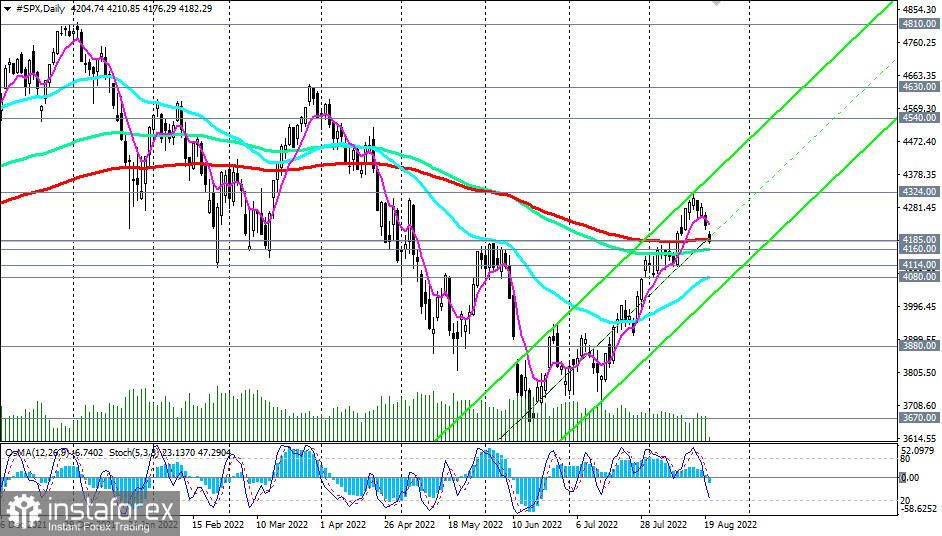

The US broad market index S&P 500 (reflected as CFD #SPX in the trading terminal) started today's trading day with a gap down. Last week it reached a local 4-month high of 4324.00, but today it has fallen sharply. At the time of writing, CFD #SPX is trading near the 4180.00 mark, testing the important support level 4185.00 (200 EMA on the daily and 1-hour charts, 50 EMA on the weekly chart) for a breakdown. The breakdown of this support level will mark the end of the upward correction and a return inside the downward channel on the weekly chart.

The confirmation signal for the resumption of short positions will be the breakdown of the important support level 4080.00 (200 EMA on the 4-hour chart, 50 EMA on the daily chart), and the target for the decline will be the key long-term support levels 3880.00 (144 EMA on the weekly chart), 3670.00 (200 EMA on the weekly chart). Their breakdown could finally break the long-term global bullish trend of the S&P 500.

In an alternative scenario, and after the breakdown of the local resistance level 4324.00, the growth of the S&P 500 will continue towards a record high above 4800.00, reached at the very beginning of this year.

Support levels: 4185.00, 4160.00, 4114.00, 4100.00, 4080.00, 3880.00, 3670.00.

Resistance levels: 4220.00, 4300.00, 4324.00, 4400.00, 4540.00, 4630.00, 4810.00.

Trading Tips

Sell Stop – 4150.00.00. Stop-Loss – 4220.00. Targets: 4114.00, 4100.00, 4080.00, 3880.00, 3670.00.

Buy Stop – 4220.00. Stop-Loss – 4150.00. Targets: 4300.00, 4324.00, 4400.00, 4540.00, 4630.00, 4810.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română