Early in the American session, Gold (XAU/USD) is trading around 2,020.75. The price has pulled back after it reached a high of 2,028.33.

This move in gold was due to US inflation data showing readings below expectations.

In a few minutes, gold appreciated by $20 dollars, reaching the highest level in six days.

At the same time, US yields fell sharply. The 10-year bond yield has fallen to 3.36%. This encouraged the recovery of gold.

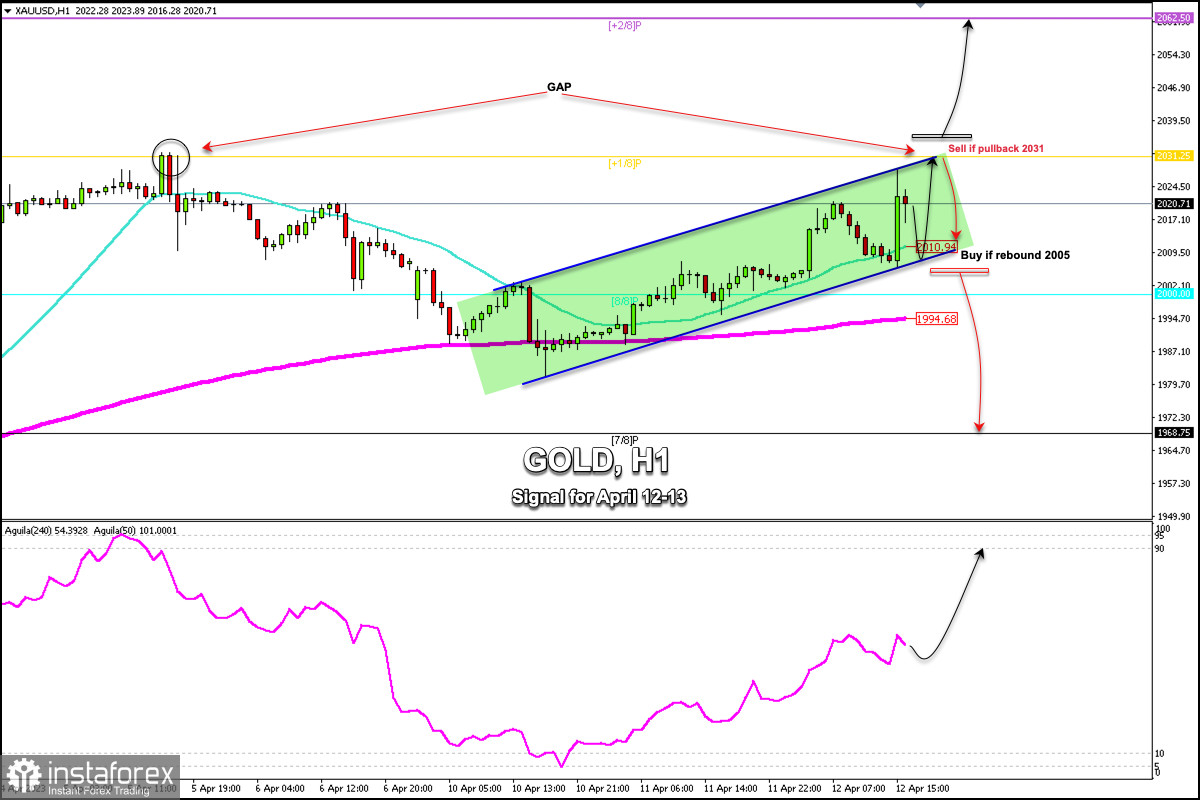

According to the 1-hour chart, gold has a gap left on April 5th. In case there is a technical correction towards the support zone of 2,005, the level coinciding with the bottom of the uptrend channel, this move could offer a technical bounce which will give gold strength to reach the zone of 2,031 (+1/8 Murray).

In case the bullish force prevails, a daily close above +1/8 Murray could benefit the bulls and XAU/USD could reach the zone of 2,062 (+2/8 Murray), the key level an extremely overbought zone.

On the other hand, in case gold falls below 2,002, we expect the downward movement to accelerate and the price could reach the 200 EMA located at 1,994 and finally the 7/8 Murray located at 1,968.

According to the price action, gold is likely to reach an area of 2,031 in the next few days. Therefore, with any retracement and as long as the instrument trades above the psychological level of $2,000, it could be seen as an opportunity to continue buying.

Our trading plan for the next few hours is to wait for a technical correction towards the 21 SMA located at 2,010 or towards the support of the uptrend channel formed from April 10 at about 2,005 to buy with targets at around 2,031.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română