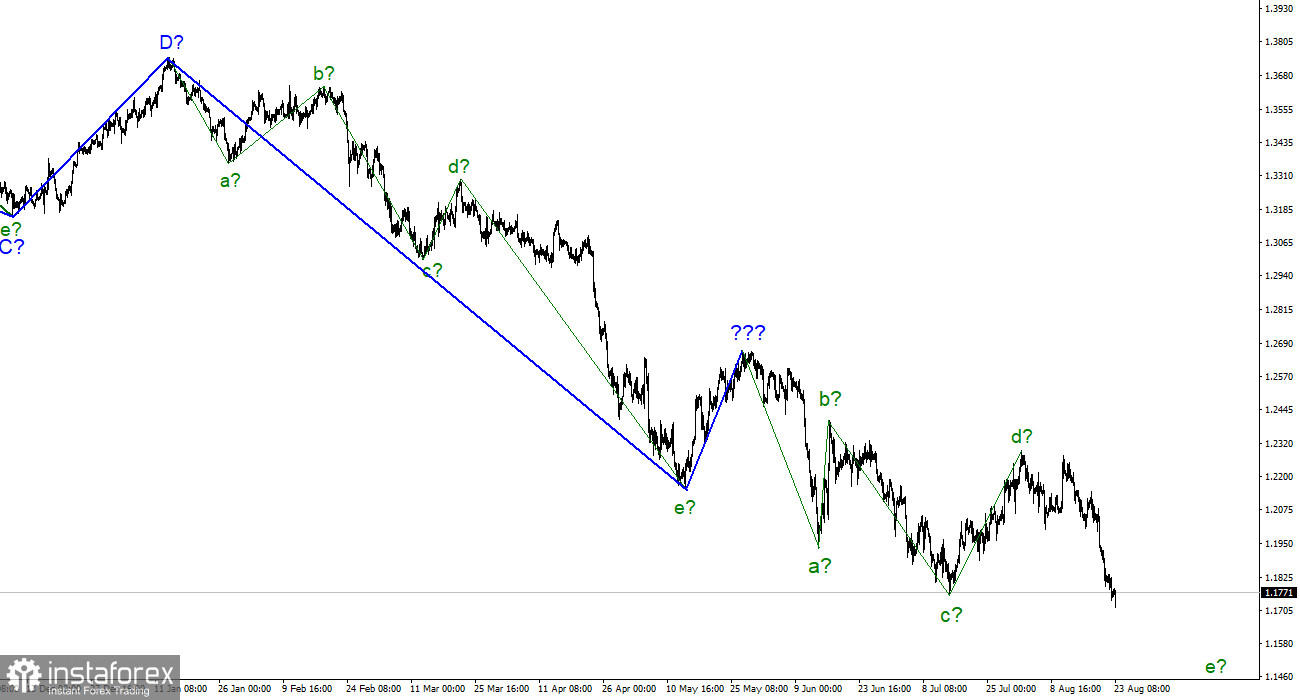

For the pound/dollar instrument, the wave marking looks quite complicated at the moment, but it does not require any clarifications yet. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a greatly lengthening trend area. And the current trend has already taken a very extended form. I believe that in this case, it is much better to identify rare corrective waves, after which new clear structures will be built. At this time, we have completed waves a, b, c and d, so we can assume that the instrument has moved on to constructing wave e. If this assumption is correct, then the decline in quotations should continue in the near future. The wave markings of the euro and the pound differ slightly in that the downward section of the trend for the euro has an impulse form. Ascending and descending waves alternate almost identically. However, the corrective status of the trend for the British allows completing the wave e near the 161.8% Fibonacci level.

