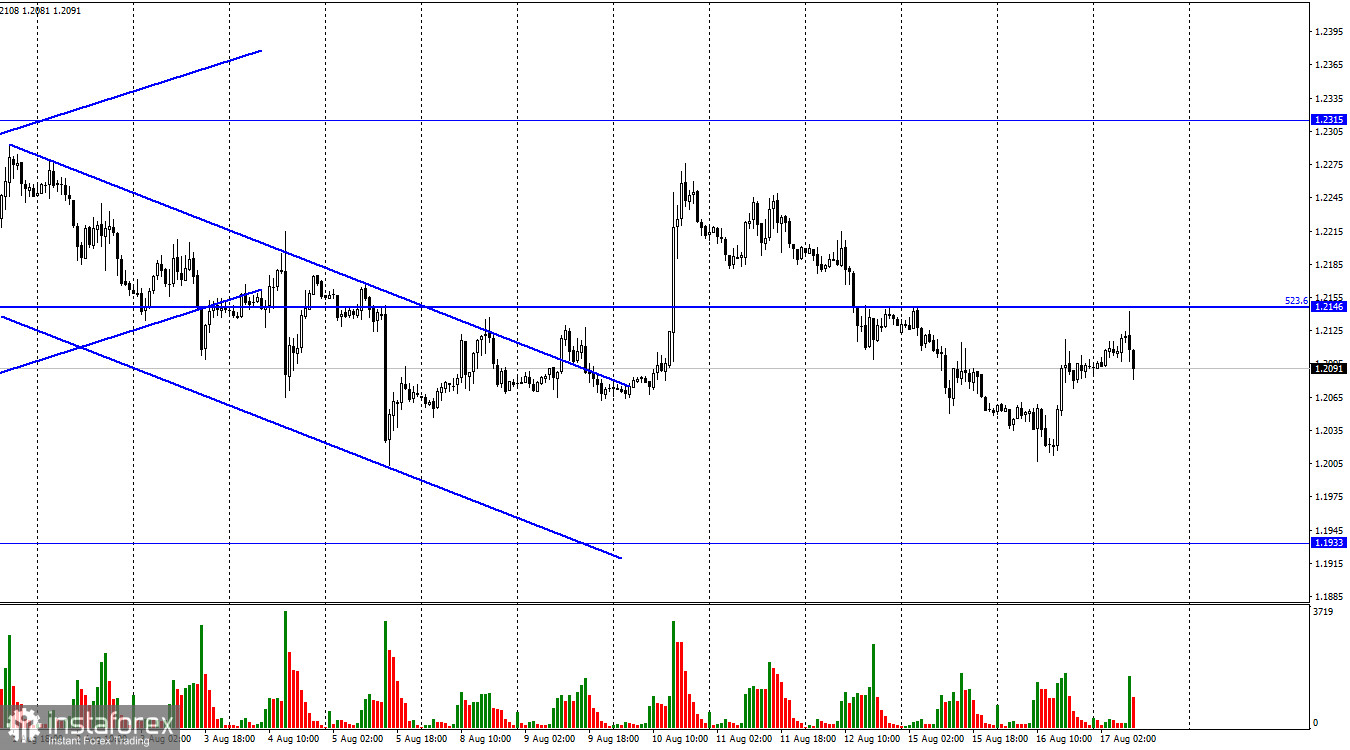

On Tuesday, GBP/USD resumed its decline as the US dollar strengthened. The price failed to settle above the retracement level of 523.6% at 1.2146, so bears are still in control of the market. Today, an important report on UK inflation for July was issued. The data showed that consumer prices rose to 10.1%. For your reference, the Bank of England has already raised the rate to 1.75% but, apparently, this measure did not have the desired effect. Like other global regulators, the UK central bank is tightening monetary policy in order to tackle inflation. However, it seems that all the current efforts of the UK regulator are in vain as inflation keeps going higher. On the other hand, the CPI could have been even worse if not for the recent rate hike. It could have reached nearly 15%. In my opinion, there is no big difference between 10% and 15% when it comes to inflation. Meanwhile, the UK economy is under serious threat if the BoE fails to tame accelerating consumer prices.

At the moment, the country is in the process of electing a new Prime Minister. In addition to this, gloomy forecasts made by Andrew Bailey who predicts a recession by the end of this year aggravate the already unstable situation in the country. If we refer to the latest GDP report that was actually negative, we can see that the recession is already here. Meanwhile, the BoE continues to cool down the economy with higher interest rates but struggles to achieve its main goal - slowing down the inflation rate. So, the pound is pressured from all the sides. Later in the day, the US will publish FOMC minutes that will reveal the number of FOMC members who support the monetary tightening at the pace of 0.75%. Any other information will be also useful for traders as it will help them predict what decision the Fed can make at its September meeting. As a rule, FOMC minutes do not usually cause strong market fluctuations but today can be an exception.

