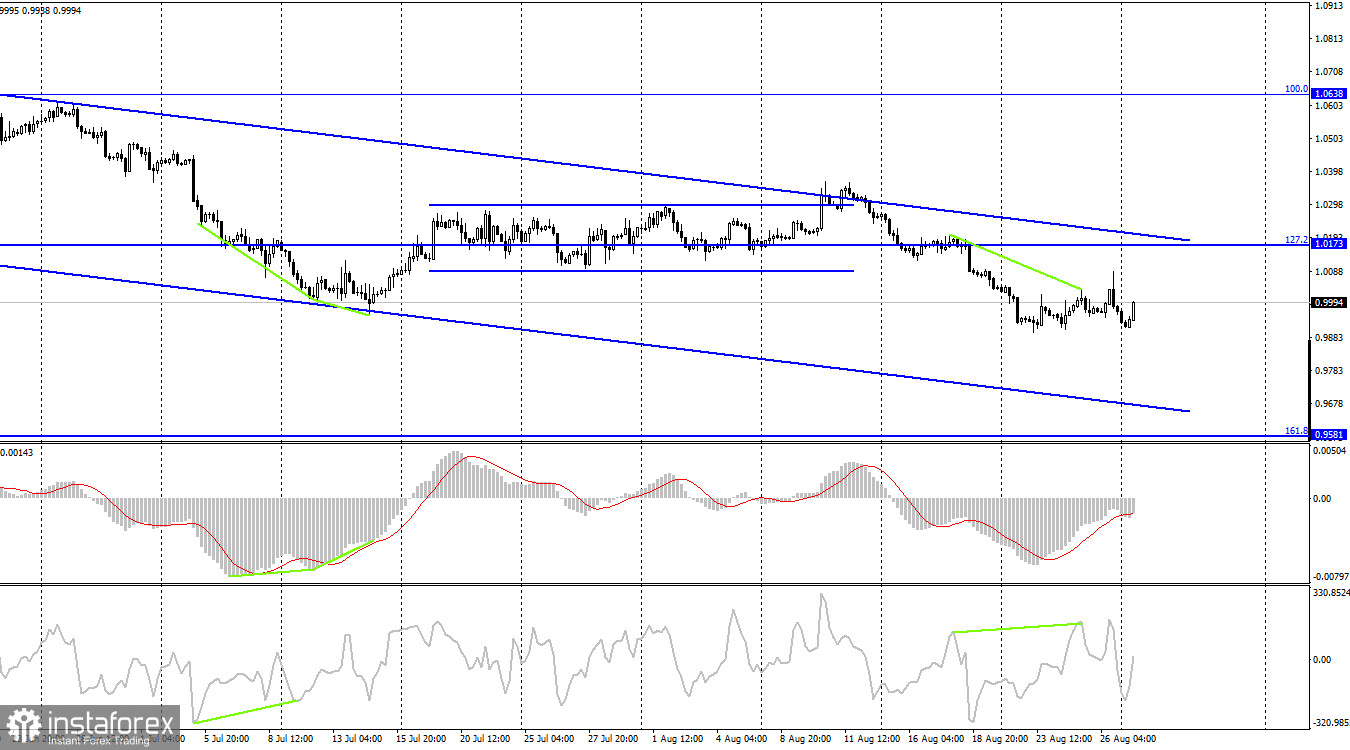

On the 4-hour chart, the pair reversed in favor of the US currency and anchored under the corrective level of 127.2% (1.0173). Thus, the process of falling can be continued in the direction of the Fibo level of 161.8% (0.9581). The "bearish" divergence of the CCI indicator formed and led to the resumption of the fall in the direction of 0.9581. The current upward pullback may also not be long. The downward trend corridor still characterizes the mood of traders as "bearish."

