The GBP/USD currency pair stood in one place for most of the day on Thursday. Recall that a day earlier, the pair's quotes rose to the Murray level of "+1/8" - 1.2268, which is also the previous local maximum. Thus, with two attempts, the price failed to overcome this level. Moreover, the pound sterling returned to this level not because most traders consider long-term purchases but because a very important report on inflation in the United States was released on Wednesday, which surprised many. But, as we said in the euro/dollar article, this is just one report. It is possible to draw certain conclusions from it, but it is unlikely, for example, that it is possible to say that now the consumer price index will only decrease. Recall that inflation slowed by a couple of tenths of a percent in May, after which it calmly resumed acceleration.

Also, we would not rush to conclusions about the Fed's future actions. Yes, the probability of an aggressive increase in the key rate at the next meetings has decreased, but this does not mean that the cycle of tightening monetary policy is over! The Fed will continue to raise the rate in any case since now it is necessary to lower inflation from 8.5% to 2%, which is much more difficult than going from 9.1% to 8.5%. As for the Bank of England, everything is relatively simple here. Andrew Bailey has already prepared everyone for the recession and said that the regulator's main task is to reduce inflation to the target level. Therefore, there is no doubt that the BA rate will continue to grow. But after all, it will also grow in the US, so, from our point of view, there are much more reasons for long-term purchases of the pound because of one inflation report. We still believe it would be more logical to resume the downward trend in both the euro and the pound. But we also remind you that the market is a collection of many players and may not always move as logically.

The Briton is growing, but doubts about his ability to continue growing remain.

The fact that the pound failed to continue its upward movement yesterday should not be confusing. There was no single important report or event in the UK or the US yesterday. There was nothing for traders to react to. They already exceeded the plan on Wednesday, when the dollar fell by 200 points. And on Thursday, they also tried to finish off the US currency, but they have already failed here. Thus, the pound could not continue to grow, which is unlikely due to the upcoming publication of the GDP report in Britain, which will be known early this morning. What can we say about this report now? The market is waiting for a value of -0.2% q/q, but the actual value may be either higher than the forecast or lower than it. If the value is much lower than the forecast, the British pound will face market pressure. The stronger and faster the British economy falls, the fewer opportunities the Bank of England will have to raise the rate. And the head of BA expects the economy to fall over the next five quarters. If the GDP value is higher than +0.1%, this may support the pound, but it is unlikely to be very strong since +0.1% is very small for a quarterly value. So it turns out that the probability of growth of the British currency today is extremely low.