On the 4-hour chart, the pair dropped to the 1.2008 level. Then, the price rebounded from it and rose slightly to the retracement level of 127.2% at 1.2250. Consolidation below the 1.2008 mark will be in favor of the US dollar and will pave the way towards another retracement level of 161.8% at 1.1709. Currently, no divergences are being observed in any of the indicators.

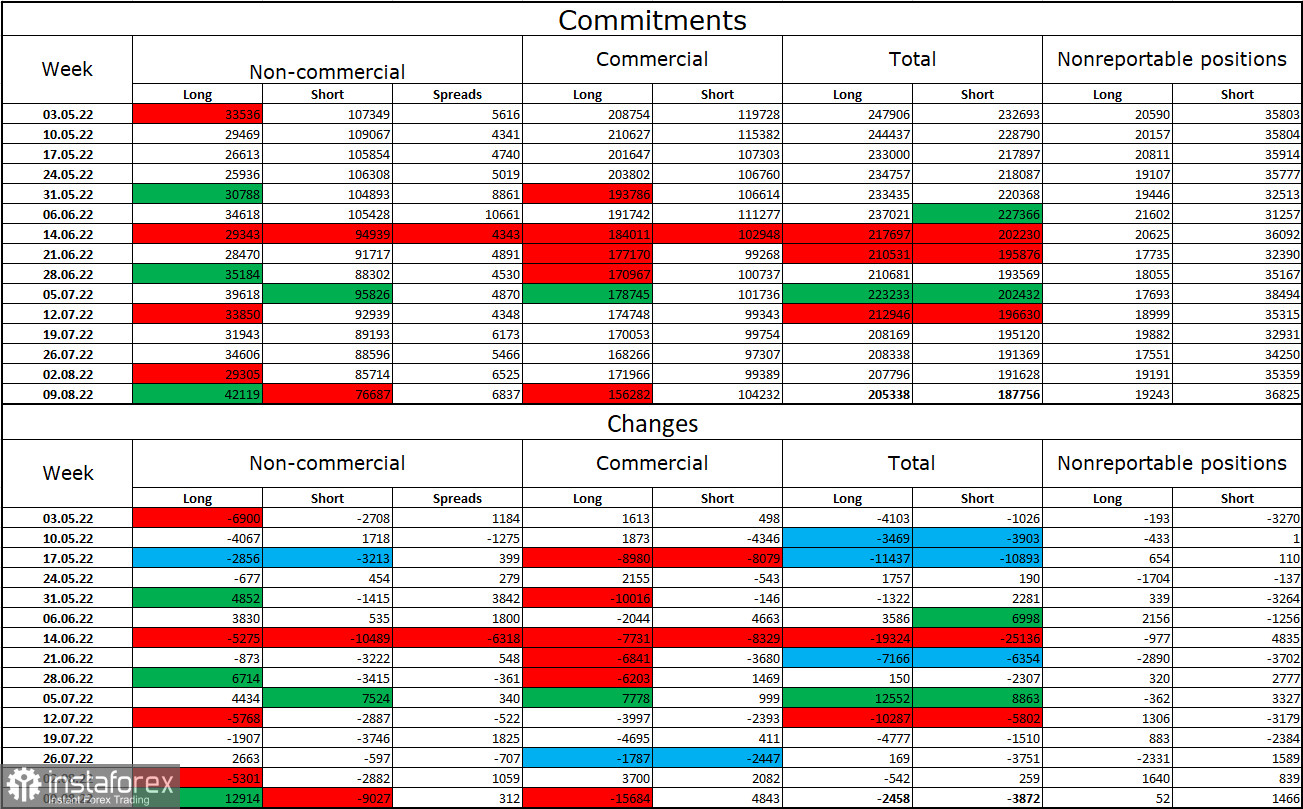

Commitments of Traders (COT) report:

The sentiment of the non-commercial group of traders became much less bearish over the past week. The number of open long positions increased by 12,914 while the number of short ones fell by 9,027. Therefore, the overall sentiment of large market players remained bearish, and the number of short contracts still outweighs the long ones even though the difference is not very significant. Large market participants still prefer to stay short on the pound. Their strategy might be gradually changing towards buying the sterling, but this process may take long to develop. In recent weeks, GBP has been performing very poorly. Meanwhile, the COT report confirms that the pound is more likely to extend its decline rather than develop an uptrend.

Economic Calendar for UK and US:

UK – Consumer Price Index (CPI) (06-00 UTC).

US - Retail Sales (12-30 UTC).

US - FOMC minutes (18-00 UTC).

On Wednesday, all important reports in the UK have already been published. The economic calendar for the US has two key events. The results of the UK CPI report may influence traders' sentiment for the rest of the day. Then later in the evening, FOMC minutes may also set the market in motion.

GBP/USD forecast and trading tips:

I would recommend selling the pound after a rebound from 1.2250 on the H4 chart with the next target located at 1.1980. It is possible to open new short positions on the pair if the price closes below the level of 1.2008 with the possible target at 1.1709. Buying the pound is not advisable at the moment as there are currently no relevant buy signals seen ahead.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română