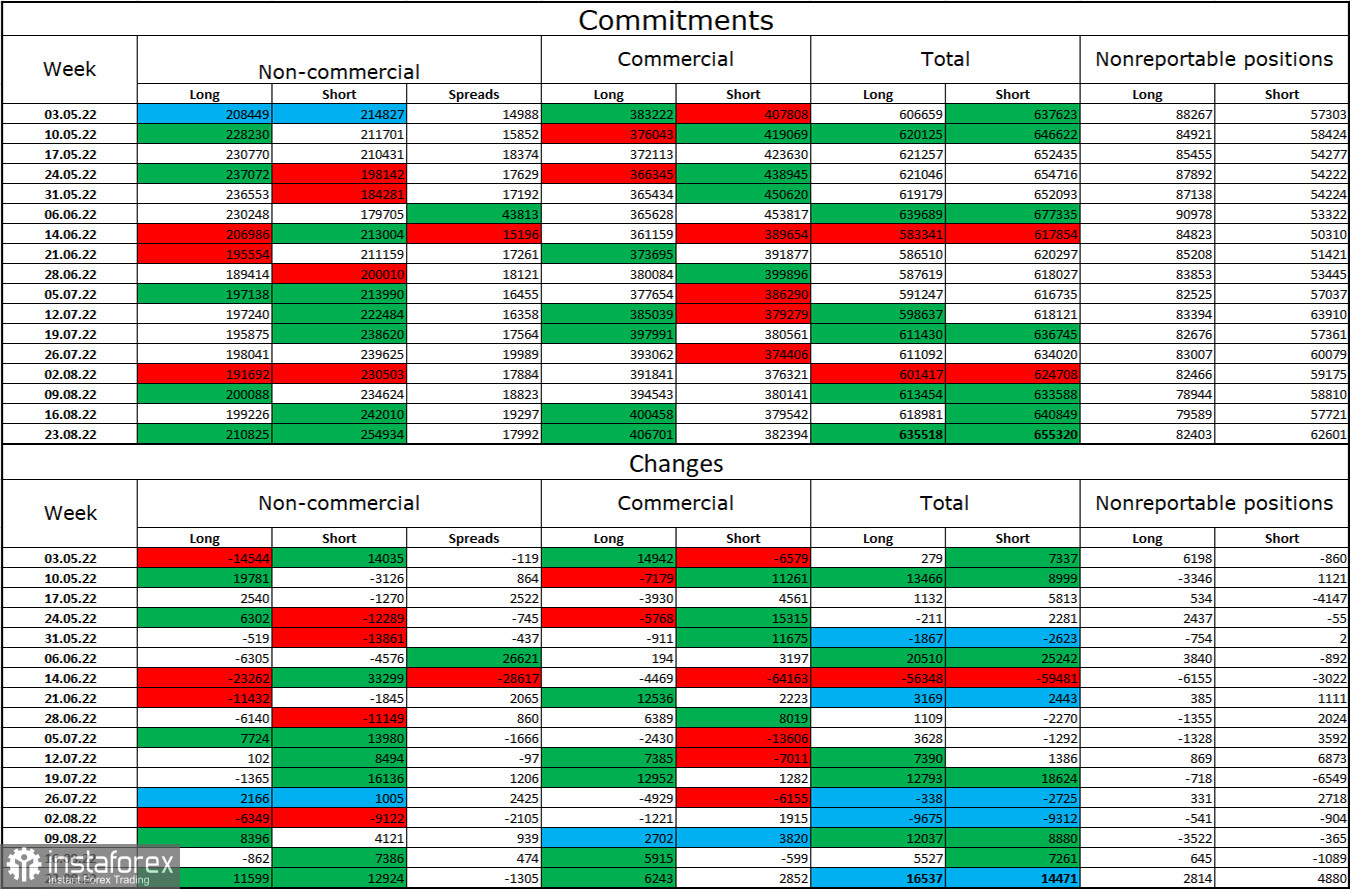

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 11,599 long contracts and 12,924 short contracts. It means that the "bearish" mood of the major players has intensified again. The total number of long contracts concentrated in the hands of speculators now amounts to 211 thousand, and short contracts – 255 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually growing, but recent COT reports have shown no strong strengthening of the bulls' positions. The euro currency has not shown convincing growth in the last five or six weeks. Thus, it is still difficult for me to count on the strong growth of the euro currency. So far, I am inclined to continue the fall of the euro/dollar pair, judging by the COT data.

News calendar for the USA and the European Union:

On August 29, the calendars of economic events of the European Union and the United States do not contain a single interesting entry. The influence of the information background on the mood of traders today will be absent.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair with a target of 0.9782 when closing under the ascending corridor on the hourly chart. New sales are possible when closing at 0.9963 for the same purpose. I recommend buying the euro currency when fixing quotes above the descending corridor on the 4-hour chart with a target of 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română