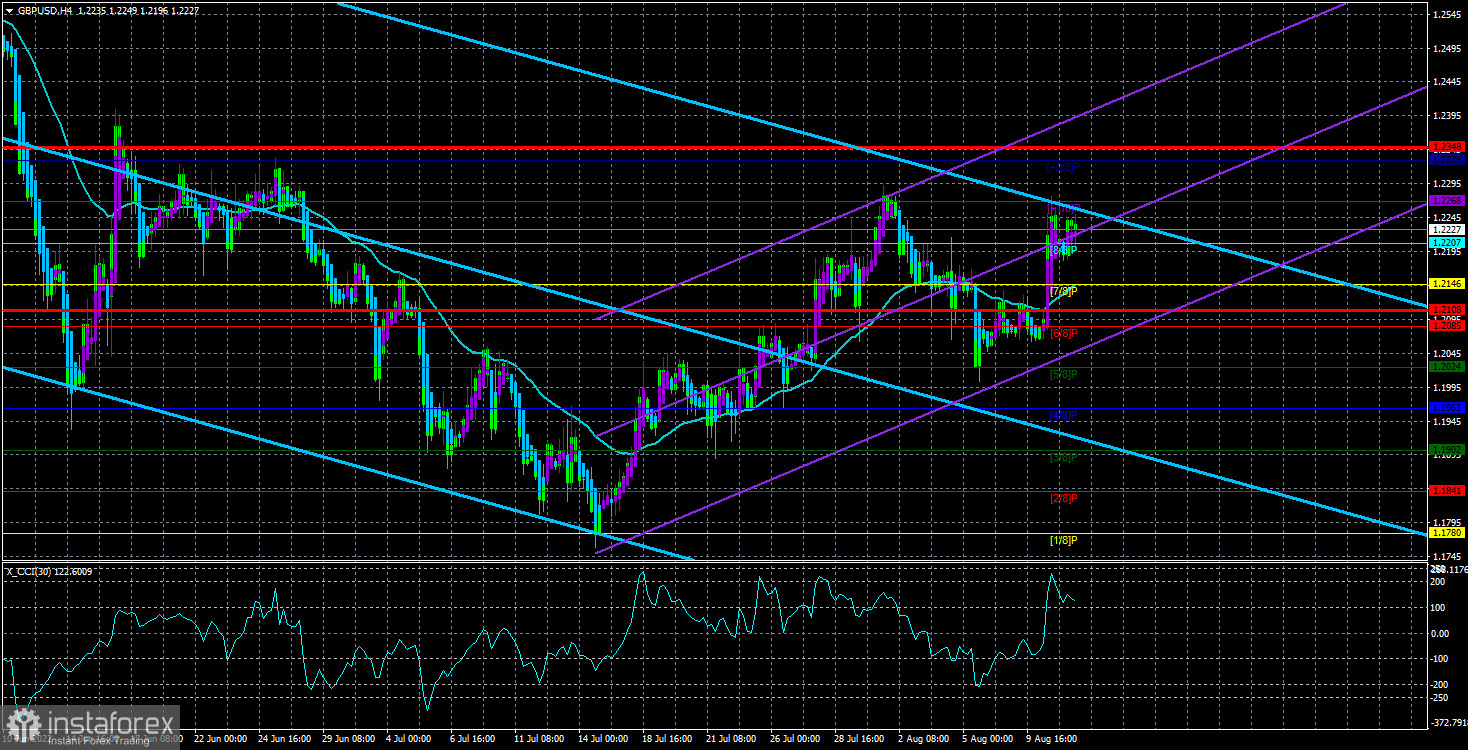

Nevertheless, the pair is now located above the moving average line, and one of the linear regression channels is directed upwards. Ignoring these technical factors is also not worth it. We believe it would be advisable to consider short positions if the pound is fixed below the moving average. In this case, we may even see a resumption of the long-term downward trend. If this consolidation happens, the market will tell us that the time has not yet come for a new upward trend.

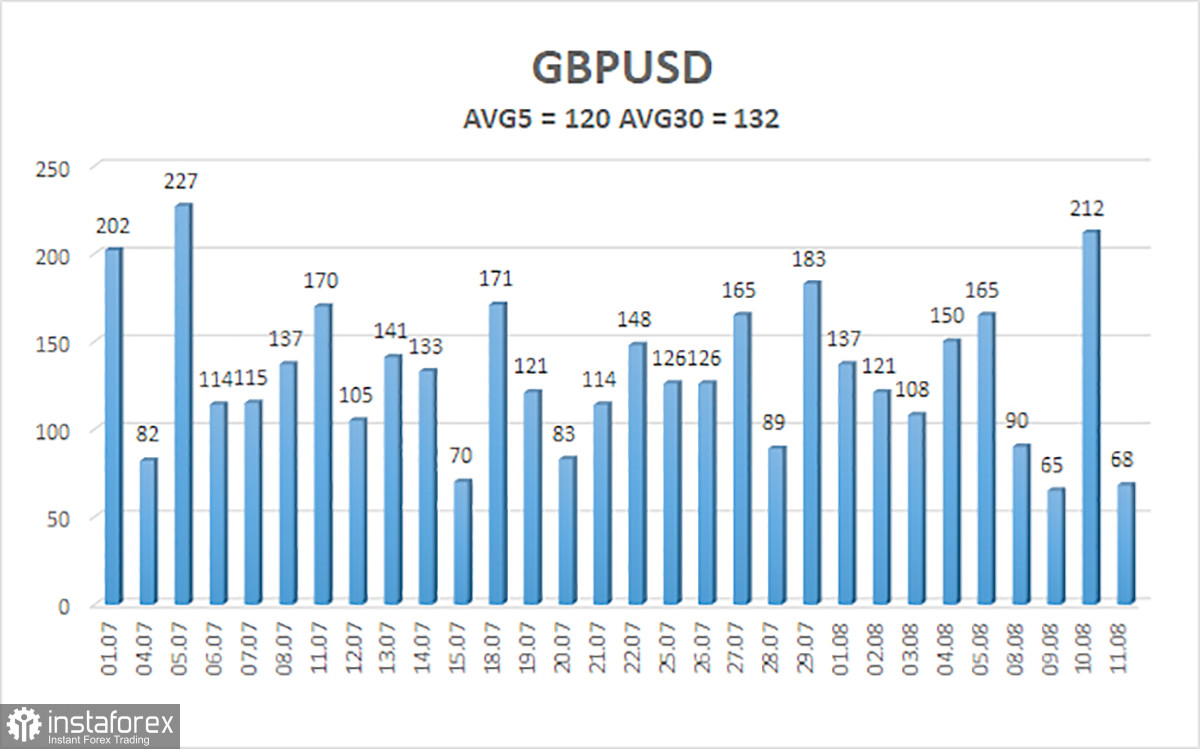

The average volatility of the GBP/USD pair over the last 5 trading days is 120 points. For the pound/dollar pair, this value is "high." On Friday, August 12, thus, we expect movement inside the channel, limited by the levels of 1.2108 and 1.2348. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest resistance levels:

R1 – 1.2268

R2 – 1.2329

Trading Recommendations:

The GBP/USD pair continues its upward movement in the 4-hour timeframe. Therefore, at the moment, you should stay in buy orders with targets of 1.2268 and 1.2348 until the Heiken Ashi indicator turns down. Sell orders should be opened when anchoring below the moving average line with targets of 1.2085 and 1.2024.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română