EUR/USD

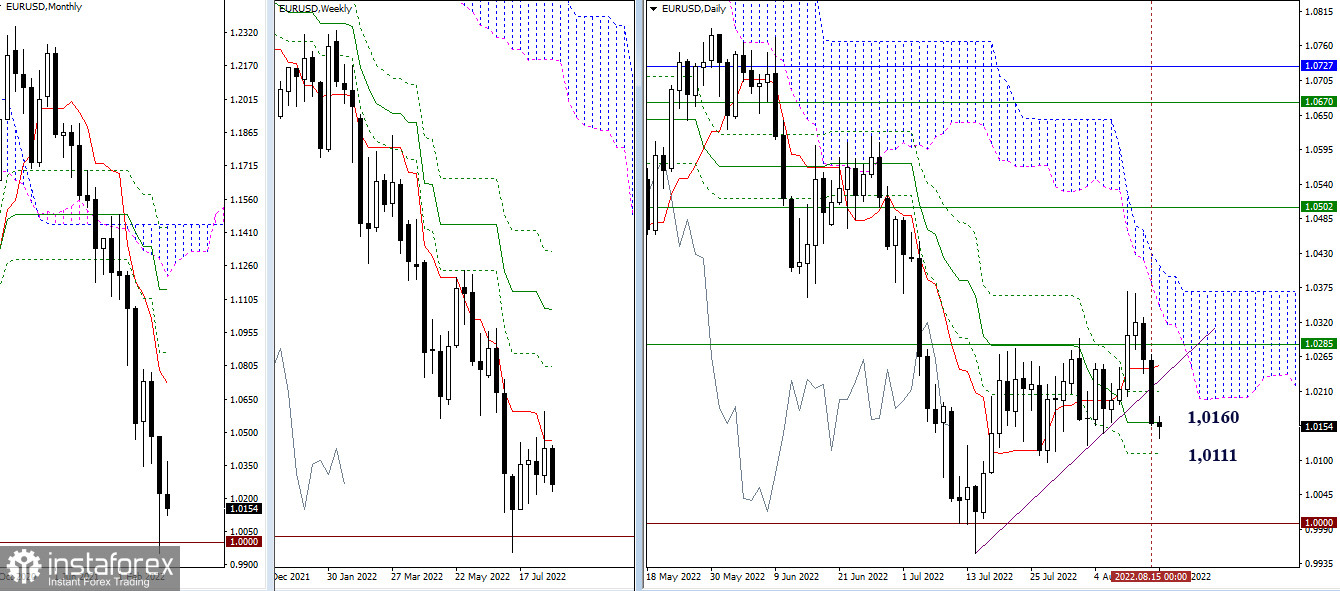

Higher timeframes

Yesterday the initiative belonged to the bears. They went down to the support of the daily medium-term trend (1.0160). If the trend continues, the liquidation of the daily Ichimoku golden cross, the final level of which is now located at 1.0111, will be of primary importance in this area.

