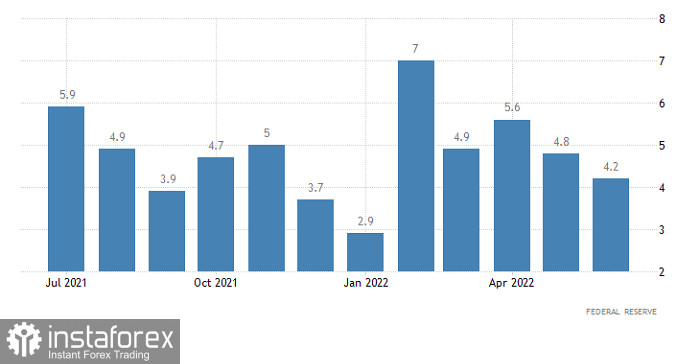

Immediately after the release of inflation data in the United States, the idea arose that as the market realized that this would not affect the policy of the Federal Reserve in any way, there would inevitably be a return to the positions where quotes were before the release of the data. That is exactly what happened. And pretty fast. The single currency fell even below those values. And now it's time to talk not about the local oversold dollar, but about its local overbought. So the market only needs a reason for a small rebound. Most likely, such an occasion will be today's data on industrial production in the United States, the growth rate of which should slow down from 4.2% to 4.0%. And although this is still growth, and quite good, the very fact of a slowdown, amid ongoing talk about the beginning of a protracted recession, will convince market participants of its inevitability. That will be an excellent reason for a slight weakening of the dollar.

Industrial production (United States):

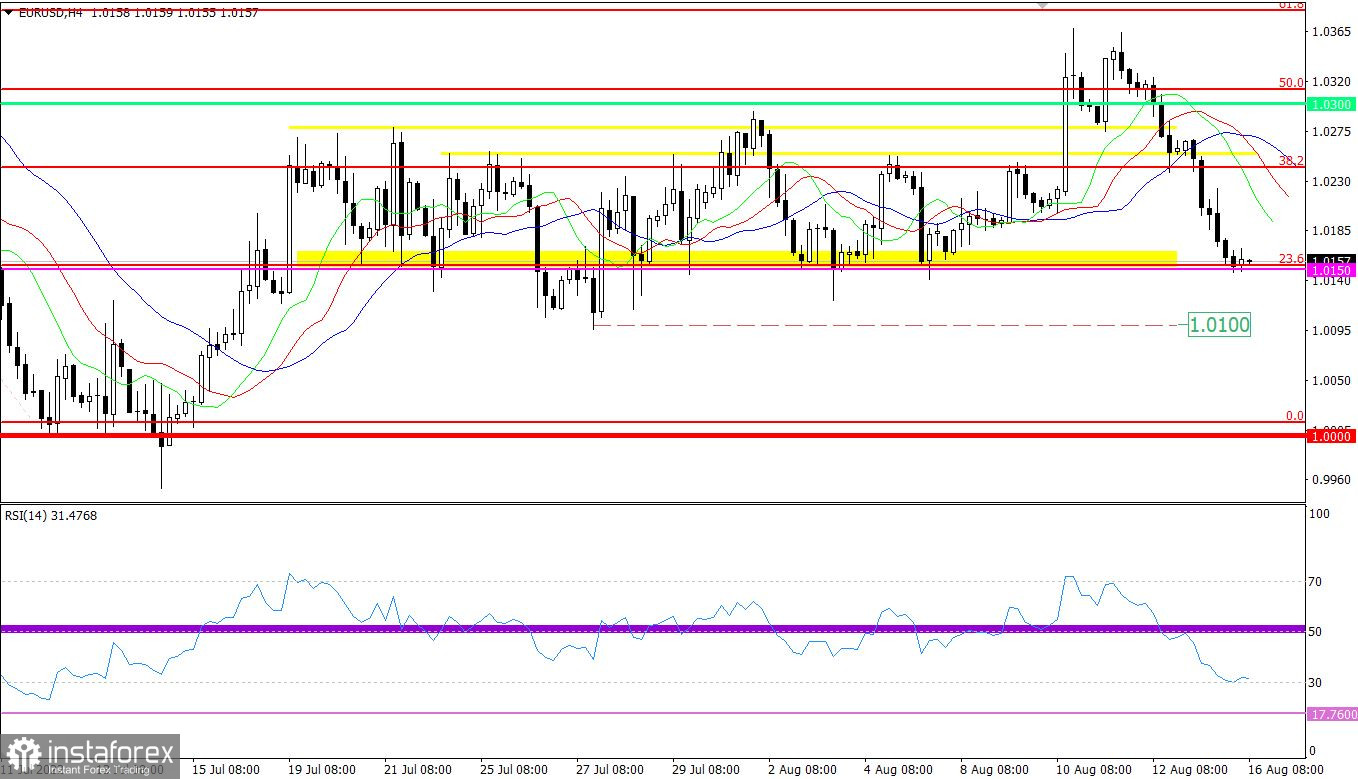

The EURUSD currency pair, during an intensive downward movement from the resistance level of 1.0350, reached the lower border of the previously passed flat 1.0150/1.0270. As a result, a local reduction in the volume of short positions appeared on the market, which led to a slowdown.

The technical instrument RSI H4 has reached the oversold level, which may be a signal to buy the euro. RSI D1 has returned below the midline 50 again, which indicates the prevailing interest of traders in the downward trend.

The moving MA lines on Alligator H4 have changed direction, from an ascending to a descending cycle. Alligator D1 is at the stage of crossing the MA lines, which indicates a variable signal.

Expectations and prospects

It can be assumed that the 1.0150 area will put pressure on the bears, which will lead to a gradual slowdown in the downward cycle. As a result, a technical rollback may occur in the market.

As for the prolongation of the current downward cycle, traders will consider it if the price stays below 1.0100. In this case, the quote will rush towards the parity level.

Comprehensive indicator analysis has a short-term and intraday sell signal due to the down cycle. Technical instruments in the medium term are again oriented to sell, which is in line with the direction of the main trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română