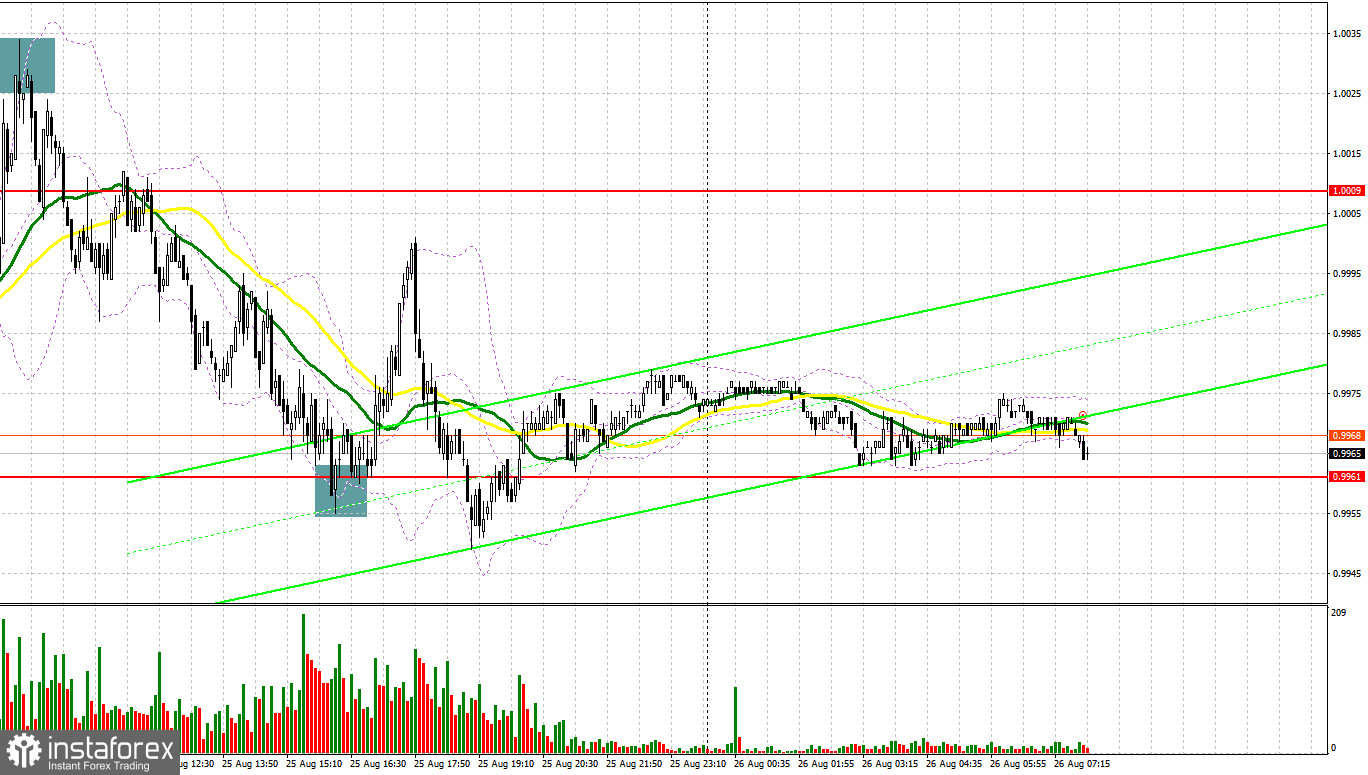

Yesterday, the market formed several good entry signals. Let's analyze the 5-minute chart to see what happened there. In my morning review, I mentioned the level of 1.0027 as a good point for entering the market. The macroeconomic data from Germany turned out to be better than expected which supported the euro. After moving upwards, the pair made a false breakout at 1.0027 which allowed bears to seize the initiative. They have already done so near the parity level. This resulted in a sell signal and a 50-pip decline in the euro. Later in the day, sellers pushed the pair lower to 0.9961 after a positive report on US GDP. Then, another false breakout created a nice buy signal that led to a rise of 40 pips.

For long positions on EUR/USD:

