On Friday, the EUR/USD currency pair worked out the moving average line, decreasing the price rather than the price rising. Thus, we saw another indistinct correction, which only confirms the obvious fact to everyone: bears now dominate the market, and even during those periods when the pair is growing, this only means that the bears just took a short pause. As we have said, the European currency cannot adjust by more than 400 points within the downward trend, although the entire trend is already 2300. In the long term, we can say that the fall is almost recoilless. And the factors that provoke more and more sales of the euro currency and dollar purchases remain unchanged. No matter how much we would like it, the euro and the pound will continue to fall as the geopolitical situation in the world not only remains tense and also manages to worsen.

Just recently, China's military exercises were held around Taiwan. In early August, shots were fired at the Serbian-Kosovo border. Transnistria is generally a time bomb, and they are shooting in the Middle East. Turkey decided to conduct its special operation against the Kurds, and the conflict in Ukraine has not gone away. How can we count on strengthening risky currencies with such "geopolitics"? In addition, do not forget that sanctions are being actively imposed against Russia, which harms the economy of the European Union itself. Already, many experts predict a "winter energy recession" in Europe, as the Kremlin may start using one of its main trump cards – gas. And what else could you expect? The European Union imposes sanctions not by the dozens but by the hundreds, and Moscow responds similarly. Gas flows through pipelines to the EU are already weakening. If Brussels itself wanted to abandon Russian hydrocarbons gradually, then Moscow reasonably decided: and why wait for the EU to stop buying gas if it is possible to stop selling gas to the EU when it is completely unprepared for this? Naturally, all these events do not contribute to the normalization of the economy, and the euro currency is going to hell.

The head of the Fed has not changed his rhetoric

The second most serious factor in the growth of the dollar was and remained the Fed's monetary policy. While the European Union is preparing for a cold winter and doing everything it can to keep GDP above zero, the United States has long openly stated that they are ready to sacrifice economic growth to return inflation to target levels. On Friday, Jerome Powell gave a speech at Jackson Hole, which, from our point of view, did not tell the markets anything that they did not know. His rhetoric has not changed and retains a pronounced "hawkish" color. What did Powell say?

He said that the key rate would continue to rise as the current neutral level cannot contribute to a rapid return of the CPI to 2%. The rate will remain at high values for quite a long period, even if it harms households and businesses. The Fed will keep a very close eye on macroeconomic statistics, but it is almost certainly not Nonfarm Payrolls or GDP that is meant, but inflation. The US labor market remains very good, and the unemployment rate is at its lowest in 50 years. Therefore, there is no need to worry about these indicators.

Consequently, it does not matter how much the rate will be raised at the next Fed meetings. If it is 0.5%, it is logical since inflation has started to slow down. If it is 0.75%, it is also quite logical because, with this step, the Fed will try to give inflation a downward vector of movement for a long period. In any case, we are talking about tightening monetary policy. And if so, then the US dollar will have enough fundamental grounds for continued growth, at least until the end of 2022. Well, everything is so complicated with geopolitics now that it can only continue to pressure the euro and the pound, even if the Fed stops raising the rate. Such several "hot spots" that are now on the world's political map can lead to a world war.

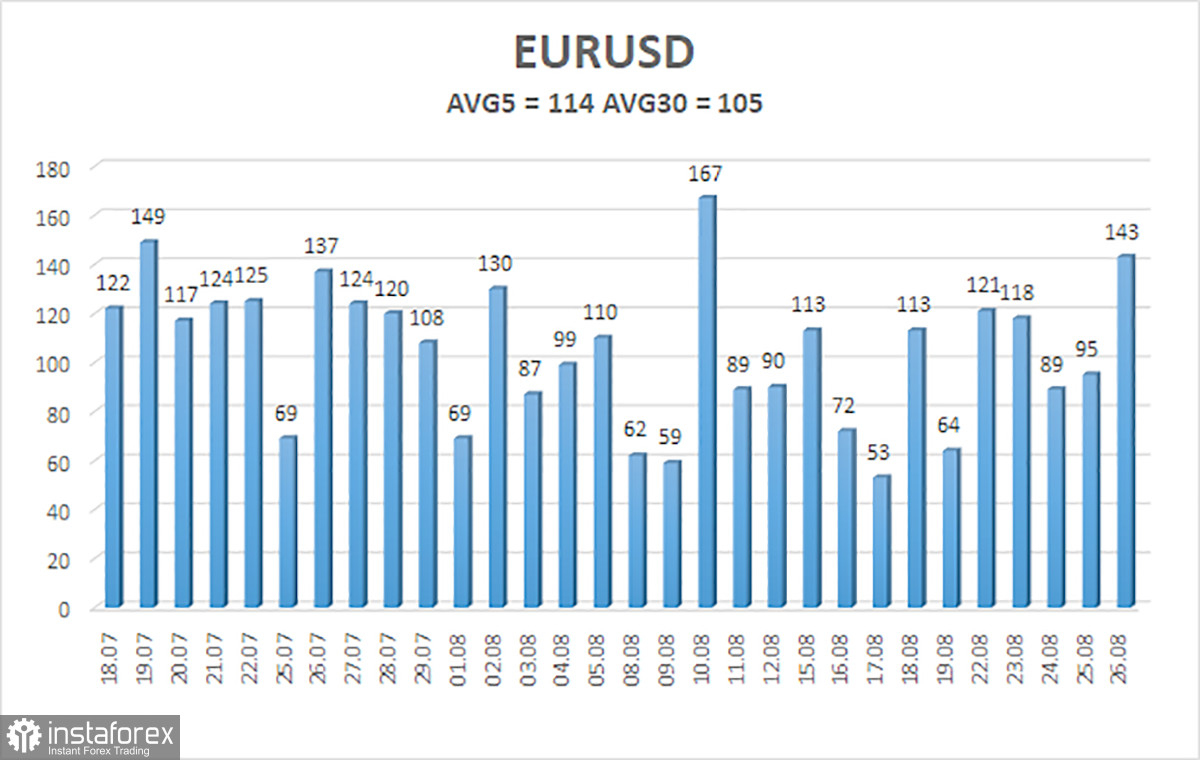

The average volatility of the euro/dollar currency pair over the last five trading days as of August 29 is 114 points and is characterized as high. Thus, we expect the pair to move today between 0.9850 and 1.0078. A reversal of the Heiken Ashi indicator upwards will signal a new round of corrective movement.

Nearest support levels:

S1 – 0.9949;

S2 – 0.9888.

Nearest resistance levels:

R1 – 1.0010;

R2 – 1.0071;

R3 – 1.0132.

Trading Recommendations:

The EUR/USD pair is trying to resume its downward movement. Thus, it is necessary to maintain new short positions with targets of 0.9888 and 0.9850 until the Heiken Ashi indicator turns up. It will be possible to consider long positions after fixing the price above the moving average with targets of 1.0078 and 1.0132.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which to trade now;

Murray Levels – target levels for movements and corrections;

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators;

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română