Federal Chairman Jerome Powell, speaking at a symposium in Jackson Hole, did everything to make the market finally realize that the central bank will stop at nothing in its plan to curb inflation in America.

In the last article, we suggested that if the head of the Fed did not throw a surprise at the markets, then it would be possible to observe another local rally in the stock and other asset markets with a simultaneous increase in demand for government bonds and a weakening of the US dollar. And that would very likely have been the case if Powell hadn't made a targeted statement pointing out that while controlling inflation through higher interest rates, slower growth and softer labor market conditions would hurt households and businesses , "failure to restore price stability will mean much more pain" in the long run.

It seems that weak hopes have finally collapsed, and this largely confirms the recovery in the growth of treasury yields amid falling demand for them. The yield of the 10-year T-Bond benchmark is already confidently staying above the 3% level and, after a slight downward correction, resumed growth. It is likely that a further sell-off in the government debt market will push it up to an immediate high of 3.5%.

How will the US dollar behave in the context of continued aggressive rate hikes and growth in Treasury yields?

We believe that it will have to further strengthen against major currencies, despite the fact that rates will also rise in other economically developed countries of Europe, Canada, Australia, and so on. Here it will be supported by the growth of Treasury yields and the flight of capital from Europe, as well as from countries with emerging economies, with the exception of Russia and China. In this case, we can expect the growth of the dollar index ICE to the mark first at 110, and then to 111 points. In fact, it will be possible to say that the dollar exchange rate against major currencies will linger for a long time at the level of the beginning of this century.

As for the possible dynamics of the markets this week, the release of data on inflation in the eurozone, which is expected to rise again, and, of course, the latest figures on unemployment in America, will play a leading role here. Considering the Fed's general position regarding rates, we believe that if the data on the number of new jobs comes out no worse than expected, the US central bank will once again be confident that it is on the right course, fighting inflation and using the still strong labor market for this, trying to bring down the economy before serious problems arise, like a high temperature with aspirin, by aggressively raising interest rates.

It is likely that after local consolidation, the smooth strengthening of the dollar will continue, and the markets will remain between the hammer of Fed rates and the anvil of inflation.

Forecast of the day:

AUDUSD pair

The pair is trading below 0.6865. Consolidation below this mark may be the basis for the pair's fall to 0.6800.

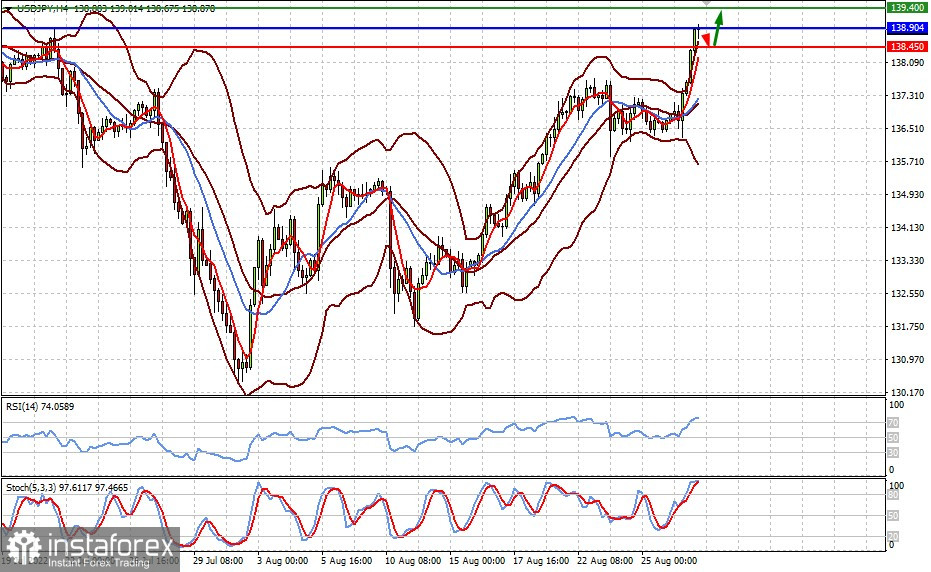

USD/JPY pair

The pair is at the level of 138.90. If it does not settle above it, it may correct down to 138.45, and then again rush to 139.40.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română