The Canadian dollar paired with the US currency is still trading in the price range of 1.2770-1.2970, despite high-profile fundamental events. Last week, amid the release of disappointing data on inflation growth in the United States, the greenback significantly lost its position: USD/CAD bears were even able to be identified at 1.2726. But almost immediately, bulls seized the initiative, returning the loonie to the area of the already established price range.

Canadian data on inflation growth have already been published on Tuesday. Despite the rather contradictory result, the loonie was "on the horse" again, not allowing the USD/CAD bulls to gain a foothold within the 29th figure.

Let me remind you that at its last meeting in July, the Bank of Canada raised the interest rate by 100 points at once, surprising market participants and many experts who predicted a 75-point increase. At the same time, Bank of Canada Governor Tiff Macklem made it clear that the central bank is not going to stop there, since a "proactive" rate hike, according to the members of the central bank, "will cool the internal inflationary pressure." At the same time, Macklem made a significant remark, stating that the pace of monetary policy tightening will depend on the incoming data. This is a very important statement, through the prism of which it is necessary to consider the current state of affairs for the USD/CAD pair.

The fact is that recent Canadian macroeconomic reports have been contradictory. For example, take the labor market. The unemployment rate remained at 4.9%, although experts predicted a slight increase to 5.0%. But the number of people employed in Canada in July decreased by 30,000. This indicator has been in negative territory for the second consecutive month. Moreover, the components of both full and part-time employment have decreased. The indicator came out much worse than forecasts – most experts expected to see an increase in the indicator by 20,000, but instead it collapsed to the level of -30,000. The index of business activity in the manufacturing sector of Canada (the PMI index from Ivey) also disappointed. Last month, it dropped significantly, falling to 49 points. The index crossed the key 50-point mark for the first time since January of this year.

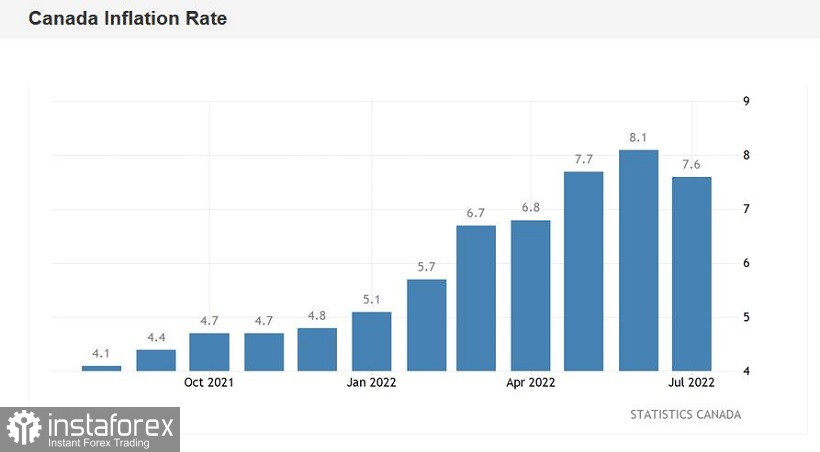

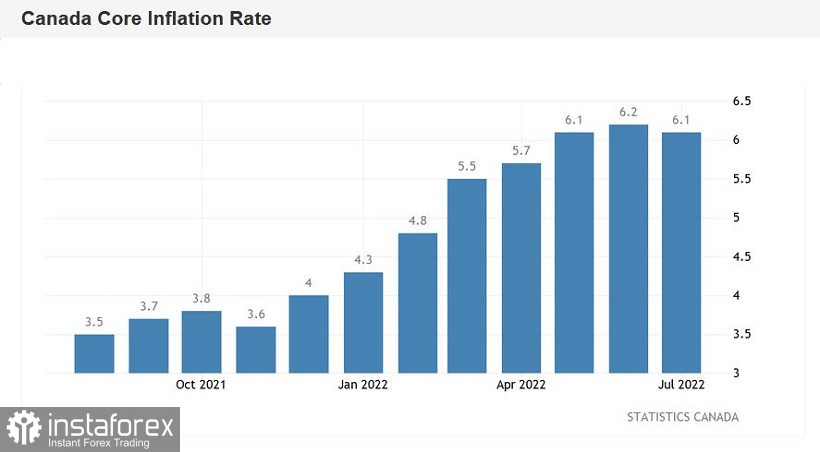

As for the latest release, there is also a contradictory situation here. The overall consumer price index came out at the forecast level: on a monthly basis, the indicator decreased to 0.1%, in annual terms – to 7.6%. It is noteworthy that on an annualized basis, the overall CPI showed consistent growth since June last year, and slowed down for the first time since May 2021. It can be assumed that in July the indicator reached its peak, being marked at 7.6%. The basic consumer price index, excluding volatile food and energy prices, decreased to 6.1% year-on-year (from the previous value of 6.2%), compared with analysts' forecast of 6.7%.

That is, on the one hand, we see that inflation has at least suspended its growth. But on the other hand, the published inflation indicators are still at a high level, the July "subsidence" will not knock the Canadian central bank off the current course of tightening monetary policy. Of course, today we should not expect another 100-point rate hike from the Bank of Canada, but at the same time, most experts are still confident that in September the Canadian central bank will increase the rate by 75 basis points.

Thus, the latest macroeconomic reports that were published in Canada "put an end" to the ultra-hawkish expectations of USD/CAD bears. On the other hand, Canadian inflation is still at a high level, allowing members of the Bank of Canada to implement a "moderately aggressive" policy.

It should be noted here that the slowdown in the rate of inflation is primarily caused by a decrease in gasoline prices. Other components of the inflation release showed the opposite dynamics. For example, the growth rate of food prices last month was the fastest since August 1981 (9.9% in annual terms). In particular, bakery products have risen in price by almost 14% compared to last year due to increased production costs. The real estate market was also "pleased": rental prices in July increased more than last month (however, this is due to an increase in interest rates). Prices for short-term rental housing jumped by 50% at once. The cost of air tickets last month jumped by 25% compared to June.

In other words, given the prevailing fundamental picture for the USD/CAD pair, we can assume that traders will continue to trade in the 200-point range of 1.2770-1.2970, within which the price has been for the fourth consecutive week. There are no good reasons for a breakthrough – neither in the direction of the downside nor in the direction of the upside. If we talk about the current situation, then it is necessary to monitor the price behavior around the 1.2850 mark (at this price point, the average line of the Bollinger Bands indicator coincides with the Tenkan-sen line on the daily chart). If the bears cannot overcome this target, then it is advisable to consider longs with a target of 1.2950 – this is the upper line of the Bollinger Bands indicator on the same timeframe.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română