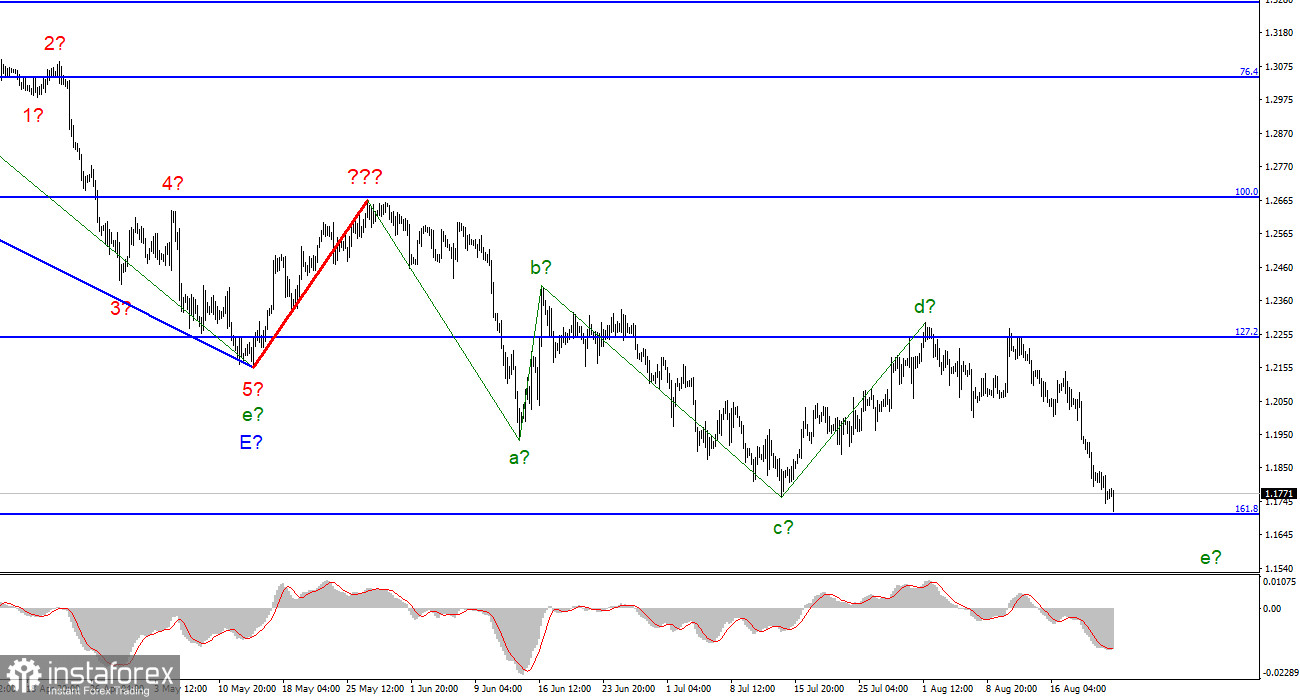

Business activity in the UK is also declining.The exchange rate of the pound/dollar instrument on August 22 decreased by 70 basis points, and on the 23rd, it increased by 10. Today, there were practically no losses for the pound. Still, in the morning, demand for it continued to decline, and only after the release of business activity indices in the UK did demand recover slightly. And this is very strange since all three indices were below their July values. The service sector was particularly upset, where the index fell from 52.1 points to 46.0. The other two indices remained above the 50.0 mark, but even a decrease in one index below 50.0 is enough to start sounding the alarm. From my point of view, all three indices can be written as negative. However, the pound, declining for two weeks before, unexpectedly responded with a slight increase. I think the unsuccessful attempt to break through the 161.8% Fibonacci mark played a role. As I have already said, near it, the pound can complete the construction of not only the wave e, but also the entire last downward section of the trend.

Today, the market will still receive information on business activity in the United States. Two out of three indices went below the 50.0 mark last month. Only in the sphere of production, the indicator remains in the "green zone." However, business activity may continue to decline this month as the Fed tightens monetary policy and moves the economy towards recession. There is simply nothing to increase business activity at the moment. But I can't imagine how the market will react to this data in the evening. The decline of the instrument has been too long and strong lately. Morning indices in the UK showed that the market reaction might be the opposite of what everyone is counting on.

General conclusions

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument with targets near the estimated mark of 1.1112, equivalent to 200.0% Fibonacci, for each MACD signal "down." But first, you need to wait for a successful attempt to break through the 1,1708 mark, which will indicate that the market is ready for new British sales.

The picture is very similar to the Euro/Dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română