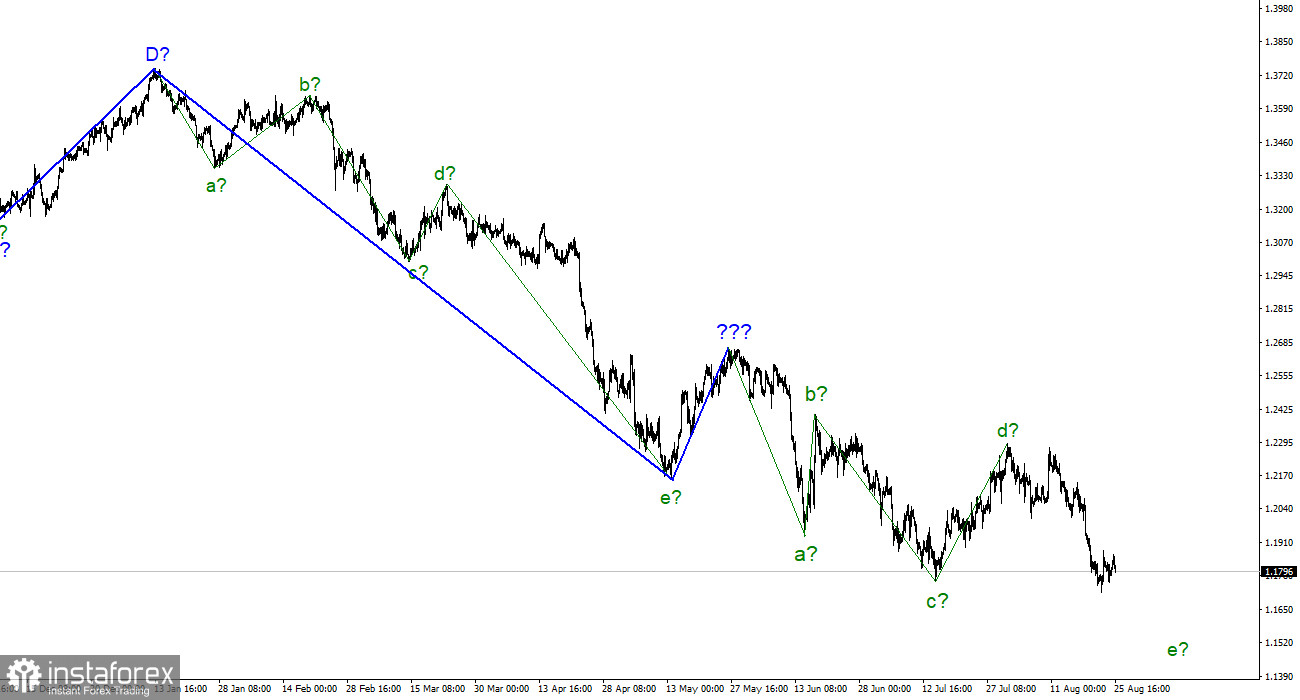

For the pound/dollar instrument, the wave marking looks quite complicated at the moment, but it does not require any clarifications yet. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a strongly lengthening trend area. And the current trend has already taken a very extended form. I believe that in this case, it is much better to identify rare corrective waves, after which new clear structures will be built. At the moment, we have completed waves a, b, c, and d, so we can assume that the instrument continues to build wave e. If this assumption is correct, then the decline in quotations should continue in the near future. The wave markings of the euro and the pound differ slightly in that the downward section of the trend for the euro has an impulse form. Ascending and descending waves alternate almost exactly. However, the corrective status of the trend for the British allows it to complete the wave e near the 161.8% Fibonacci level.

The pandemic and Brexit have dealt the strongest blow to the economy in the last 300 years

The exchange rate of the pound/dollar instrument increased by 30 basis points on August 25. The entire downward section of the trend may already be completed, but low demand for the British dollar may persist for some time. Remember that a few months ago, the wave pattern also looked quite complete, but the British pound continued to decline instead of starting to build an upward trend. Now the situation may repeat itself. At the moment, the deviation of quotes from the reached lows is very small, so I am waiting for a new decline from the British. But I repeat once again: starting from the current day, the construction of a downward trend section can end at any time.

Meanwhile, the UK Bureau of National Statistics has estimated that in 2020, the decline in industrial production was a record for the last 300 years. The British economy shrank by 11%, the maximum drop in GDP since 1709. It is important that this drop was previously estimated at 9-10%, but more thorough analysis and calculations allow us to conclude that it was larger. The bureau does not provide data on how much the economy has shrunk due to Brexit and how much because of the coronavirus pandemic. And this data would be very important in understanding exactly how the country's exit from the European Union was affected. For example, in Spain, the drop in production in 2020 was 10.8%. In many other countries, the decline was about the same in volume. Thus, Brexit could only have a minor impact on production and GDP. Nevertheless, the UK economy is currently on the verge of a new recession, as already stated by the governor of the Bank of England. This factor may lead to another downward set of waves being built on the British.

General conclusions

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument with targets near the estimated mark of 1.1112, equivalent to 200.0% Fibonacci, for each MACD signal "down." But first, you need to wait for a successful attempt to break through the 1.1708 mark, which will indicate that the market is ready for new British sales.

The picture is very similar to the Euro/Dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română