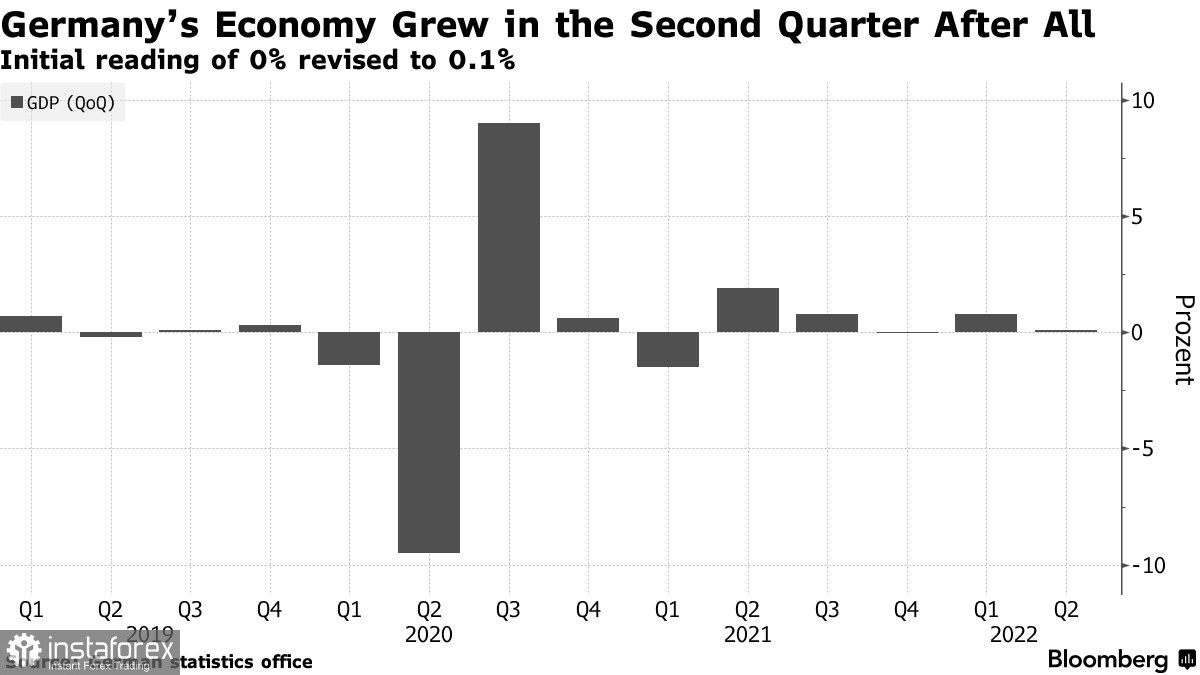

The European currency strengthened its position against the US dollar after it became known that the German economy in the second quarter was more stable than initially expected, showing growth of 0.1%, despite high inflation and a special military operation in Ukraine.

According to the statistical office's data today, the second estimate exceeds the preliminary one, indicating the economy's stagnation over the past three months. And although the European currency rose against the background of this data, it will not help much to dispel concerns about the deterioration of the prospects of Europe's largest economy. The initial value of 0% has been changed to 0.1%.

The revision in the positive direction was due to government spending, including household spending. But the restraining factors for growth have remained the same: Russia is reducing natural gas supplies, and a sharp rise in prices threatens households and companies.

This week, a Bundesbank report said that production in the third quarter will stagnate more or less, while the risk of contraction in the fourth quarter of 2022 and the first quarter of 2023 has increased significantly. Inflation by the end of the year may even reach about 10%. The July meeting minutes of the European Central Bank will be published today, from which it will be clear to what extent the regulator intends to continue to adhere to a more aggressive increase in interest rates. If traders do not find anything interesting there, the further growth of risky assets will be limited.

Most recently, German Chancellor Olaf Scholz promised citizens the third package of financial assistance to compensate for losses from rising inflation caused, in his opinion, by Russia's actions in reducing gas supplies. However, Scholz warned that the coming months would not be easy for Europe's largest economy. Scholz also tried to convey to people that his government is controlling the energy crisis and will not leave citizens suffering from rising heating prices. "We are facing serious times, and I think everyone in this country knows about it," Scholz told reporters. "We will do everything possible to ensure that citizens survive this period safely."

Let me remind you that half of the homes in Germany use gas for heating, and the country may face rationing if it fails to provide sufficient reserves. The government plans to fill warehouses by 95% by November, compared with 73.7% as of last week.

Against the new fundamental background, the euro recovered slightly from yesterday's annual lows, which was not enough to update quite a bit. Now the bulls need to cling to 1.0030 since, without this level, it will be very problematic to expect more rapid growth of the trading instrument. Going beyond 1.0030 will give confidence to buyers of risky assets, which will pave the way to 1.0070 and 1.0200. In the event of a decline in the euro after weak statistics and the publication of ECB protocols, buyers will probably offer something around 0.9980. Having missed this level, there will be talk of a continuation of the bear market, pushing the euro to 0.9910 and 0.9860, which will open a direct road to 0.9820.

The pound managed to recover yesterday and has every chance of continuing the upward correction so far. Buyers now need to do everything to stay above 1.1800 – the nearest support level. Without doing this, you can say goodbye to the hope of recovery. In this case, we can expect a new major movement of the trading instrument to the levels of 1.1760 and 1.1720. A breakdown of these ranges will give a direct road to 1.1680. It will be possible to talk about the continuation of the correction only after fixing above 1.1850, allowing the bulls to count on a recovery to 1.1895 and 1.1940.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română