Over the past week, BTC has completed its upward movement, bouncing off the local low and breaking through the ascending trendline. Subsequently, the coin failed to consolidate at the $22,500 support area. As a result, the price of bitcoin collapsed to the $21,000 level acting as the final support line for the cryptocurrency on the way to a retest of the $20,000 mark. Judging by pessimistic statements, the price is likely to go to the round level.

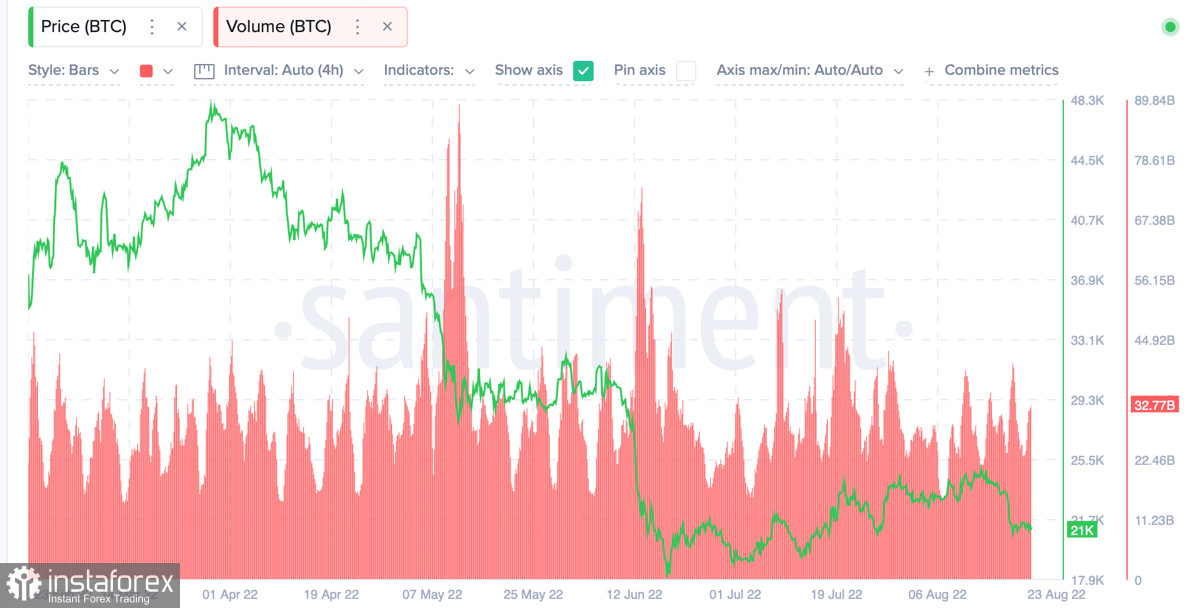

According to Bitfreedom Research, bitcoin and the cryptocurrency market are approaching the second phase of a bear market. Analysts predict that BTC could fall below the $20,000 level and extend losses, hitting a new local low. Lower trading activity in the crypto market can be confirmed by several key technical indicators. For example, trading volumes in the bitcoin network remain low, but bullish sentiment has sunk.

