Although the US dollar significantly appreciated during a short period of time, the market continues moving in the same direction. Notably, on Friday, the greenback was significantly overbought. In other words, conditions for at least a local bounce were created long ago. Nevertheless, the euro once again dropped. The most important thing is that it is falling, approaching the level of 0.9900. It seems that investors lost hope not only for the euro, but for all the currencies except for the US dollar.

Notably, the US dollar has become even more overbought. Yesterday's trading day showed that the greenback needs some strong reasons to decline. For example, it may lose in value amid a particular macroeconomic report. However, today's preliminary estimates on business activity are likely to boost the US dollar even more. Meanwhile, in Europe, the similar forecasts are absolutely negative. Thus, services PMI may drop to 50.8 points from 51.2 points, whereas manufacturing PMI may decline to 48.6 points from 49.8 points. As a result, the composite PMI may slide to 49.3 points from 49.9 points.

Eurozone Composite PMI

At the same time, in the US, the situation is a bit different. Although the manufacturing PMI should decrease to 51.1 points from 52.2 points, the services PMI is expected to climb to 48.0 points from 47.3 points. Against the backdrop, the composite PMI may rise to 49.0 points from 47.7 points.

US Composite PMI

In other words, in Europe, business activity is falling, while in the US, the main indicator of business activity is rising. Under the current conditions, the US dollar will hardly decline.

In other words, in Europe, business activity is falling, while in the US, the main indicator of business activity is rising. Under the current conditions, the US dollar will hardly decline.

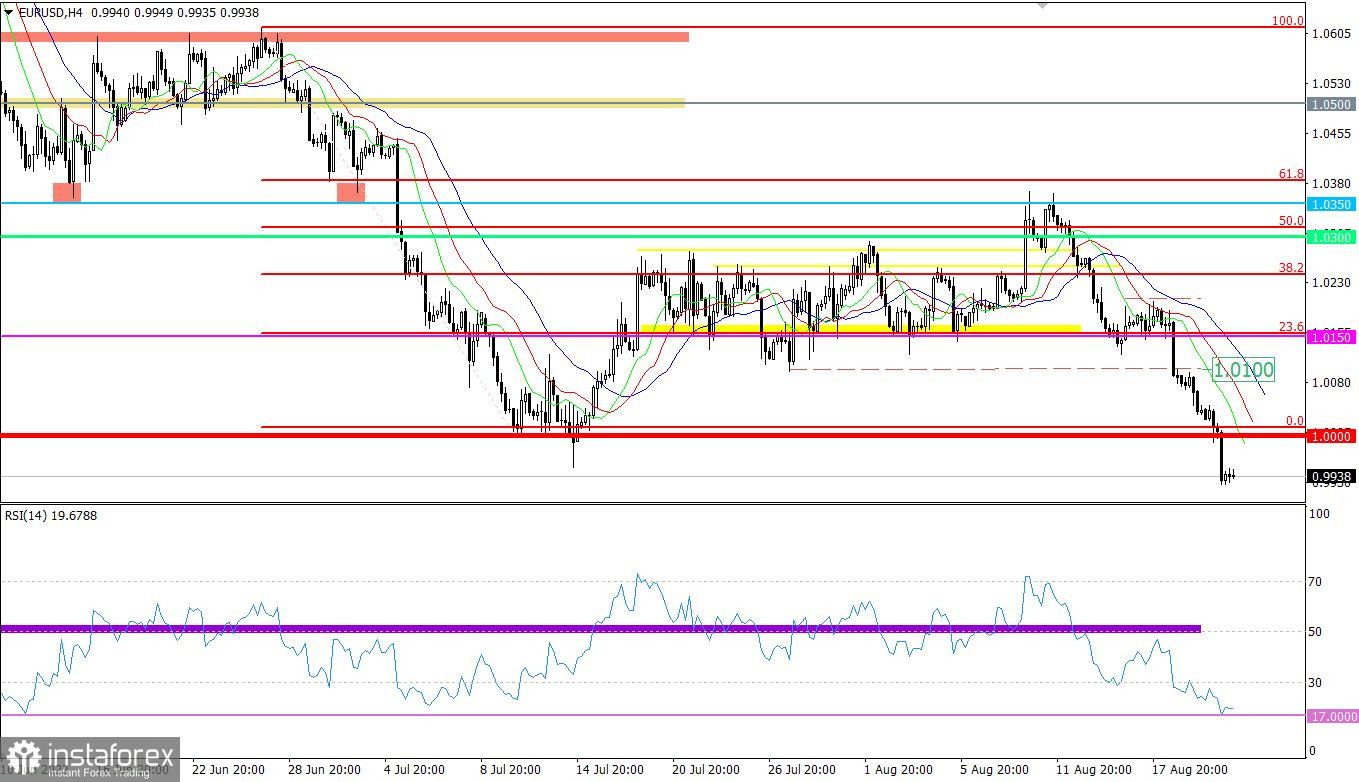

The euro/dollar pair managed to break the parity level and reach a new local low of the mid-term trend amid an inertial movement. As a result, the quote once again settled at the levels recorded in 2002.

On the four-hour chart, the RSI technical indicator dropped, breaking level 17. This points to the fact that the euro is extremely oversold in the intraday period. On the daily chart, the indicator is in the area of 30/50, which corresponds to the prolongation of a downtrend.

On the four-hour chart, the Alligator's moving averages settled below the parity level for the first time since 2002. At the moment, it is a test breakout, which was performed by the fastest moving average.

On the daily period, we can see that the downtrend has fully recovered after the recent upward correction.

Outlook

Under the current conditions, a lot will depend on speculators' sentiment since most technical instruments are reflecting the overheating of short positions on the euro. This should result in a technical rebound. Notably, it is just a theory. The fact is that traders may ignore these signals, allowing the pair to fall even deeper.

In terms of the complex indicator analysis, we see that technical indicators are signaling sell opportunities on the short-term and intraday period amid the inertial downward movement. On the short-term period, technical instruments are also providing sell signals, which corresponds to the direction of the main trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română