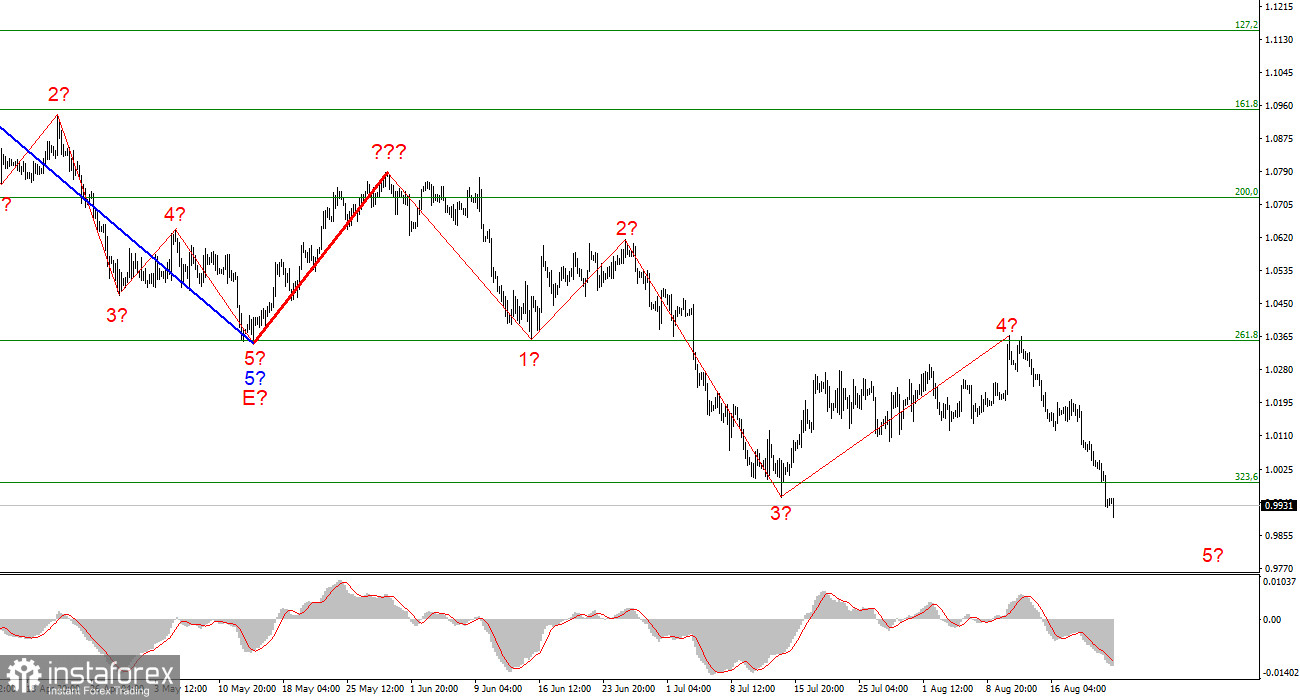

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, despite the increase in quotes within the framework of the expected wave 4 turned out to be stronger than I expected. The new wave marking does not yet consider the rising wave marked with a bold red line. The whole wave structure may become more complicated, but any structure can always take a more complex and extended form. The construction of an ascending wave has been completed, which is interpreted as wave 4 of the downward trend section. If this assumption is correct, the instrument continues to build a descending wave 5. The assumed wave 4 has taken a five-wave but corrective form. However, it can still be considered wave 4. There are no grounds to assume the completion of the downward trend section. An unsuccessful attempt to break through the 1.0356 mark, which equates to 261.8% by Fibonacci, indicates that the market is not ready to continue buying the EU currency. And a successful breakout attempt of 0.9989, which corresponds to 323.6% by Fibonacci, on the contrary, indicates a willingness to continue reducing demand for the euro. I expect the decline in the quotes of the instrument will continue with targets located below the 1.0000 mark within wave 5. Wave 5 can take on almost any length since wave 4 was much longer than wave 2.

