EUR/USD

Higher timeframes

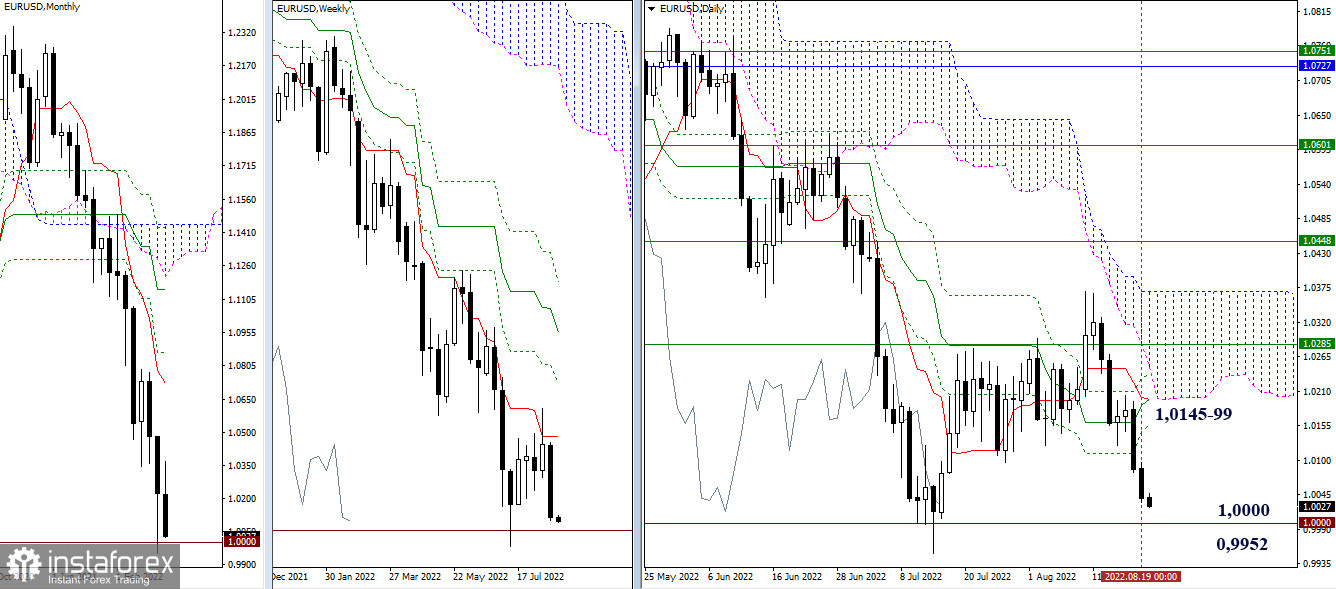

Last week, the initiative belonged to the bears, who managed to organize a fairly effective decline. Today, the main task is to restore the downward trend on the higher timeframes, where it is necessary to overcome the psychological support (1.0000) and consolidate below the minimum extremum (0.9952). The nearest resistance zone is now being formed by the levels of the daily Ichimoku cross (1.0145 – 1.0196) and the lower boundary of the daily cloud (1.0199), passed the day before.