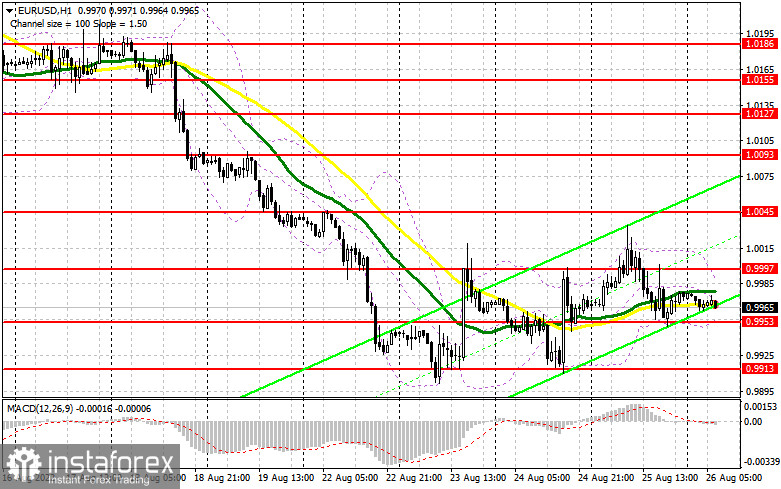

There is no important data expected in the first half of the day that could shape the market sentiment. The leading consumer price index in Germany is forecasted to show even more contraction. Other reports include the data on M3 money supply and private sector loans. However, their relevance is offset by the economic symposium in Jackson Hole and the speech by Fed Chair Jerome Powell. I will talk about it later in my forecast for the US session. In the meantime, I would like to pay your attention to the Flag chart pattern which indicates the continuation of the bearish trend that has been going on since August 11. This means that buyers may face serious pressure at any moment. A false breakout near the interim support of 0.9953, which coincides with the lower boundary of the ascending correction channel of August 23, will generate a buy signal. If so, EUR/USD may recover to the resistance area of 0.9997. A breakout and a downward retest of this range will be possible only amid strong data or dovish comments made by the Fed Chair. This will definitely trigger stop-loss orders set by bears and create an additional signal to go long on the pair with the target at 1.0045. The resistance at 1.0093 will serve as the next upward target where I recommend profit taking. If EUR/USD declines and buyers are idle at 0.9953 in the first half of the day, the pair will come under more pressure. If so, it is better to buy the pair after a false breakout at the yearly low of 0.9913. If there is a rebound, buy the euro only from the level of 0.9861, or closer to the parity level - at 0.9819. Keep in mind a possible upside correction of 30-35 pips within the day.

For short positions on EUR/USD:

The main task for bears today is to protect the resistance level of 0.9997. In fact, this is almost a parity level. If bulls manage to push the price higher after Powell's speech, this may initiate a deeper correction. Otherwise, the pair will continue to fall to 0.97 or even 0.96 that can be reached as soon as this autumn. In the short term, you can open short positions after a false breakout of 0.9997 during the morning session. The price may then slide towards the area of 0.9953. A breakout and consolidation below this range and its upward retest will create another sell signal. In this case, stop-loss orders set by the bulls may be triggered, and the pair may drop to the level of 0.9913. The next downward target is seen at 0.9861 where I recommend profit taking. The lowest level will be the mark of 0.9813 in case Powell intensifies his hawkish rhetoric. If EUR/USD jumps to the upside in the European session on positive data in Germany and the eurozone and if bears are idle at 0.9997, there might be large profit taking on short positions. This scenario will favor the buyers. If so, I wouldn't recommend selling the pair until the price reaches 1.0045 and there is a false breakout there. You can sell EUR/USD right after a rebound from the high of 1.0093, or even higher at 1.0127, bearing in mind a possible downside correction of 30-35 pips.

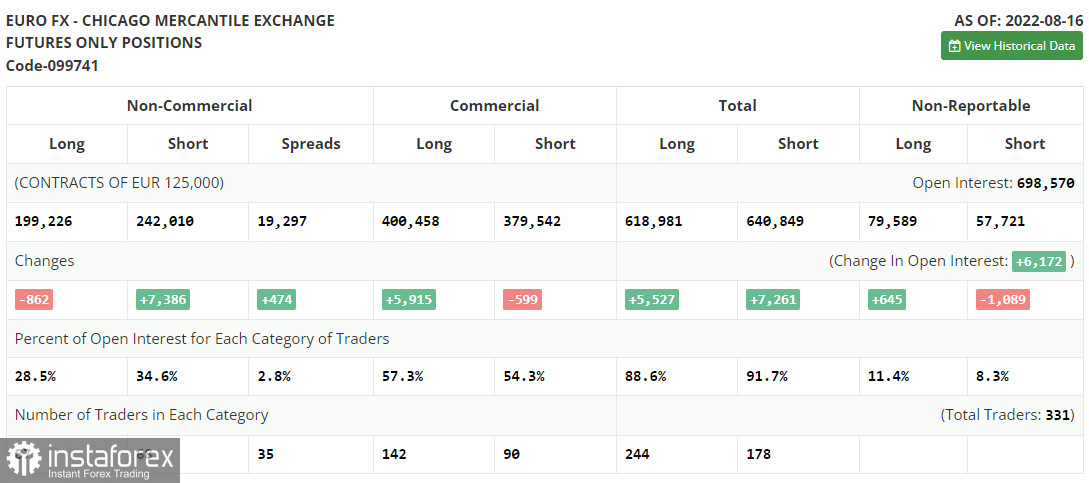

COT report

The COT report for August 16 shows a sharp rise in short positions and a fall in the long ones, which reflects the current status of the euro against the US dollar. The threat of a recession in the US is coupled with an aggravating crisis in the eurozone. The EU economy will face even more hardship this autumn when energy prices soar and inflation accelerates further. So far, the ECB has taken moderate steps to cap rising prices. The meeting in Jackson Hole and Jerome Powell's speech will determine the future trajectory of the pair. The fact is, a strong dollar is not good for the economy as it fuels inflation. According to the COT report, long positions of the non-commercial group of traders decreased by 862 to 199,226, while short positions surged by 7,386 to 242,010. As a result, the negative non-commercial net position decreased to -42,784 from -34,536, indicating a further decline in the instrument. The weekly closing price fell to 1.0191 from 1.0233.

Indicator signals:

Moving Averages:

Trading around the 30 and 50-day moving averages indicates market uncertainty.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands:

In case of a decline, the lower band of the indicator at 0.9953 will act as support. If the pair advances, the upper band at 1.0000 will serve as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română