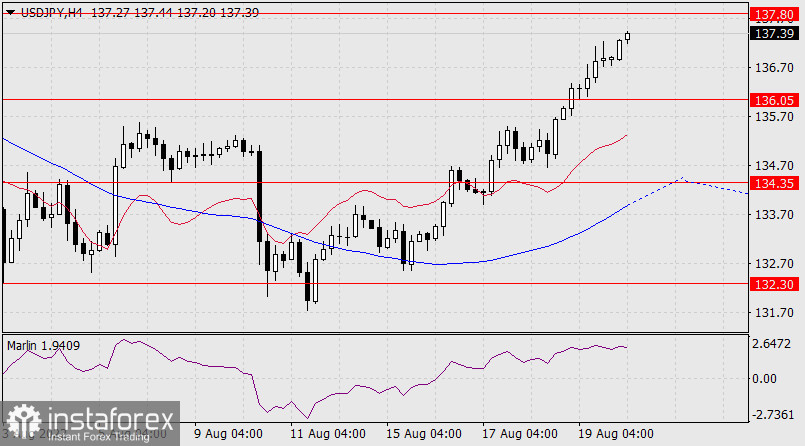

The dollar continues to advance on the Japanese yen for the eighth consecutive session. The quote of the USD/JPY pair is already struggling with the resistance of the MACD indicator line of the daily scale, above it is the target level of 137.80, formed by the embedded line of the price channel of the monthly timeframe.

The signal line of the Marlin Oscillator is slowing down the growth and this suggests an impending correction, since all this growth in the dollar is taking place amid a decline in the stock market. The S&P 500 lost 1.29% on Friday. The price may soon turn into a correction on a new wave of flight from risk.

The Marlin Oscillator has gone sideways on the four-hour chart, the price continues to grow. Long positions in this situation are associated with increased risk. Growth may continue if the price consolidates above the resistance line at 137.80, the target will be 139.02. The depth of a possible correction is not visible at the moment, but it may be the area of 134.35 - the area of the embedded line of the price channel on a daily scale, to which the MACD line on a four-hour scale is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română