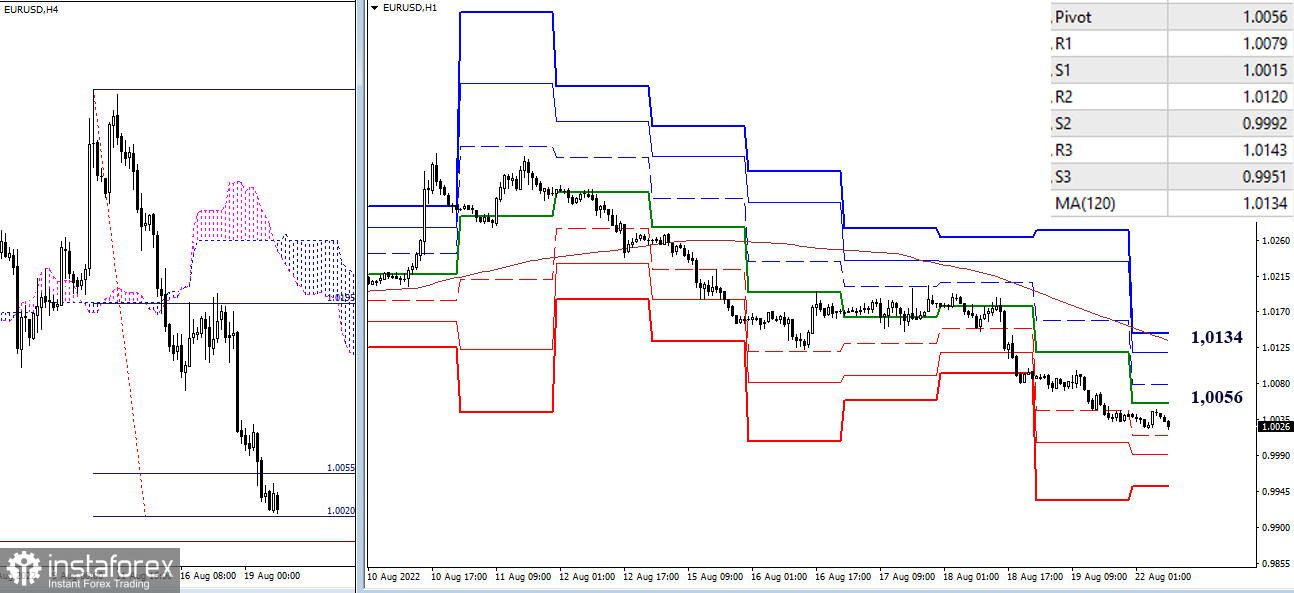

H4 – H1

On the lower timeframes, bears hold the advantage. At the moment, they have worked out a downward target for the breakdown of the H4 cloud (1.0020). The breakdown of the target and the continuation of the decline will open up opportunities for testing the supports of the higher timeframes (1.0000 and 0.9952), and the support of the classic pivot points (1.0015 – 0.9992 – 0.9951) can serve as additional reference points within the day. The key levels of the lower timeframes are now at 1.0056 (the central pivot point of the day) and 1.0134 (the weekly long-term trend). Intermediate resistances can be noted at 1.0079 (R2) and 1.0120 (R3).

