Futures on US stock indices rose sharply on Thursday as China's large-scale incentives slightly normalized investors' nerves alarmed by the key speech of Federal Reserve Chairman Jerome Powell, which he will deliver tomorrow. Treasury bond yields have declined. Futures for the S&P 500 and Nasdaq 100 continued their growth on Thursday after closing in the black a day earlier in the regular session. Sentiment strengthened after China announced new measures to stimulate the economy by another 1 trillion yuan.

Many expect that volatility will continue to remain high as the start of the symposium in Jackson Hole is ahead. Investors will be looking for clues about the pace of further tightening of US monetary policy, which will directly affect inflation and the pace of slowing economic growth. On the eve of Jackson Hole, Fed officials made it clear that they expect further tightening of monetary policy, which hit the stock market quite hard at the end of last week and the beginning of this week. The whole question is: will the indices also continue to fall actively, returning to the lows of the year, or will buyers gain confidence in their actions, and the downward correction will end?

Many are betting that Powell will dismiss premature expectations of a dovish reversal, confirming that he will continue to be fully focused on fighting high inflation.

Oil prices continued to rise and, at the moment, have reached $ 95 per barrel. High energy prices have once again raised concerns about whether inflation has reached its peak. Natural gas prices have jumped to new highs, exacerbating the energy crisis threatening the eurozone economy and its global prospects.

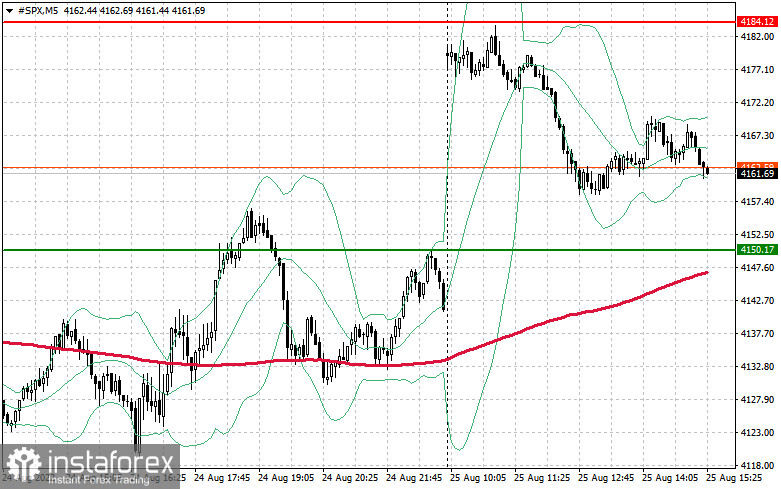

According to the S&P500, bulls managed to defend the $4,116 level yesterday and got above $4,150, even managing to reach $4,184. I advise you to place all your emphasis on these levels today. In the case of a downward movement after weak statistics on the US economy, the breakdown of $4,150 will provide a direct road to the area of $4,116 and $4,090, where the pressure on the trading instrument may ease slightly ahead of the start of the symposium. The index will also approach fairly important support levels, breaking below, which will not be easy – provided that there are real buyers in the market. The index will be able to talk about further growth only after controlling the resistance of $ 4,184, the test of which has already taken place today. This will open the way to $4,208. Only in this way will we see fairly active growth in the area of $4,229, where large sellers will return to the market again. At a minimum, there will be those who want to lock in profits on long positions. A more distant target will be the $4,255 level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română