The pound stood firm at lows after the release of the UK retail sales report. The figures came well above economists' forecasts. Consequently, pressure on the pound that mounted on record-low UK consumer confidence eased. The plunge in consumer confidence came amid growing recession risks. Soaring inflation exerted additional pressure on households.

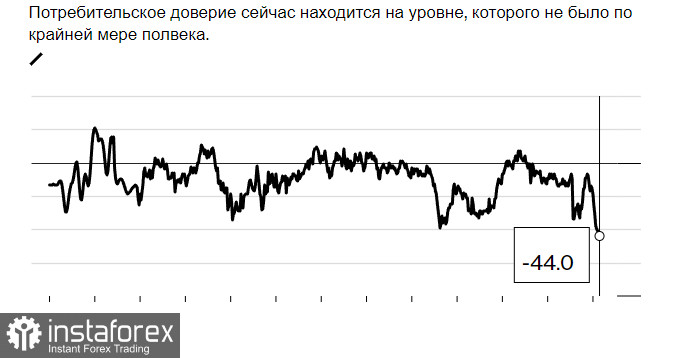

According to the GfK report, consumer confidence fell to -44 in August, the lowest level since 1974. All indicators dropped, with the worst forecast for personal finances.

The data takes into account a spike in the annual inflation rate to 10.1% last month that resulted in higher prices on food, energy, and clothing. The Bank of England sees inflation exceed 13% in the coming months. This will have an adverse effect on consumers, whose real wages are falling at a record pace. Consumers are either already dealing with rising costs or fear they will have to cut their spending drastically in the future.

Lloyds Bank's recent survey shows that nine out of 14 UK sectors reported falling output in July. In addition, ten sectors reported decreasing demand, with the biggest impact on tourism and recreation. Inflationary pressure now depends not only on the BoE's monetary stance but also on demand. A drop in real incomes will be good for inflationary pressure but harm economic growth. The GfK report says that confidence was the lowest in a year, and forecasts for personal finance fell below last year's figures. The index measuring how willing people are to make big purchases plunged by 35 points to -38 from the previous year.

Meanwhile, retail sales in the UK rose 0.3% in July, beating market forecasts. A 4.8% increase in sales of non-store retailing boosted purchases and offset a decline in sales of non-food stores. Still, these positive results were offset by a record drop in consumer sentiment.

These figures also show the value of retail sales rising sharply while volumes stagnate. Higher prices also mean that consumers are still willing to pay more for the same amount of goods.

The Bank of England is now focusing on bringing inflation to the 2% target, so further rate hikes are likely to follow. Investors see the benchmark rate up by 50 basis points to 2.25% in the near term and above 3.5% by the middle of next year.

The pound extends the bear run, and today's data will hardly instill optimism in the market. Bulls should consolidate above 1.1880 support. Otherwise, we won't see the currency recover any time soon. In such a case, targets are seen at 1.1840 and 1.1800. The price could head towards 1.1760 if a breakout through the range occurs. Should the quote break above 1.1935, the bearish trend will stop. This will allow the price to recover to 1.1980 and 1.2010.

The euro is also bearish. If the quote returns to 1.0100 and breaks through it, bullish power could increase. In such a case, targets are seen at 1.0130 and 1.0160. Should the euro extend the bear run, bearish power will rise, with no hope for a correction. In this light, the euro could head towards 1.0030 and then hit parity with the US dollar at around 1.0000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română