Business activity in the European Union continues to decline

The euro/dollar instrument fell by 100 basis points on Monday, and today – by another 20. Thus, the market continues to reduce the demand for the euro currency. Today, a few hours ago, the first reports of this week were released. Business activity indices have become known in Germany and the European Union. In Germany, business activity in the service sector decreased to 48.2 points, in the manufacturing sector – it increased to 49.8 points, and in the composite index, it fell to 47.6. In the European Union, business activity in the service sector decreased to 50.2 points, in the manufacturing sector – to 49.7 points, and the composite index fell to 49.2. Thus, 5 out of 6 indices turned out to be below the key mark of 50.0 by the end of August, below which it is believed that the sphere is shrinking and not developing and growing. Of course, this is a negative sign for the euro currency, but it is strange – after these reports, the euro currency slightly increased. However, I would not draw any conclusions after this growth. Demand for the euro continues to decline, and in the last two weeks alone, the instrument has fallen by almost 500 basis points. The departure from the reached lows by 30 points does not mean anything. The proposed wave 5 may already be completed or nearing its completion since it has gone beyond the low of wave 3. However, the dimensions of the previous waves make it possible to assume that it will take a much longer form. Thus, there is still a long way to complete the reduction of the instrument. But then it can move on to building a new upward section of the trend. At least correctional.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section continues. I advise you to sell the instrument with targets located near the estimated 0.9397 mark, which equates to 423.6% Fibonacci, for each MACD signal "down" in the calculation of the construction of wave 5. So far, I do not see a single signal indicating this wave's completion.

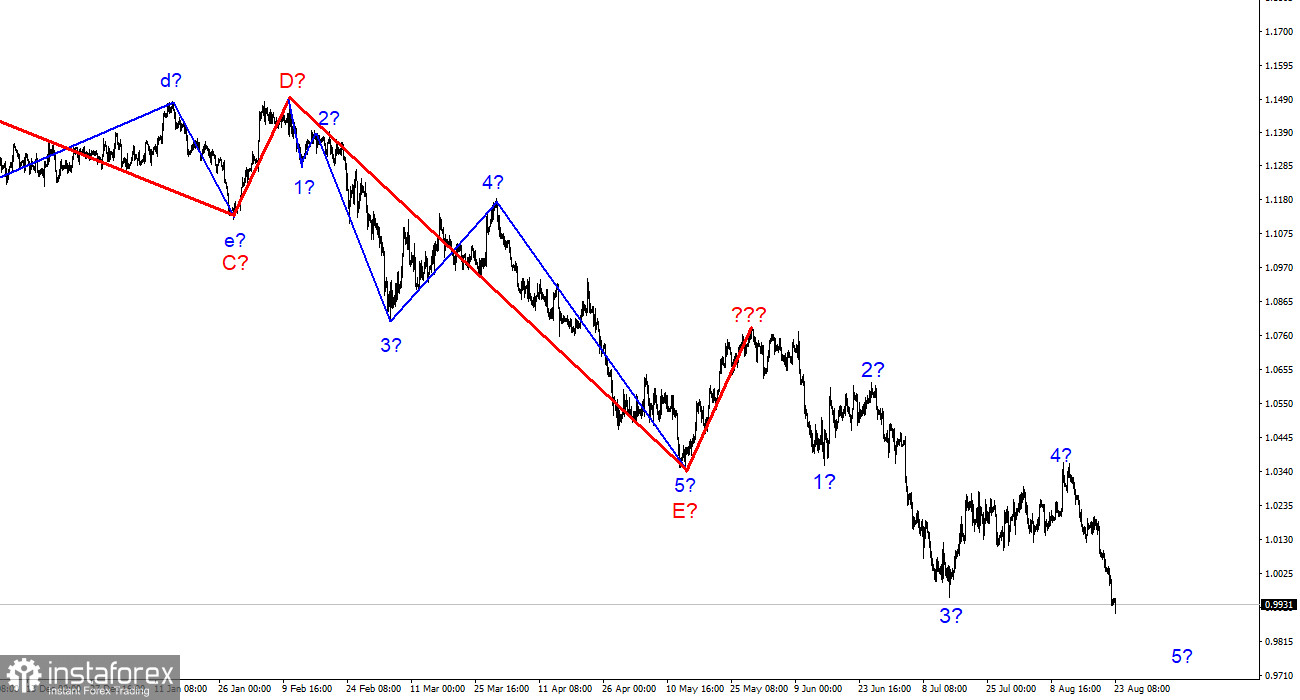

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three and five-wave standard structures from the overall picture and work on them.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română