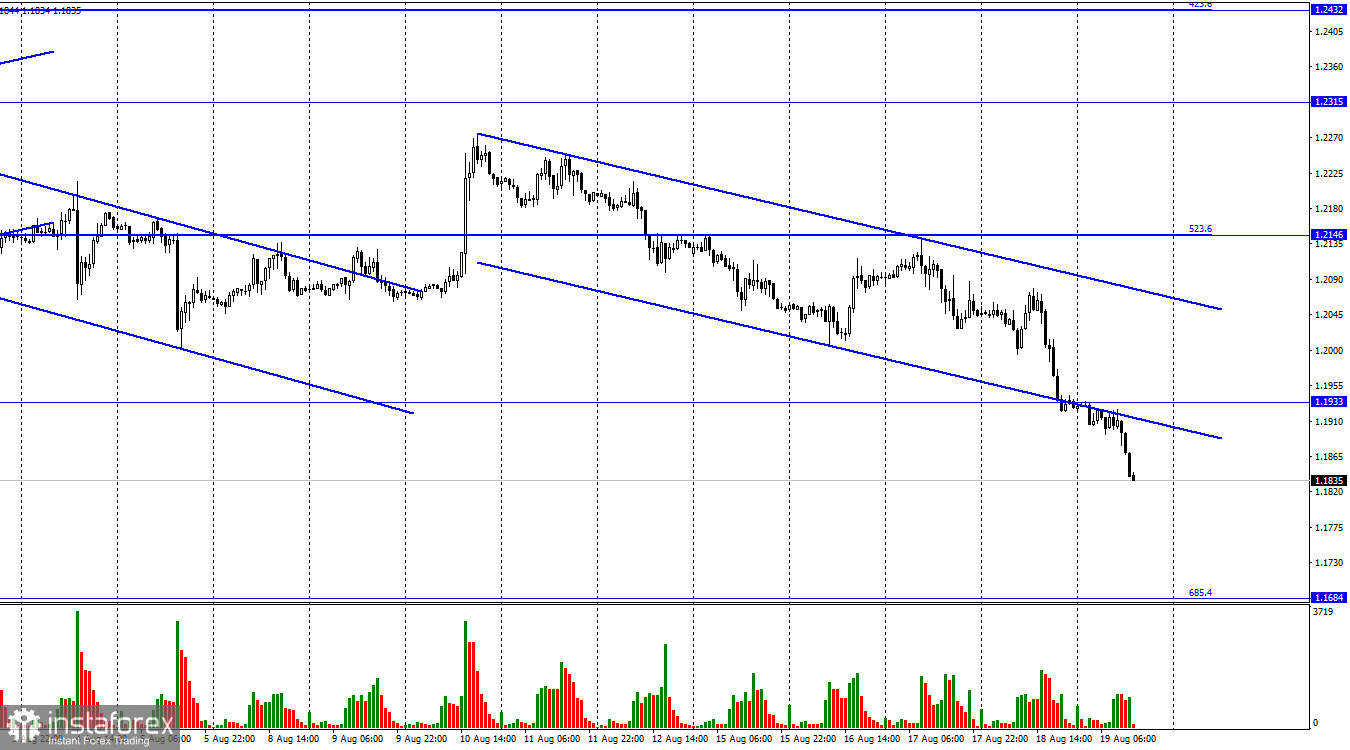

On the hourly chart, the GBP/USD pair fell to the lower boundary of the descending trending channel and to the level of 1.1933 on Thursday. Today the pair has consolidated below both of those levels and continues to fall towards the correctional level of 685.4% - 1.1684. The downward channel continues to prove traders' bearish sentiment, so there is no reason to buy the British currency now. In addition, there is no reason to pay attention to the information background. That sounds a bit weird because the fundamental background always matters. In particular, it is what is causing traders to get rid of the pound and the euro right now. The reason for this lies in the difference between the Fed and ECB policies with the Bank of England. Among other reasons, there could be a geopolitical crisis in Ukraine, which considerably affects Europe in terms of energy security. These factors push the euro and the pound down.