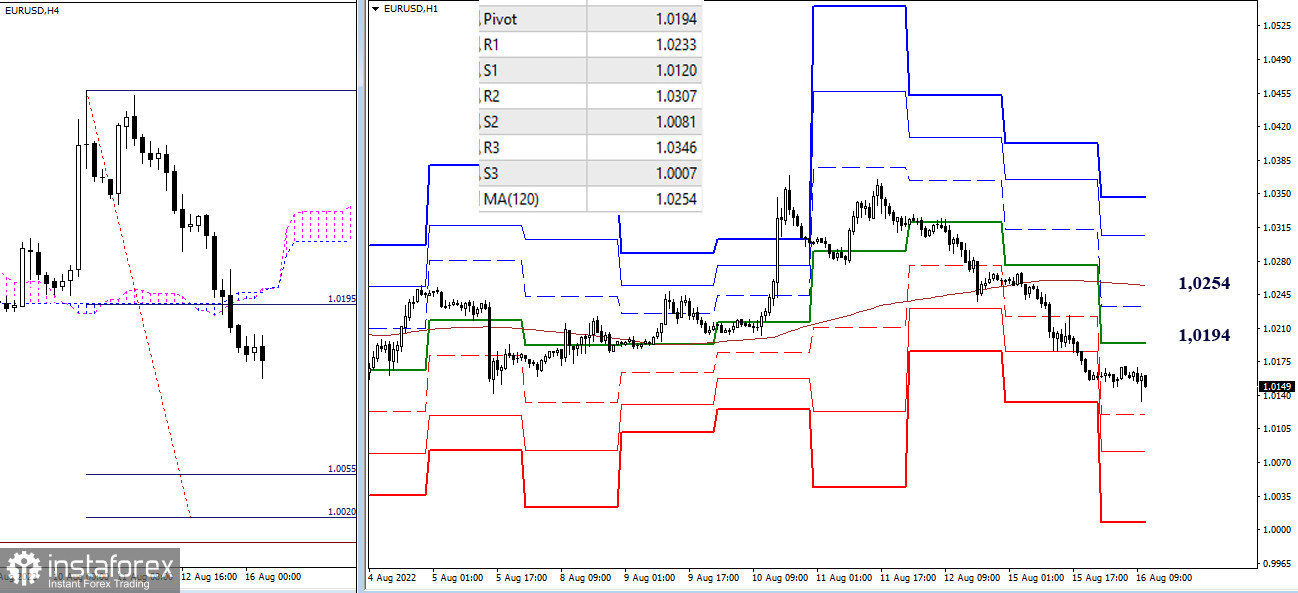

H4 – H1

On the lower timeframes, the advantage currently belongs to the bears. The reference points for the continuation of the decline within the day are the support of the classic pivot points (1.0120 – 1.0081 – 1.0007). The key levels are now acting as resistance and forming reference points for correction, located at 1.0194 (central pivot point of the day) and 1.0254 (weekly long-term trend).

