With gold ending the week down 3%, Wall Street analysts have turned bearish on gold this week, blaming the strong US dollar and pressure from the upcoming Jackson Hole symposium.

On Friday, gold fell under dollar pressure as the US dollar index climbed to a 20-year high.

Markets remain focused on the Fed's speech after July FOMC minutes showed that Fed officials ultimately agreed on the need to slow down the tightening cycle. However, they first need to see how their rate hikes will affect inflation.

This week, it is worth paying attention to the speech of Fed Chairman Jerome Powell at the economic policy symposium in Jackson Hole, scheduled for Friday, in which the economic forecast will be announced.

Powell's remarks this week are one of the key avenues the Fed could use to stop the market from sizing up next year's rate cut cycle after this year's tightening. Market expectations do not match forecasts. If rates remain elevated, this will increase interest in precious metals.

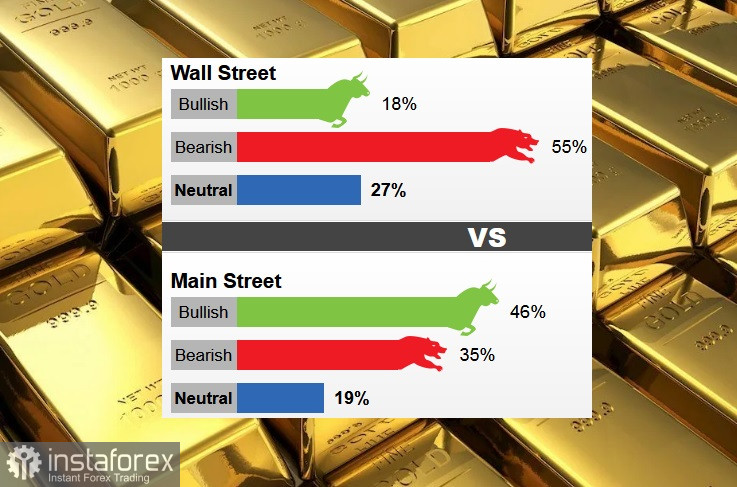

The results of the weekly survey of gold showed that Wall Street analysts are bearish on gold prices this week. Of the 11 analysts who took part in the survey, 55% expect prices to fall, 27% are neutral, and only 18% call for price increases.

The Main Street side remained bullish. Of the 709 retailers, 46% predicted higher prices, 35% called for lower prices, and 19% were neutral.

According to senior analyst Jim Wyckoff, the near-term technical picture remains bearish. Last week's drop below $1,800 an ounce put the bulls on hold.

Alliance Financial precious metals dealer Frank McGee is forecasting lower prices this week.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română