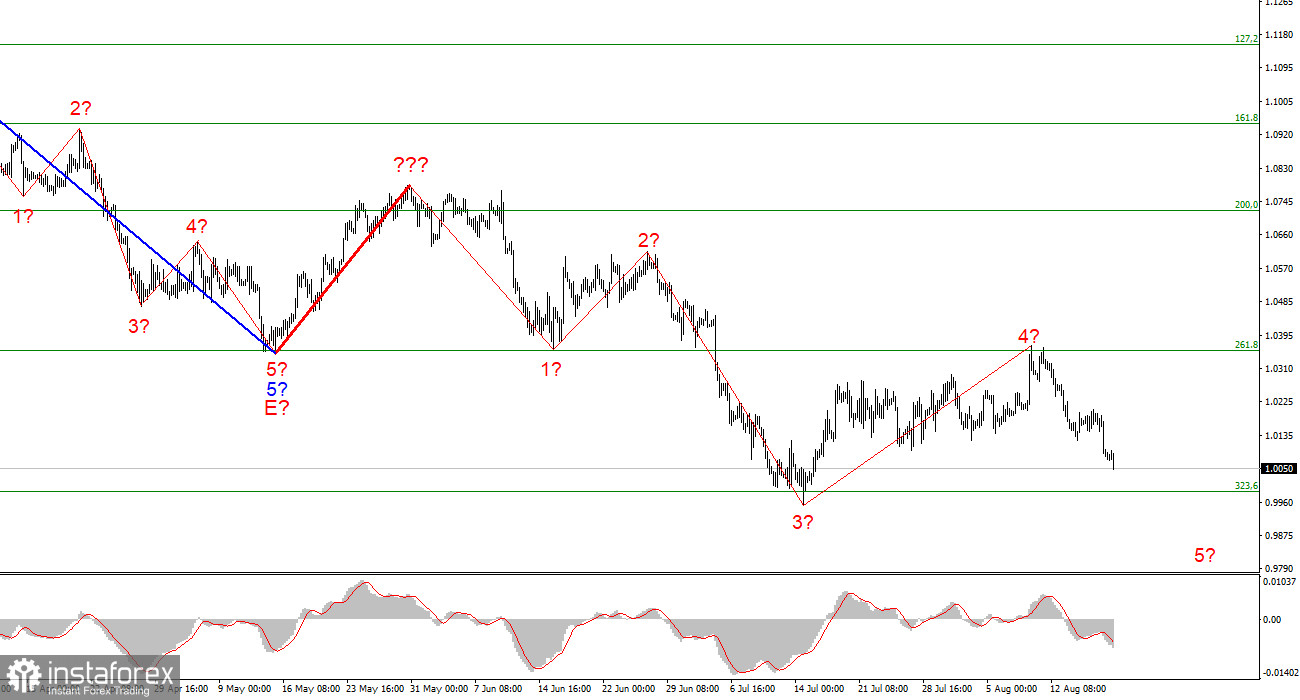

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, despite the increase in quotes within the framework of the expected wave 4 turned out to be stronger than I expected. The new wave marking does not yet consider the rising wave marked with a bold red line. The whole wave structure can become more complicated again, which is the disadvantage of wave analysis since any structure can always take a more complex and extended form. The construction of an ascending wave has been completed, which is interpreted as wave 4 of the downward trend section. If this assumption is correct, then the instrument has started and continues to build a descending wave 5. The assumed wave 4 has taken a five-wave but corrective form. However, it can still be considered wave 4. There are no grounds to assume the completion of the downward trend section. An unsuccessful attempt to break through the 1.0356 mark, which equates to 261.8% by Fibonacci, indicates that the market is not ready to continue buying the EU currency. Therefore, I expect the decline in the quotes of the instrument will continue with targets located below the 1.0000 mark within wave 5. Wave 5 can take almost any length since wave 4 was much longer than wave 2.

Markets are not interested in anything this week except dollar purchases.

The euro/dollar instrument fell by 95 basis points on Thursday, and today – by another 35. The increase in demand for the US dollar was unexpected since there was not a single important report in the US before that. There were no events today either. Neither in Europe nor the USA. Nevertheless, the dollar is steadily moving forward, and the euro can only hope that the fall will not be too strong this time. But these hopes are unlikely to be justified. The wave pattern indicates the need to build wave 5, and this wave is pulsed. It may be the last in the composition of the entire downward section of the trend, which began its construction two years ago. Therefore, it is unlikely to be weak.