Economic reports do not have an influence on traders' sentiment. This week there was enough information on the UK economy. There were some strong data and some weak reports as well. However, the pound sterling has been falling almost for the seventh day in a row. We can conclude that the reports had almost no effect on the GBP movement. Notably, the euro and the pound are falling almost equally, so it has nothing to do with the UK statistics or the European ones. It definitely was not the US statistics because there were none released this week. Thus, the change in traders' sentiment can be expected in September at the earliest, when the Fed and the BoE will hold new meetings, announce new monetary policy decisions, and when new conclusions can be drawn about the difference between the US and UK monetary policy.

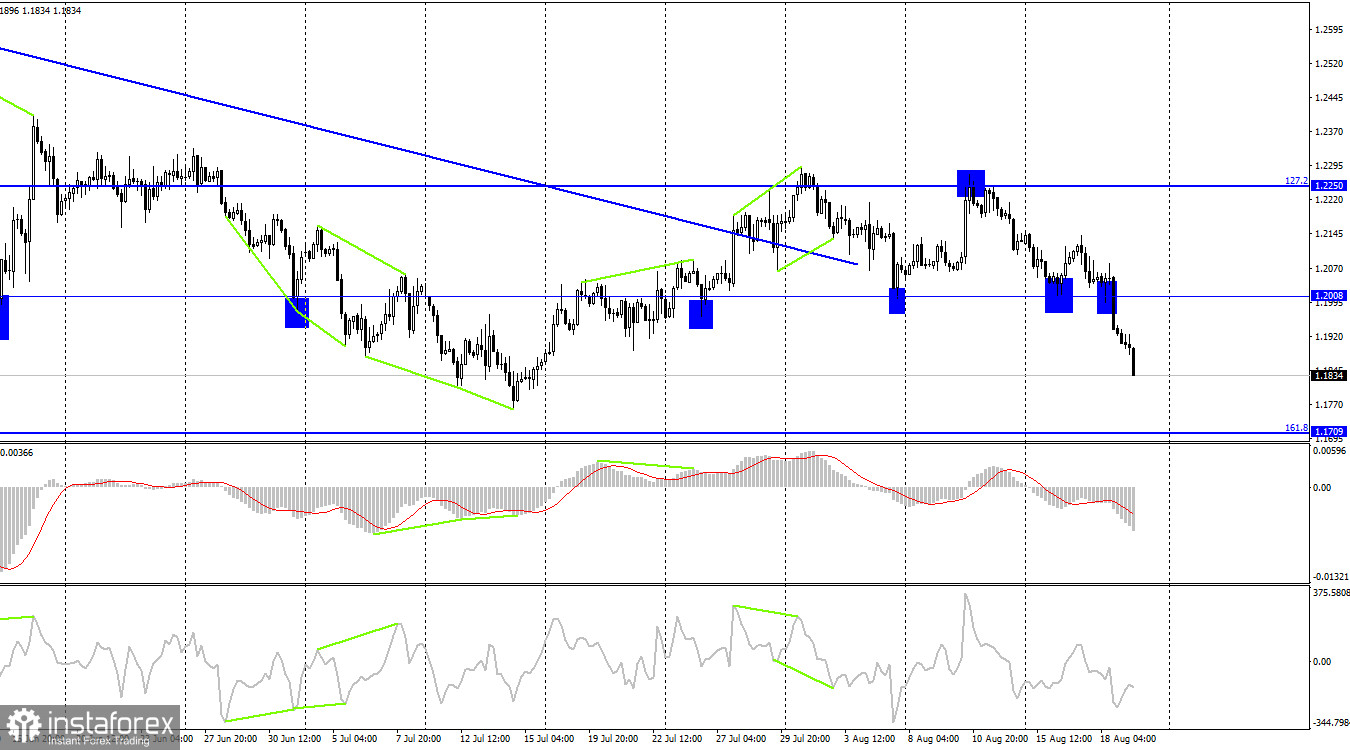

On the 4-hour chart, the pair returned to the level of 1.2008 again and fixed below it. The price continued falling towards the correction level of 161.8% - 1.1709. There are no emerging divergences today, and the trend line makes no impact on the quotes. Nevertheless, the pound failed to fix above 1.2250, and this double rebound can be considered one of the trend line points. The bearish sentiment persists.

