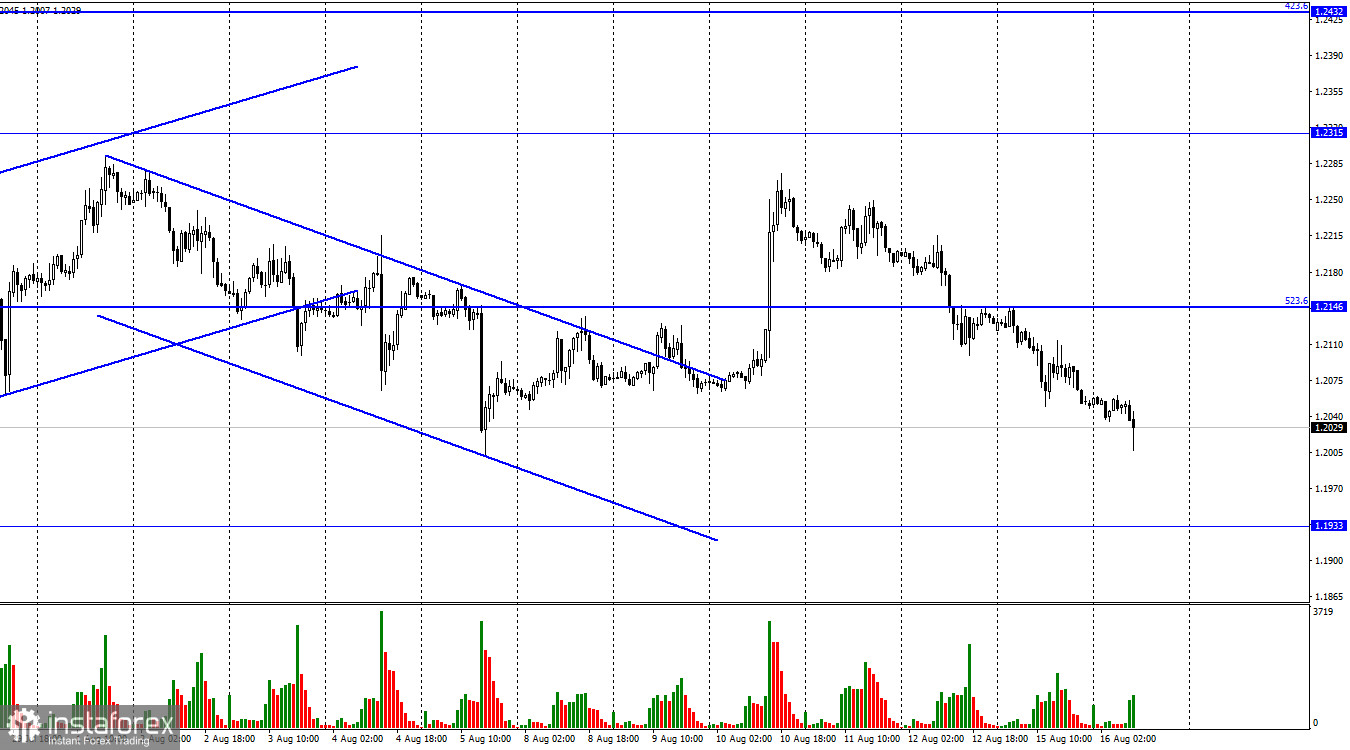

Hi, dear traders! According to the H1 chart, GBP/USD slid down on Monday and has continued its decline on Tuesday. If the pair settles below the retracement level of 523.6% (1.2146), it could then continue to move down towards 1.1933. The upcoming events on the economic calendar are likely to influence traders significantly. Today, the first batch of statistic data was released. Unemployment remained unchanged at 3.8%, while jobless claims decreased by about 10,500. Wages increased by 5.1%, slightly exceeding the expectations of traders. All three data releases largely matched forecasts and thus could not have sent GBP in any direction. However, the pound sterling has been on the decline for the past three days, and it is likely to drop even further in the near future. Traders have ignored today's data releases, but tomorrow the situation could be different.

Early on Wednesday, the UK inflation data for July is set to be released. Inflation is forecasted to rise to 9.8% in July from 9.4% in June. The data release is likely to meet expectations, but the market reaction to it could be unexpected and counterintuitive. Inflation data is key for predicting the next steps by the Bank of England at its upcoming policy meetings. However, the BoE has already hiked interest rates 6 times, and it is unclear how high the regulator can move it in the future. Andrew Bailey has stated that he expects a recession in the second half of 2022. The UK's GDP has already decreased by 0.1% in the second quarter - high interest rates will only put extra pressure on the economy. It remains unclear if Bailey and other BoE policymakers will prioritize tackling inflation or preventing a recession.

