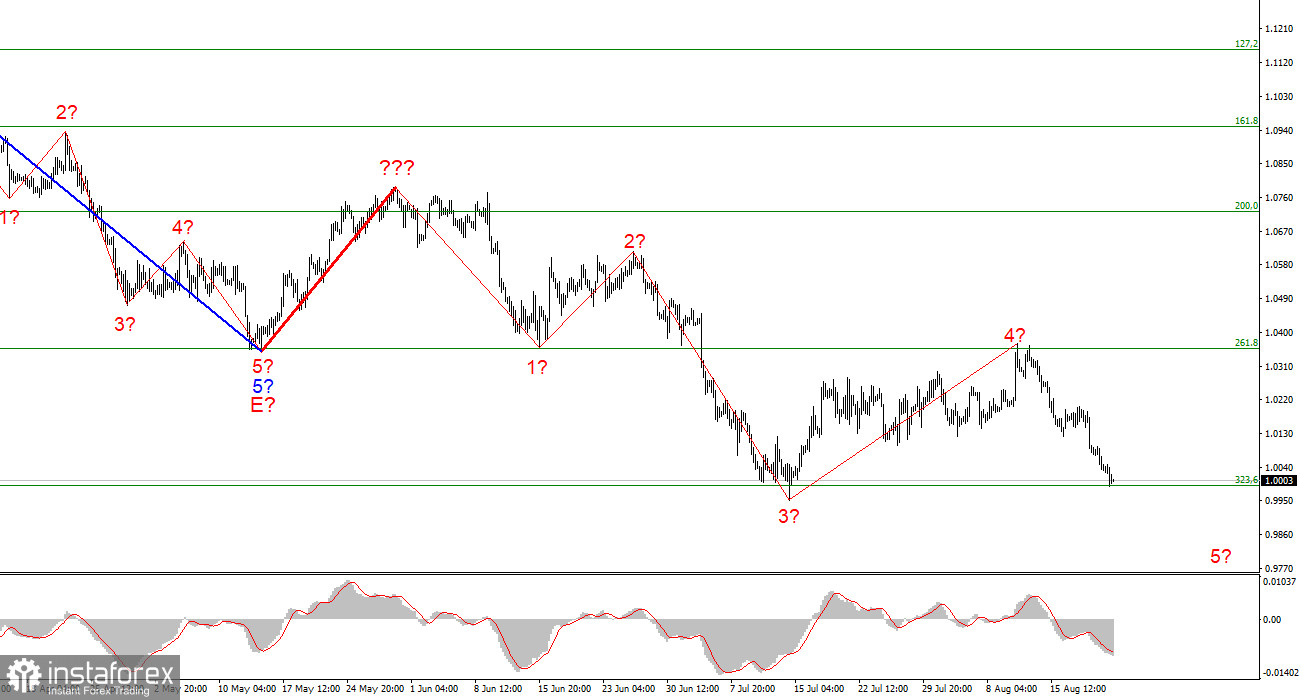

The wave marking of the 4-hour chart for the euro/dollar instrument at the moment still does not require adjustments, although the increase in quotations within the framework of the expected wave 4 turned out to be stronger than I expected. The new wave marking does not yet take into account the rising wave marked with a bold red line. The whole wave structure can become more complicated once again, but any structure can always take a more complex and extended form. Now the construction of an ascending wave has been completed, which is interpreted as wave 4 of the downward trend section. If this assumption is correct, then the instrument continues to build a descending wave 5. The assumed wave 4 has taken a five-wave, but corrective form, however, it can still be considered wave 4. There are no grounds to assume the completion of the downward trend section. An unsuccessful attempt to break through the 1.0356 mark, which equates to 261.8% by Fibonacci, indicates that the market is not ready to continue buying the EU currency. I expect that the decline in the quotes of the instrument will continue with targets located below the 1.0000 mark within wave 5. Wave 5 can take on almost any kind of length since wave 4 turned out to be much longer than wave 2.

Markets are not interested in anything this week, except dollar purchases

The euro/dollar instrument fell by 50 basis points on Friday, and today – by another 40. Thus, the market practically does not take pauses in the sales of the instrument. On Friday and today, no news background could interest the market. Nevertheless, the euro currency has decreased in price by another 1 cent and is now near price parity with the dollar. Let me remind you that a month ago the instrument was already falling to these levels, but then it managed to move away from the reached lows quite quickly. Some even thought that this would be the lowest point of the current trend segment. But only a few weeks have passed, and we see that the downward section of the trend continues its construction, and the euro currency can fall as low as you want. The entire downward trend could have ended on May 13, but instead, it became more complicated. So what prevents the market from complicating it again after the completion of the current fifth wave?