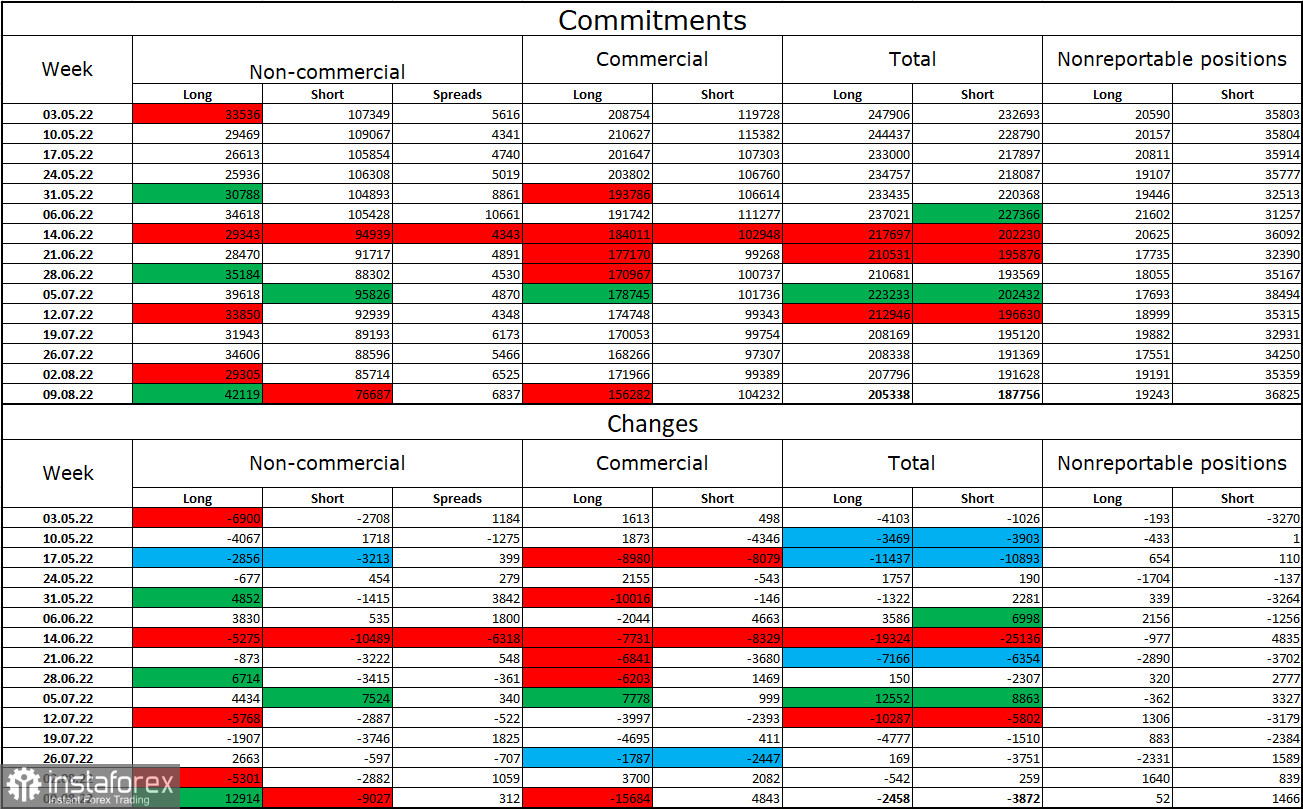

COT report:

The sentiment of the Non-commercial traders has become much less bearish over the past week. The number of Long-contracts in the hands of speculators increased by 12,914, and the number of Short-contracts decreased by 9,027. Thus, the sentiment of the big players remained bearish, and the number of Short-contracts still exceeds the number of Long-contracts, however, much less than before. Large players continue to sell the pound for the most part but their sentiment is gradually becoming bullish. The pound showed weak growth in recent weeks, and the COT reports confirm that the British pound is more likely to resume its fall, rather than begin a long-term uptrend.

Economic calendar for US and UK economies:

UK - Retail Sales (06-00 UTC)

The UK retail sales report was released on Friday, posting an increase of 0.3% in July. Traders were expecting red figures, and the pound was barely affected by this report at all and continues to fall since this morning. For the rest of the day, traders' sentiment is unlikely to change amid the information background.

GBP/USD forecast and recommendations for traders:

I recommend selling the pound when it fixes below 1.2208 on the hourly chart with a target of 1.1709. These trades can be held open. It is better to buy the pound when the pair's rate fixes above the descending trading channel on the hourly chart with the target at 1.2146.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română