On Monday, traders adjusted their strategies according to the events that occurred last Friday, namely rising US Treasurers, a drop in stock indices, and increased demand for the US dollar amid market uncertainty/

Last week, Fed officials spoke in favor of further monetary tightening. They have warned that it is too early to talk about rate cuts as inflation still does not reach the target level. James Bullard backed a 0.75% basis point rate increase at the September meeting. Tom Barkin did not specify the size of a rate hike. However, he also believes that the regulator needs to raise the key rate to curb inflation. Yet, he admits the possibility of a recession. Overall, Fed policymakers did not touch upon the topic of a recession.

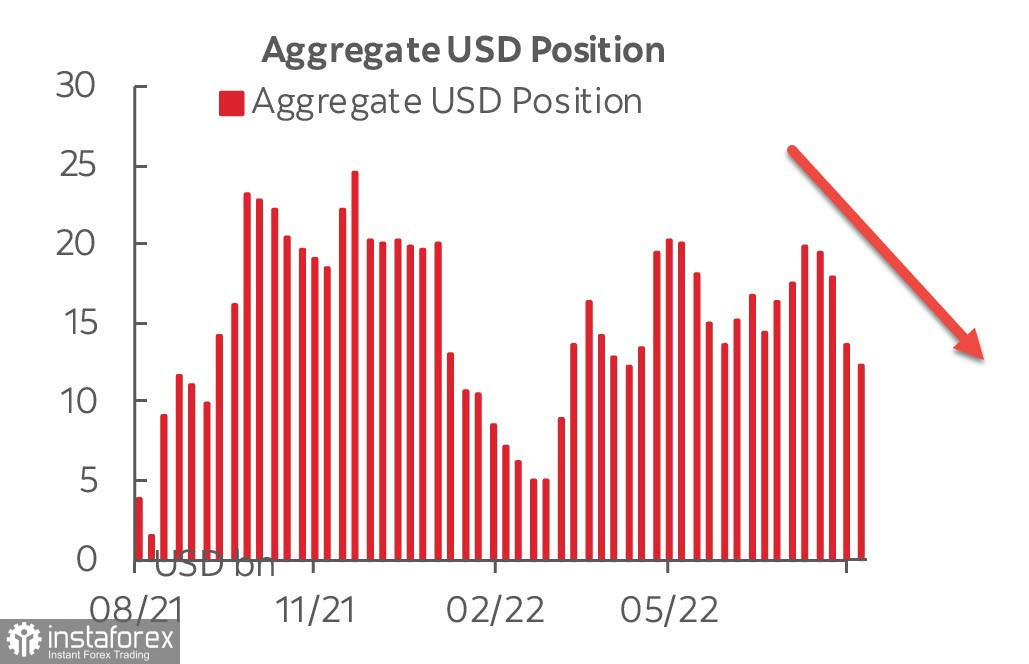

The CFTC report revealed a further decline in the net position on the US dollar. It means that investors believe that inflation in the United States is likely to slow down.

Demand for the US currency was mainly fueled by the latest CPI report, showing that inflation tumbled to 8.5% in July. However, such a drop occurred due to a strong seasonal decline in gasoline prices. Analysts reckon that it is unwise to expect US inflation to slow down, while it continues to grow in other countries.

The main highlights of this week will be the publication of the PMI indices for August and the Jackson Hole Symposium.

EUR/USD

The economic situation in Europe is getting worse. The energy crisis is in full swing. All sectors of the economy are now shrinking. Therefore, a recession seems inevitable. Despite the fact that soaring commodity prices have stopped boosting consumer prices, wage growth as well as electricity and gas tariffs still increase inflationary pressure. So, it is too early to expect inflation to decline in the near future.

The Producer Price Index for Germany approached a fresh record high, rising sharply by +5.3% versus the forecast reading of 0.7%. The figure totaled +37.2% against the forecast reading of 31.8% in annual terms. As gas prices remain high, the index is likely to approach a new record high.