The problems for the European currency are only getting bigger every day. Even if we forget for a while about the sluggishness of the ECB, which seems to be in no hurry to fight inflation and raise interest rates, the whole of Europe is now on the verge of recession and an energy crisis. The market believes that the recession in the EU will be deeper and stronger than in the US, so it prefers to deal with the dollar rather than the euro. This is partly true since the recession in the US begins against the background of a strong tightening of monetary policy, and in the EU it can simply begin. Due to the lack of gas this winter, due to a minimal increase in the ECB interest rate. What would happen if the ECB raised the rate at the same pace as the Fed? In any case, we have a clear wave marking, and it will make sense to speculate how far the euro can fall after the current wave 5 ends. And after we see if the market is going to build an upward section of the trend after that.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section continues. I advise you now to sell the instrument with targets located near the estimated 0.9397 mark, which is equivalent to 423.6% Fibonacci, for each MACD signal "down" in the expectation of building a wave.5 An unsuccessful attempt to break through the 261.8% Fibonacci level indicates that the market is ready for new sales of the instrument.

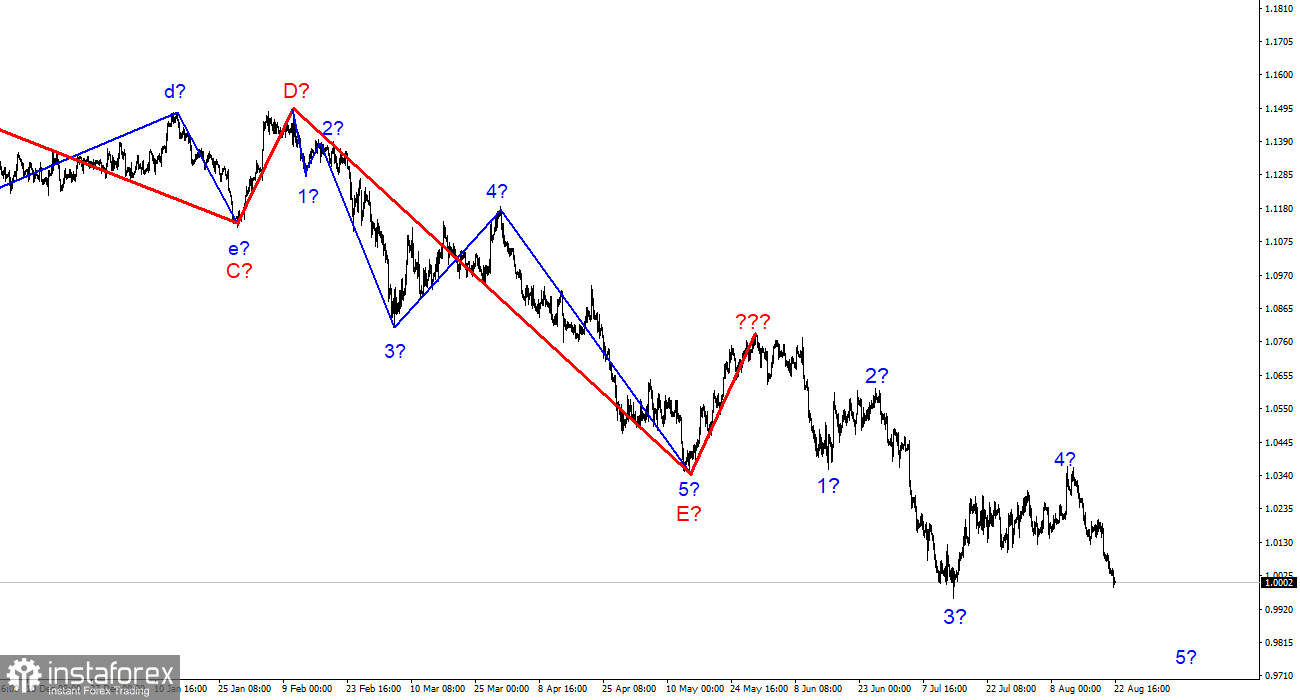

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any kind of length, so I think it's best now to isolate three- and five-wave standard structures from the overall picture and work on them.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română