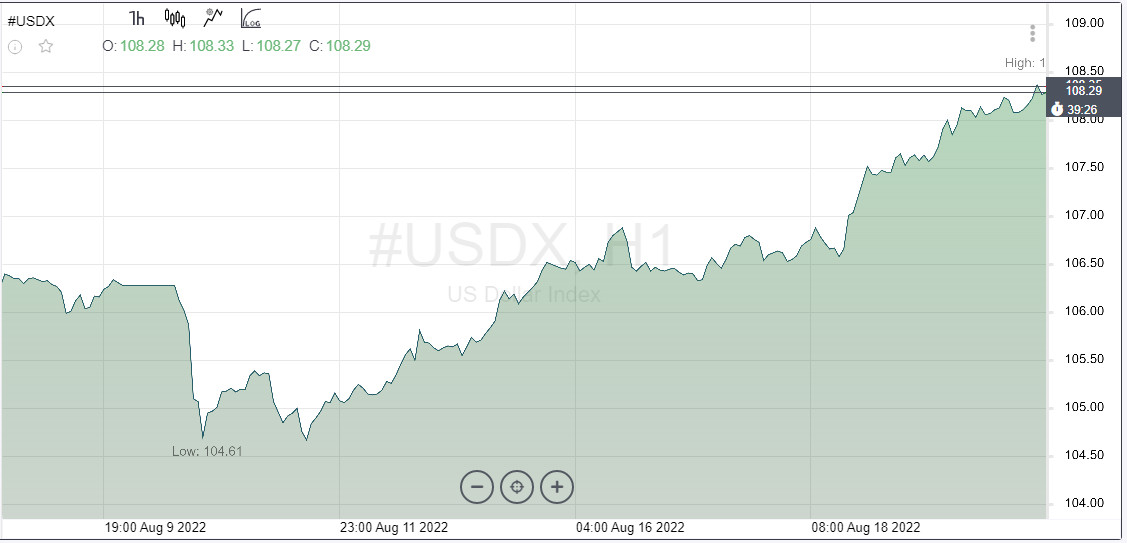

The general atmosphere of global uncertainty, as a rule, contributes to the dollar's growth as the most liquid of safe havens. Today, the US currency index rose to 108.40, demonstrating a confident upward trend. Last week, it jumped 2.3%, showing the best performance since April 2020.

The dollar's growth is due to the strengthening of hawkish sentiment in the markets after a number of speeches by Federal Reserve members on Friday.

Among the most convincing at the moment is the statement of the president of the St. Louis Federal Reserve, James Bullard. He said he was considering supporting a third consecutive 75 basis point rate hike in September, and added that he was not ready to say that the economy had experienced the worst spike in inflation.

The head of the Federal Reserve Bank of Richmond, Thomas Barkin, made a similar position, the emphasis was also placed on accelerated rate hikes.

Market players are also waiting for Fed Chairman Jerome Powell to make a hawkish statement in the coming days, in line with recent comments by other central bank officials supporting the dollar.

This week, the index may rise above 110.00 if the August preliminary PMIs for the major economies show a further slowdown in economic growth or a reduction in activity. In general, the new week is quite rich in macroeconomic events, so the end of the month and the summer period may be quite volatile.

The focus of the traders is the Jackson Hole Symposium. This will be the main event of the week.