***

GBP/USD

Higher timeframes

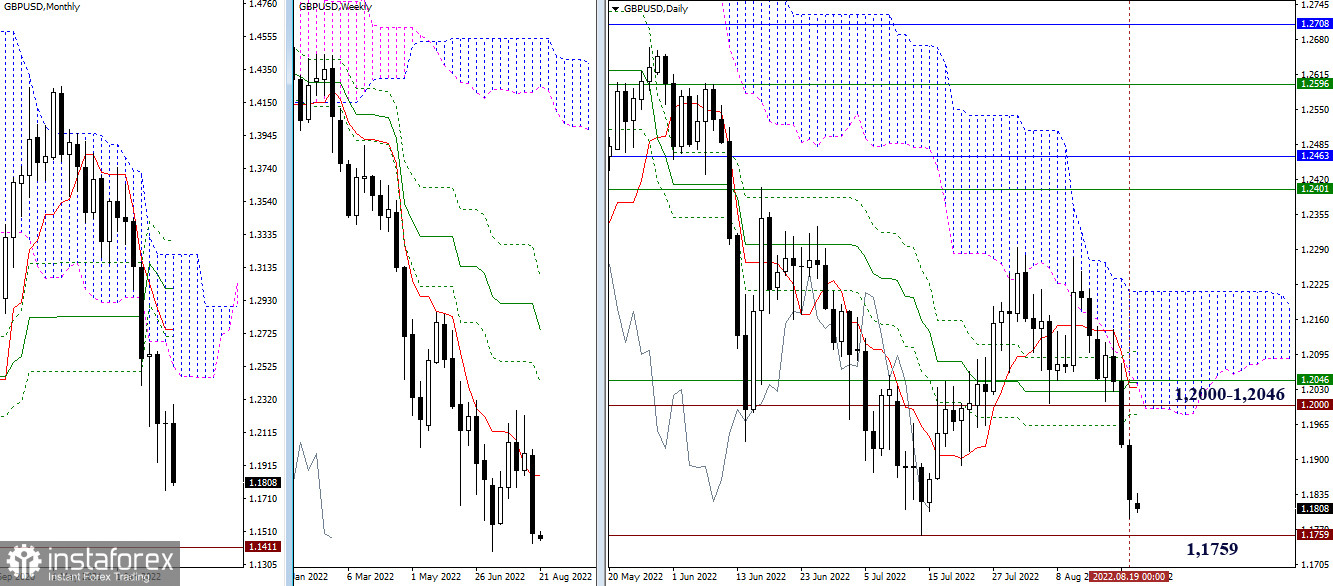

Thursday and Friday of the last working week allowed the bears to achieve a good result, bringing them almost close to the minimum extremum (1.1759) of the current upward correction. The recovery of the downward trend will again designate the 2020 low fixed at 1.1411 as the main benchmark for the decline. In the case of new activity of bulls, the key primary levels will be in the area of 1.2000 – 1.2046 (daily cross + lower limit of the daily cloud + weekly short-term trend + psychological level).

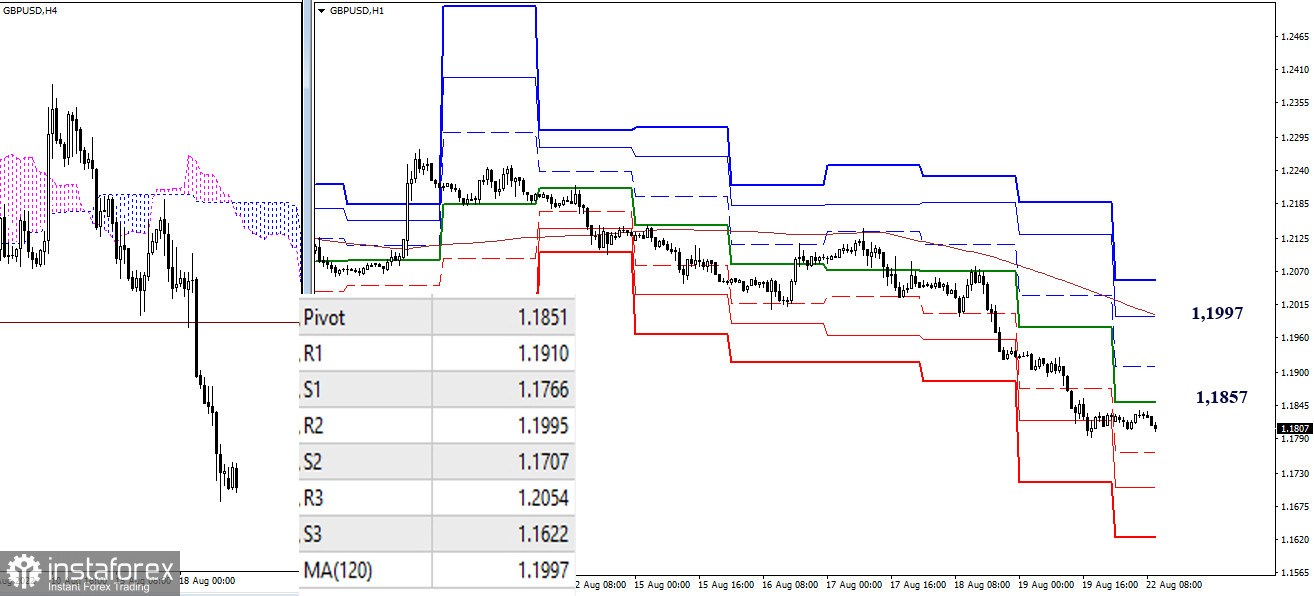

H4 – H1

The advantage on the lower timeframes remains on the bears' side despite the current correction. When leaving the correction zone and continuing the decline, intraday reference points will serve as support for the classic pivot points (1.1766 – 1.1707 – 1.1622). With the development of a corrective rise, bulls will focus on overcoming the key levels that today act as resistance—1.1851 (central pivot point of the day) and 1.1997 (weekly long-term trend). Intermediate resistance along this path can be noted at 1.1910 (R1).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română