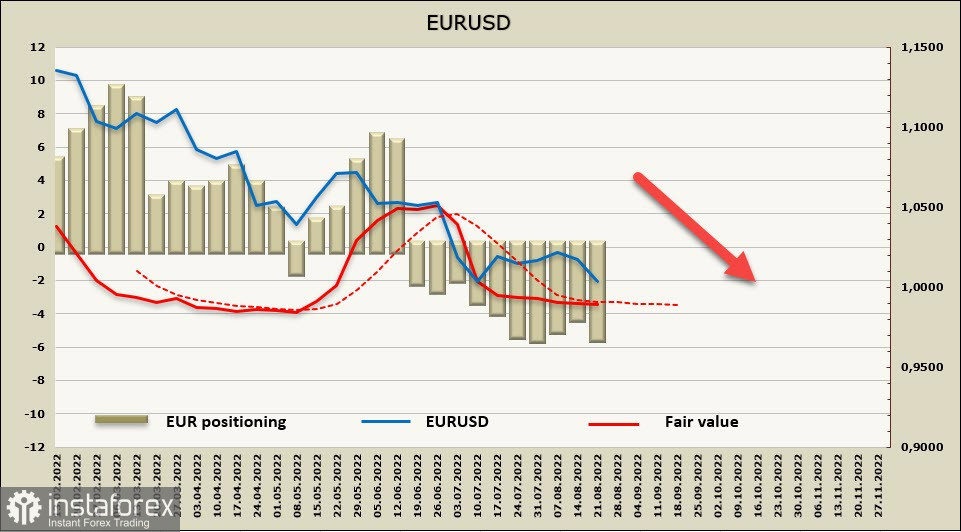

According to the CFTC report, the net short position on the euro increased during the week to -5.3 billion. The sentiment remains bearish. The estimated price lacks a clear-cut trend. It is trading below the long-term moving average. Hence, a further decline looks feasible.

A week earlier, I assumed that after a short corrective growth, the euro reached a swing high. So, it resumed a downward movement after another test of the parity level. As of Monday morning, EUR/USD is trading near the swing low of 0.9953. The situation will become clearer in the coming days. There are no strong support levels. The euro could drop lower if the energy crisis in Europe aggravates.

GBPUSD

Retail sales in the UK unexpectedly turned out to be better than forecasts. The figure, including gasoline, increased by 0.3% mom in July against an expected drop of 0.3%. Analysts are now casting doubts on the resilience of the UK economy. The UK is dealing with an energy crunch. Like the EU, it is sure to face negative consequences.

Households are bracing for hard times. The GfK's long-running Consumer Confidence Index fell by three points to -44 in August, its lowest level since records began in 1974. The forecast for personal finances over the next 12 months came in at -60. Surging inflation undermines the purchasing power of households.

As inflation in the UK keeps growing, the Bank of England is likely to stick to aggressive tightening. Traders are now pricing in that the BOE base rate will rise to 3% by the end of 2023.

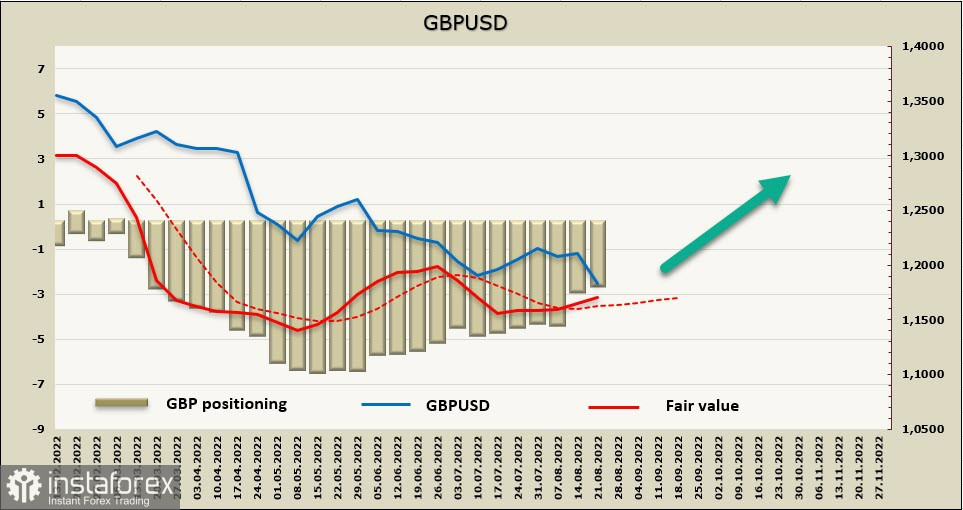

The net short position on the pound sterling decreased slightly during the week. Since June there has been a shift from a bearish trend to a bullish one. The current trend looks strong. The estimated price is higher than the long-term moving average and it pointed upwards.

Despite a decline last week, the pound sterling has a greater chance to resume growth than the euro. It is unlikely to break through the swing low of 1.1758. It is also recommended to open long positions at the current levels with the Stop Loss order near 1.1750. The nearest target is located at the 1.1950/70 level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română