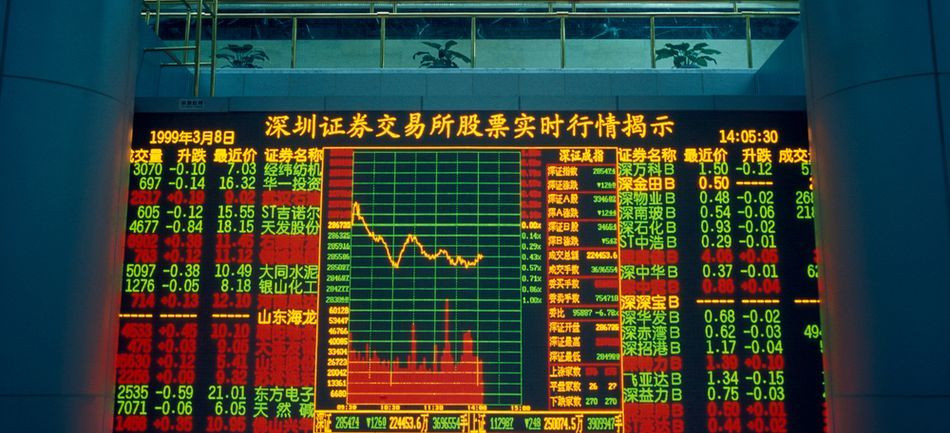

Major Asia-Pacific stock indices have been rising to 1.04% for the second day in a row. Some of them increased slightly: China's Shanghai Composite gained only 0.09%, while the Shenzhen Composite added 0.22%. Korea's KOSPI increased by the same amount. Hong Kong's Hang Seng Index rose by 0.72% and Japan's Nikkei 225 went up 0.65%. Australia's S&P/ASX 200 was the top gainer, it advanced by 1.04%.

On Friday, the US Federal Reserve Chair Jerome Powell delivered his speech. Moreover, market makers expected to get some information about the future course of the US monetary policy. At the same time, since the markets were already prepared for the Fed's tougher stance, Powell's speech did not produce a dramatic negative effect.

The rise in US stock indices by 1-1.7% was considered another positive factor. It was determined by the latest statistical data. They showed that the estimates of the US GDP contraction improved from 0.9% to 0.6%.

Chinese authorities decided to allocate 1 trillion yuan ($146 billion) to support the country's economy, placing an emphasis on infrastructure spending.

It was also announced that an additional 300 billion yuan would be provided after a similar amount of money had been allocated in June for infrastructure projects by state-owned banks.

Local governments will be allocated 500 billion yuan in government bonds from previously unused quotas. State-owned energy companies will be allowed to sell their bonds for a total of 200 billion yuan.

The agricultural sector will also be provided with subsidies of 10 billion yuan.

Shares of Wuxi Biologics (Cayman), Inc., Longfor Group Holdings, Ltd. and Xinyi Solar Holdings, Ltd. rose among the Hong Kong Hang Seng Index. They gained by 5.5%, 4.95%, and 4.4% respectively.

At the same time, CNOOC, Ltd. shares fell by 1.1% despite the fact that the company managed to more than double its net profit in January-June 2022 due to higher energy prices, particularly oil.

Unitika, Ltd., Komatsu, Ltd. and Toray Industries, Inc. were top gainers among Japanese companies. They added 3.2%, 3%, and 2.75% respectively.

South Korean companies traditionally do not show significant changes in their share prices. Shares of Samsung Electronics Co. rose by 0.8% and stocks of Hyundai Motor Co. advanced by 1.04%.

The increase in the Australian indicator was contributed by the rise of the largest companies' quotes. Moreover, it is calculated on their basis: the value of BHP shares increased by 1.9% and Rio Tinto gained 1.5%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română