***

GBP/USD

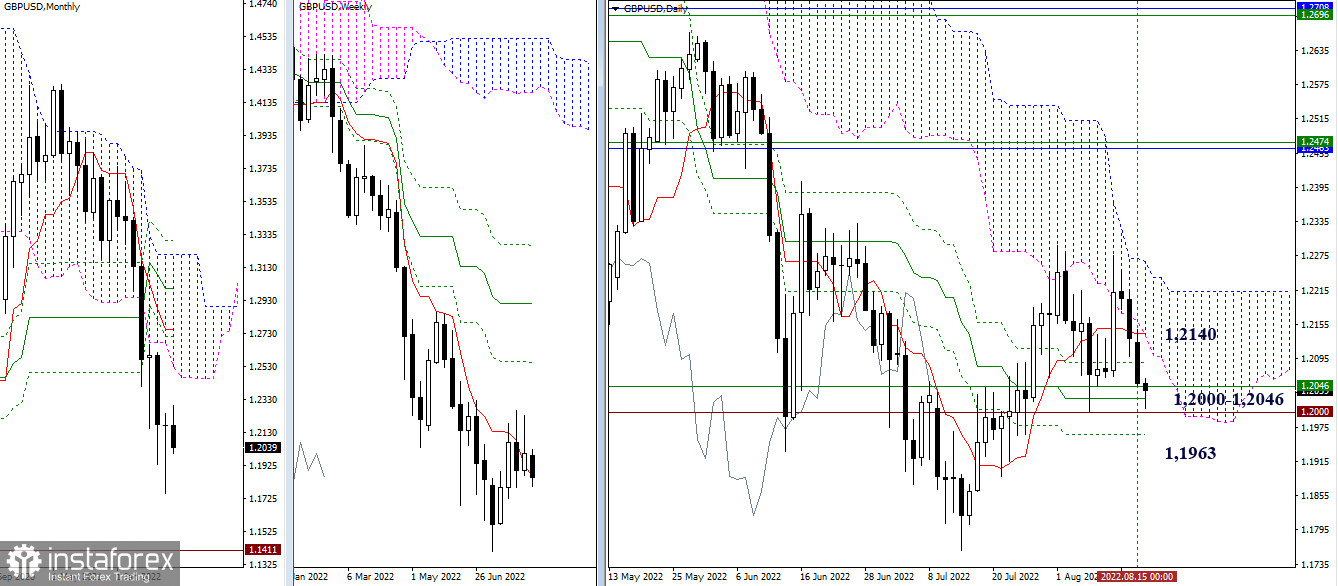

Higher timeframes

Bears continued their decline and are now interacting with a cluster of supports led by the weekly short-term trend (1.2046) and the psychological level (1.2000). The breakdown of the levels and the liquidation of the daily golden cross (1.1963) are now the main priorities of bears. The opponent needs a pause, and even better, a rebound from the accumulated supports.

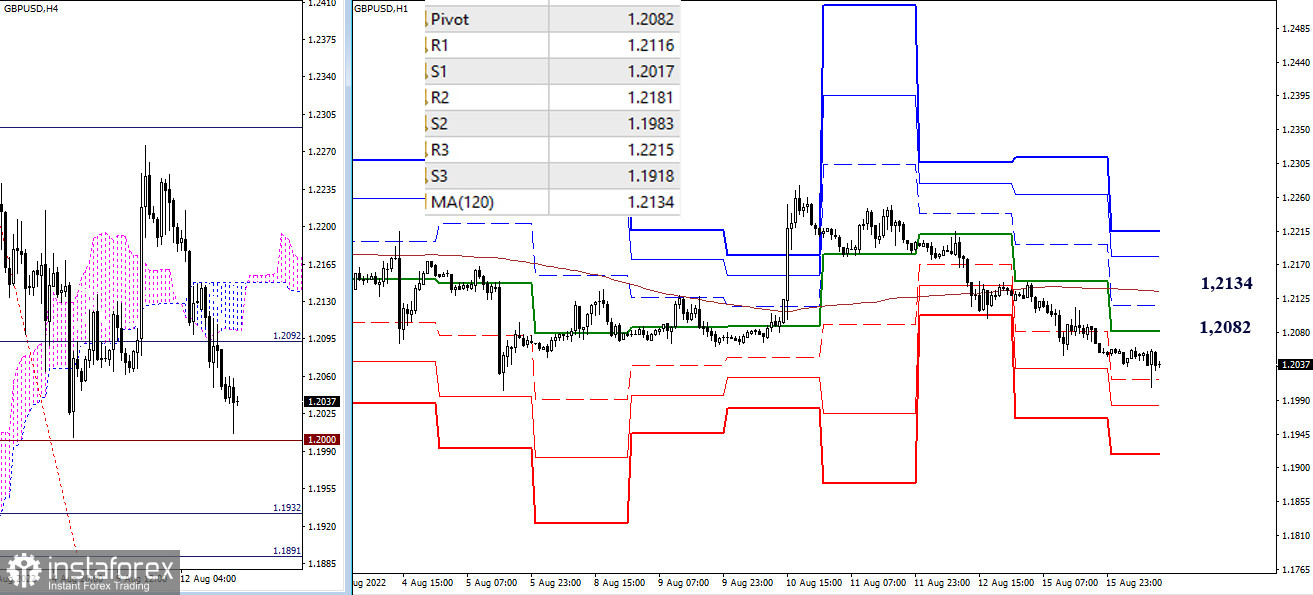

H4 – H1

In the lower timeframes, the advantage is on the side of the bears. Now they are testing the first support of the classic pivot points (1.2017). Further reference points are 1.1983 (S2) – 1.1918 (S3) and the target for the breakdown of the H4 cloud (1.1932 – 1.1891). Key resistance levels today can be seen at 1.2082 (central pivot point of the day) and 1.2134 (weekly long-term trend).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română