According to the H4 chart, the pair has bounced off the retracement level of 127.2% (1.2250) and continues to fall towards 1.1980. Indicators show no signs of emerging divergences today. If GBP/USD bounces off 1.1980, it could rebound upwards slightly towards 1.2250. If the pair closes below 1.1980, it could then drop towards the next Fibo level of 161.8% (1.1709).

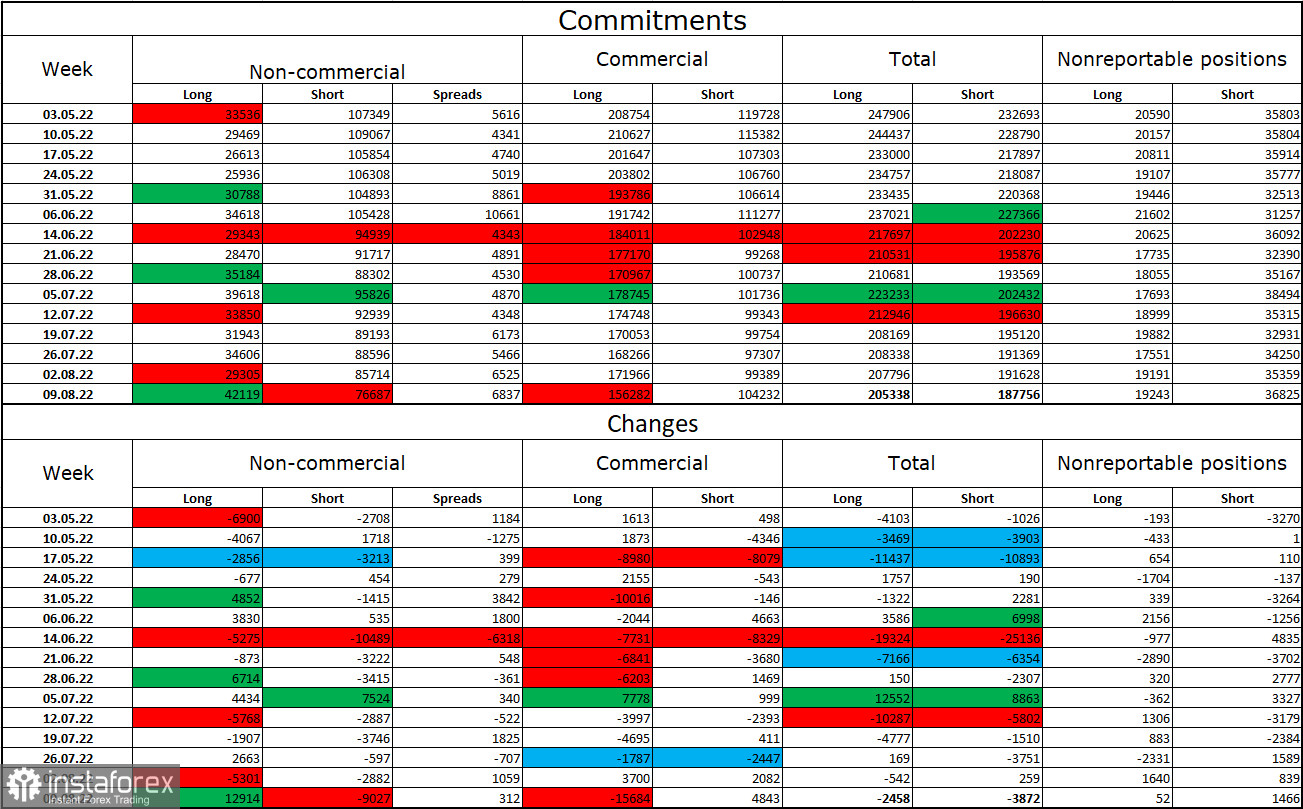

Commitments of Traders (COT) report:

Non-commercial traders became much less bearish on GBP/USD last week. Traders opened 12,914 Long positions and closed 9,027 Short positions. The overall sentiment of traders remains bearish, and the number of Short positions still outnumbers Long ones. However, the gap is narrowing. Major market players continue to go short on GBP. While traders are slowly becoming more bullish on the pound sterling, it will take a lot of time before the dominant mood in the market changes. The pound's upward movements this week have been very limited, and the COT reports currently indicate that GBP is more likely to resume its drop than begin a new long-term uptrend.

US and UK economic calendar:

UK – Unemployment Rate (06-00 UTC).

UK – Claimant Count Change (06-00 UTC).

UK – Average Earnings Index (06-00 UTC).

There are no events in the US today.

Outlook for GBP/USD:

Earlier, traders were recommended to open new short positions if GBP/USD bounced 1.2250 on the H4 chart targeting 1.1980. These positions can be kept open. Long positions can be opened if the pair bounces off 1.1980 on the H4 chart with 1.2250.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română