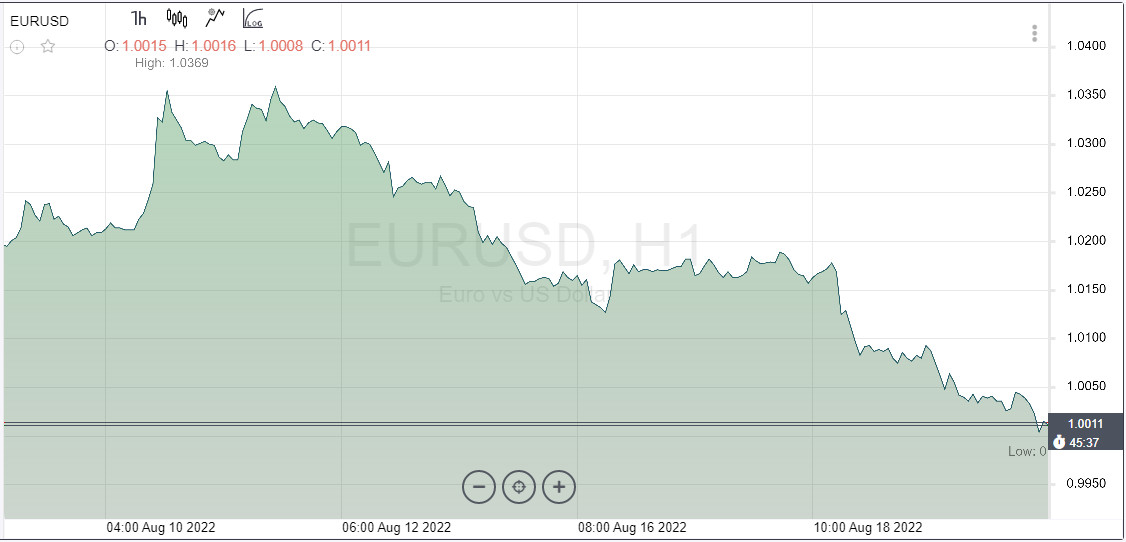

The euro briefly crossed the key parity level of $1 again, as the recession in Germany becomes more and more obvious. Natural gas prices are approaching 300 euros per megawatt hour after Gazprom announced the closure of the Nord Stream gas pipeline to Germany for three days of maintenance.

In addition, the business activity index is expected to show in August that manufacturing activity in Europe's largest economy contracted at the fastest pace since May 2020, and the services sector contracted the most in 18 months.

More optimistic traders believe that the report on the European Central Bank monetary policy meeting on Thursday will sound tough, which may save the euro from a more significant collapse. In July, the ECB surprised the markets and raised interest rates by 50 basis points, as inflation in the bloc continues to exceed record levels.

However, Commerzbank believes that the ECB's rhetoric, no matter what it is, will not matter now. Actions are important, not conversations. The interest rate policy should show at least some signs of reducing the lag behind the Fed. Only in this case, the euro will feel some support.

The EUR/USD pair is expected to be particularly susceptible to a revision of the Fed's baseline expectations, as the ECB has taken the second strongest possible dovish position among G10 central banks after the Bank of Japan.

EUR/USD, as well as GBP/USD, continue to remain under pressure from the pressing dollar. The euro cannot recover after a sharp drop last week and is trading below the 1.0050 mark. The GBP/USD pair continues to remain under pressure near 1.1800. In the short term, EUR/USD and GBP/USD quotes are likely to stabilize around 1.0000 and 1.1800, respectively.

Given the dynamics and the situation inside Europe and in the world, the euro risks breaking down the level of 1.0000. Bears will aim for a further decline in the exchange rate to 0.9950. However, for such a scenario, stability below the 1.0105 level is important. If it is broken up, the pair will take a course for recovery. Support is located at 1.0000, 0.9980, 0.9945. Resistance is at 1.0070, 1.0115, 1.0140.

The pound now remains without any internal support. It failed to take advantage of better-than-expected UK economic data and a sharp rise in market expectations for Bank of England interest rates last week.Stronger wage growth, the annual consumer price index, which exceeded 10% on Wednesday, and impressive retail sales data all contributed to the increase in rates.

The pound's inability to get at least some support from this movement speaks volumes, more precisely about its weakness. The forecast for GBP/USD does not look favorable, the pair may fall in the near future beyond expectations. The quote risks falling to 1.1500.

Until Powell's speech at the symposium, which will take place on Friday, the markets will be in limbo. Uncertainty is on the side of dollar bulls.

A number of US economic indicators will help determine market appetite, each of which is important in its own way.

These include the second estimate of GDP for the last quarter and the July value of the preferred US inflation indicator from the Fed. The underlying PCE price index will be carefully studied by investors in search of anything confirming the signs of moderate inflationary pressure recently noted in official figures.

Due to the fact that financial markets lowered earlier expectations of a Fed interest rate hike in September to 0.50%, the pound/dollar exchange rate will be at risk this week due to everything that pushes market prices back in favor of a greater tightening by 0.75%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română