The GBP/USD currency pair continued its near-collapse on Friday. Last week, the pound sterling fell by 300 points and was already only 40-50 points from its 2-year lows. However, do not be misled by such an interpretation. After all, only 450 points remain to go down to the absolute lows of the pound/dollar pair. Most importantly, the pound sterling now has no place to wait for help. Although it is generally getting cheaper and a little weaker against the dollar than the euro, it is still getting cheaper quickly. Although the Bank of England does raise the key rate and does not only pretend to be like the ECB, the pound sterling is still getting cheaper. Although the US recession has technically already begun, and in the UK, it can only begin, the pound is still falling. Thus, it is difficult even to imagine what could stop this pair's fall.

A lot of different statistics were published in the UK last week, but, as we can see, it doesn't matter to the market now whether there are statistics, whether they are in favor of the British pound, whether they are not, everyone is selling the pound anyway. Thus, we believe that, in principle, all macroeconomic publications are of little importance now. The pound is probably getting cheaper for the same reasons as the euro. The Bank of England is raising the rate more slowly than the Fed, and the geopolitical conflict in Ukraine has a more negative impact on the UK than on the US. We do not see any other global factors that would be able to push the pair down for six months (although the entire downward trend has lasted for more than a year and a half). Therefore, until these factors cease to influence the market mood, it is unlikely to expect a change in the situation for the pound.

Business activity in the UK also risks going below the "waterline."

Macroeconomic statistics this week will begin to be published on Tuesday. Business activity indices in Britain's manufacturing and services sectors declined last month but remained above 50.0. By the end of August, they may stay above this level, but according to forecasts, they will continue to decline. And no more events are planned for this week in Britain. Let's go to the USA. On Tuesday, all the same, business activity indices will be published, one of which (for the service sector) showed a paradoxical divergence last month. According to the S&P version, the index fell to 47.3 points, and the ISM version rose to 56. Who to believe? However, the more important ISM index will not be published on Tuesday.

A report on orders for long-term use goods in the United States will be released on Wednesday. This report was once quite important and could have provoked a market reaction. But the market almost always ignores it in the last year or two. Therefore, now it is nothing more than just an interesting statistic. On Thursday, the GDP for the second quarter will be published in the second assessment, and applications for unemployment benefits will be processed. The reaction is unlikely to follow the same pattern because traders already know what to expect in the first case, and in the second, the report itself is far from the most significant. On Friday, data on personal income and expenses of the American population will be published, and in the evening, Jerome Powell will give a speech. It seems that this speech, which will take place when traders have to leave the market and prepare for the weekend, will be the most important event of this week. From the Fed and Powell personally, everyone is now waiting for new comments on future monetary changes. The dollar, however, is growing just fine without them, but the more "hawkish notes" there are in Powell's speech, the higher the probability that the dollar will continue to strengthen.

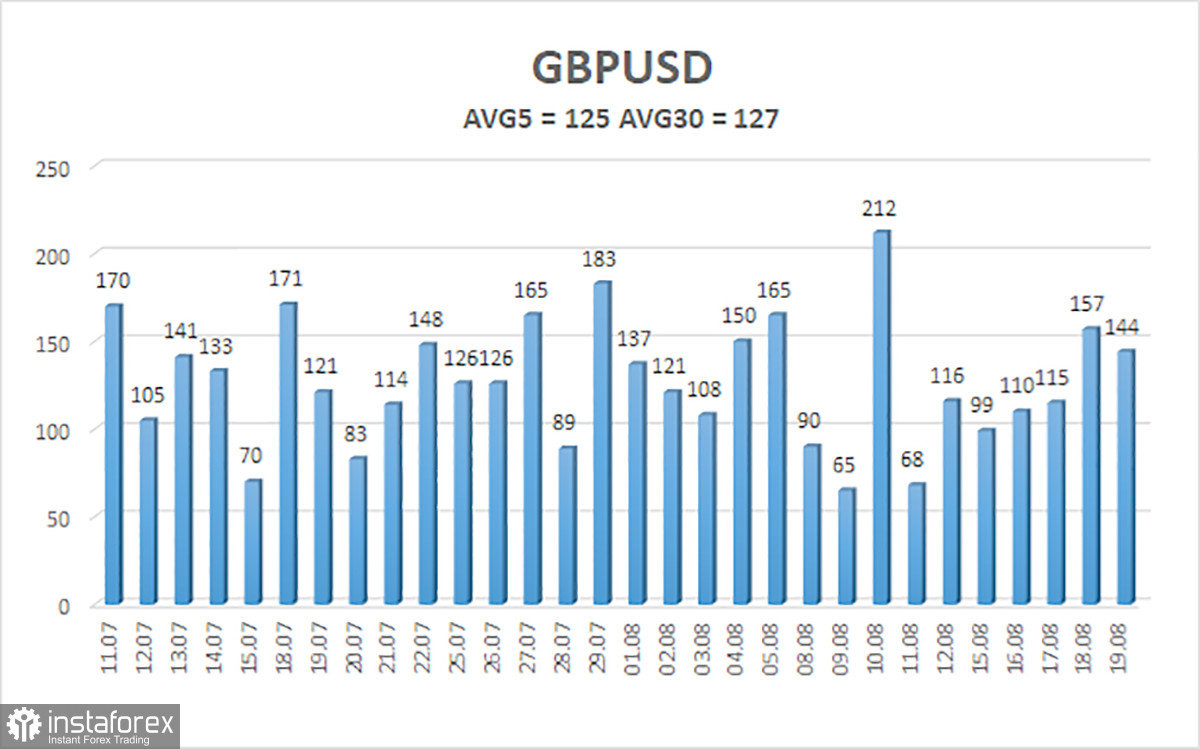

The average volatility of the GBP/USD pair over the last five trading days is 125 points. For the pound/dollar pair, this value is "high." On Monday, August 22, thus, we expect movement inside the channel, limited by the levels of 1.1700 and 1.1951. The upward reversal of the Heiken Ashi indicator signals the beginning of an upward correction.

Nearest support levels:

S1 – 1.1780

S2 – 1.1719

S3 – 1.1658

Nearest resistance levels:

R1 – 1.1841

R2 – 1.1902

R3 – 1.1963

Trading Recommendations:

The GBP/USD pair continues to be located below the moving average on the 4-hour timeframe. Therefore, at the moment, you should stay in sell orders with targets of 1.1780 and 1.1719 until the Heiken Ashi indicator turns up. Buy orders should be opened when fixing above the moving average line with targets of 1.2085 and 1.2146.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română