As the reasons for the decline of the European currency, I will not open America. It is the same action of the Fed to reduce inflation and the active inaction of the ECB in the same direction. There is nothing more to add to this thesis. The markets got exactly the information they were supposed to get. Inflation in the EU and the UK continues to rise because the ECB is not raising the rate, and the Bank of England is not doing it fast enough. The recession has already begun in America, but the Fed rejects this interpretation, and no one in the ECB talks about a recession. However, the markets believe that the European Union will be unable to avoid it. But the dollar is still growing, but the euro is still falling. Thus, I believe that for another month or two, we can look precisely at the decline of the instrument. When the Fed announces that raising the rate is no longer necessary, we can expect the end of the downward trend section.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section continues. I advise you to sell the instrument with targets near the estimated 0.9397 mark, which equates to 423.6% Fibonacci, for each MACD signal "down" in the expectation of building a wave 5. An unsuccessful attempt to break through the 261.8% Fibonacci level indicates the market's readiness for new instrument sales.

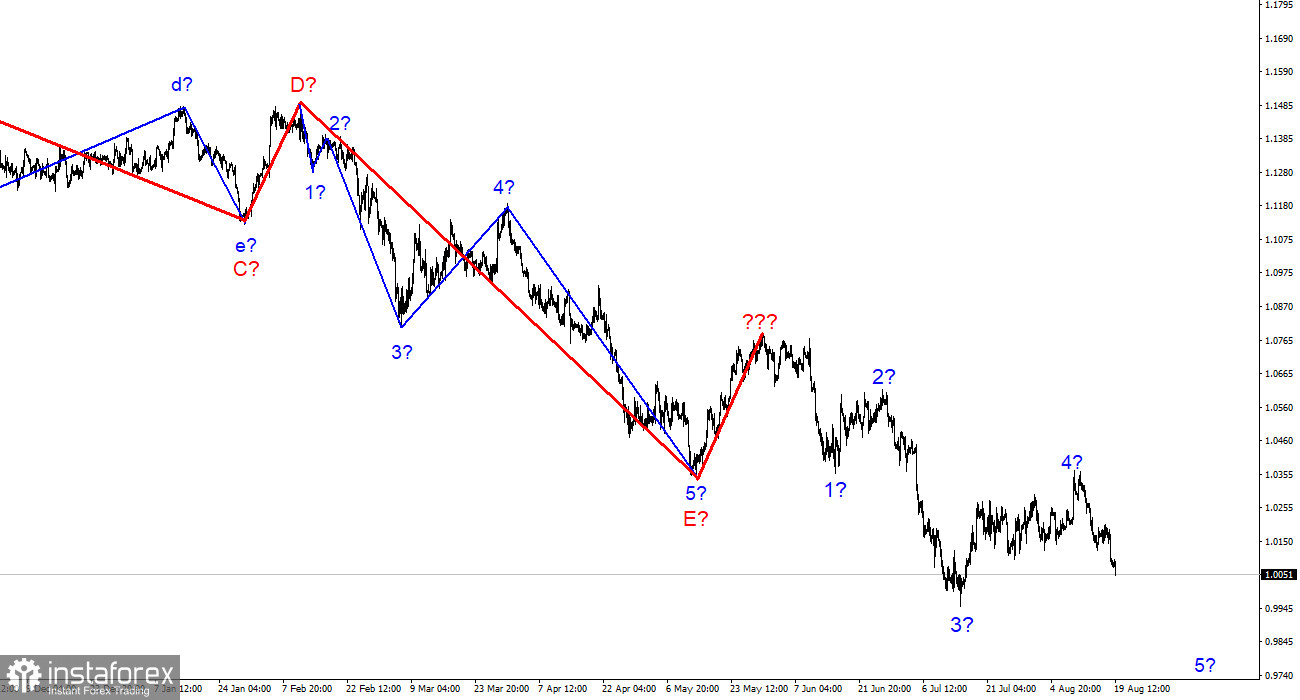

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three and five-wave standard structures from the overall picture and work on them.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română