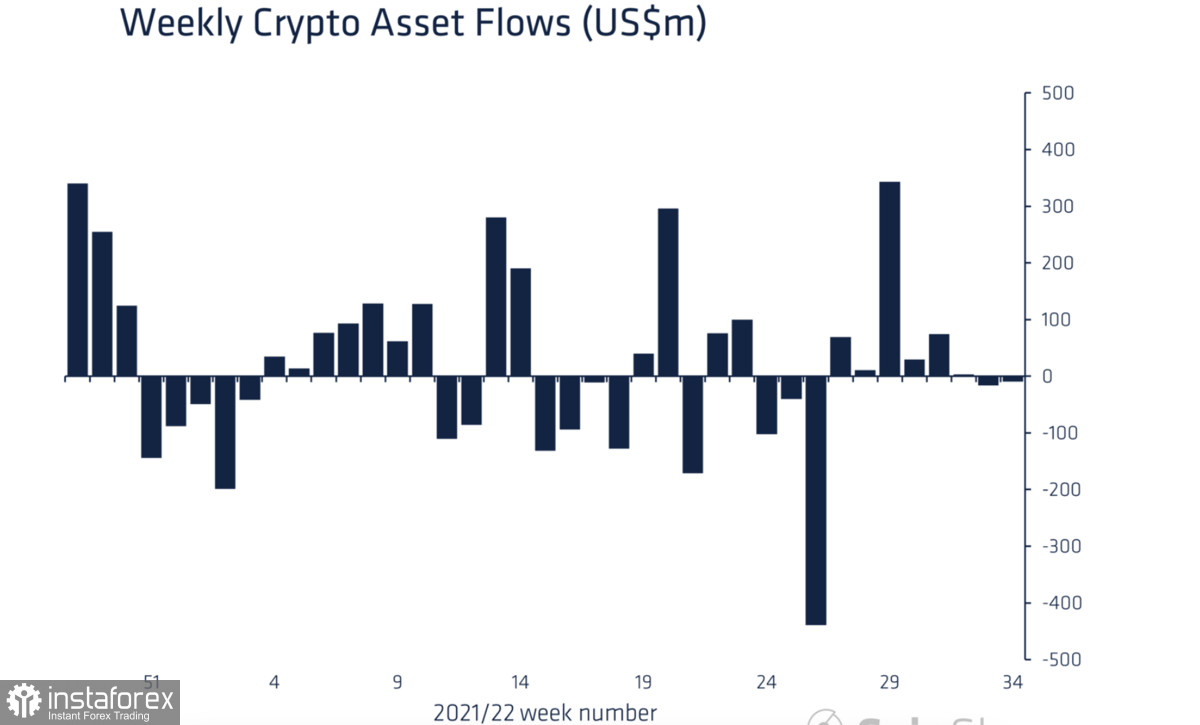

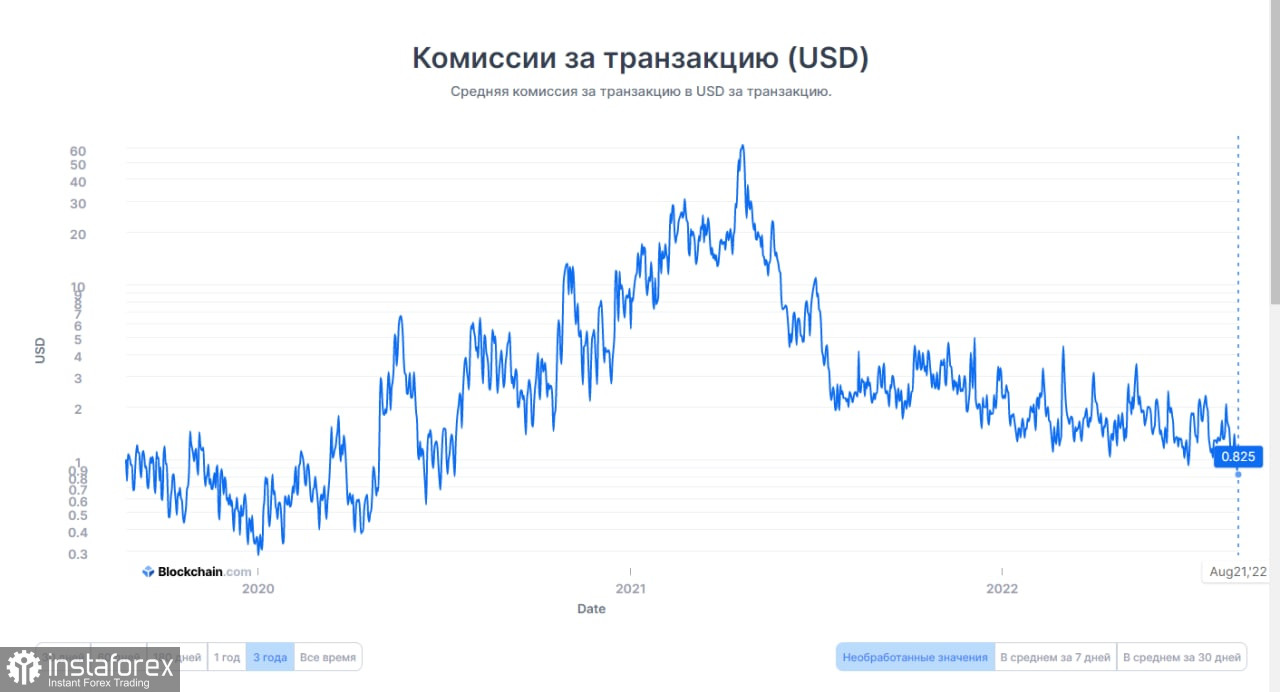

The lack of interest in the main cryptocurrency is also confirmed by the average transaction fees on the Bitcoin blockchain. According to the latest data, the indicator fell below $1 for the first time in two years since the summer of 2020, following the mining ban in China. Peak values of the indicator are typical for the periods of a bullish rally. In addition, according to CoinShares experts, BTC-based crypto funds saw an outflow of over $14 million. These factors indicate that investors have little interest in bitcoin and point to a significant decline in investment activity in relation to the cryptocurrency.

This can be attributed to the Fed meeting, at which the regulator's members said that they would stick to their aggressive monetary policy until a meaningful decline in inflation. After the consumer price index fell to 8.5%, markets were optimistic about the autumn of 2022. However, the Fed remained adamant and left the current monetary policy unchanged. With this in mind, markets are preparing for another increase in the key interest rate. Also, the Fed's statement contributed to a further rally in the US dollar both in the foreign exchange and related markets.

As a result, the DXY index surged, once again testing the resistance level of 109. As we have already noted, this index is of great importance to all markets until the end of the Fed's current monetary policy. According to the daily chart, there is an obvious inverse correlation between bitcoin and the DXY index. When the latter was in a correction phase, the cryptocurrency hit a new local high, rising to $25,000. As of August 23, the situation is changing again. Technical indicators point to a continued bullish run of the US dollar index. This means that BTC and stock indices will most likely resume their downward movement.

However, there is an important factor that may have a positive impact on the first cryptocurrency. Obviously, the Fed resumed its active withdrawal of liquidity from the markets. This supported the US dollar, which began to post gains against other financial instruments. Notably, the US dollar index reached 109 in mid-July, which affected the euro. On August 23, the European currency fell to the level of 1.04 against the greenback again. Apparently, the situation is repeating itself.

However, this raises difficulties as a strong euro is very important for the global economy's stability. Given this fundamental factor, the US dollar may be deliberately lowered in the near future with a view to stabilizing world currencies. It is also important to note that last week ECB members said that an aggressive hike in the key rate had not had the desired effect on the economy and the euro. This is a key factor that could force the Fed to lower the US dollar to maintain parity. In this regard, bitcoin may well gain value in the medium term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română