EUR/USD

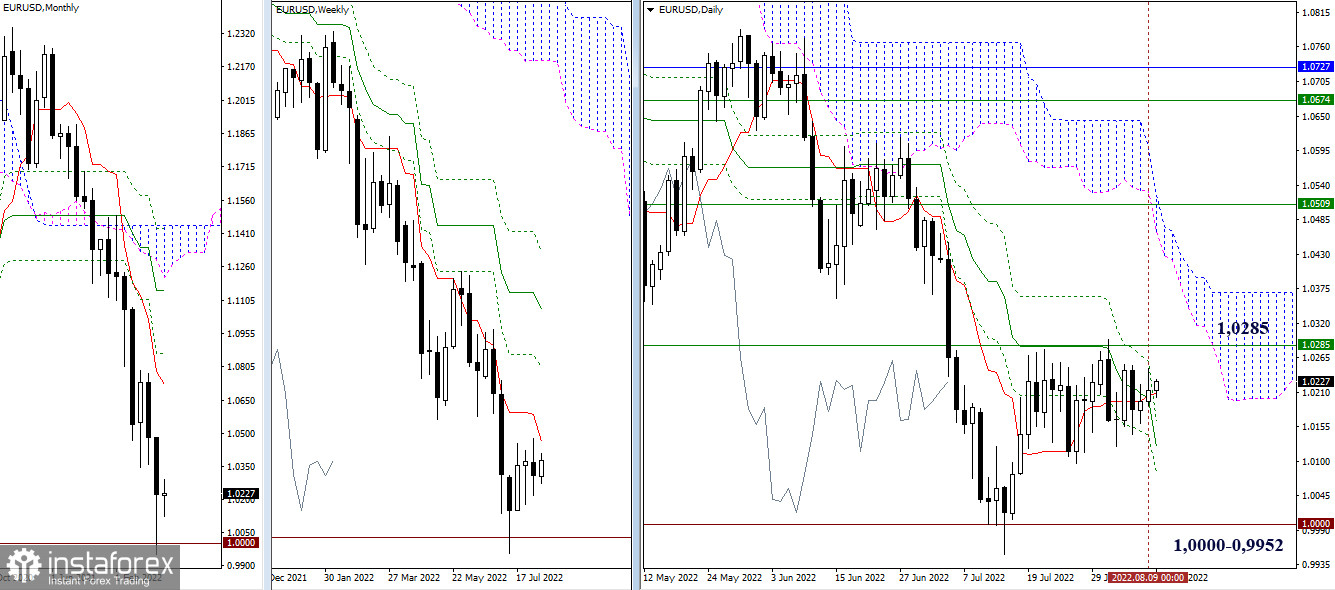

Higher timeframes

The situation again did not undergo significant changes. The only thing is that several daily levels left the center of consolidation, moving into the category of supports at the levels of 1.0123 and 1.0083. Immediate important resistance is now at 1.0285 (weekly short-term trend).

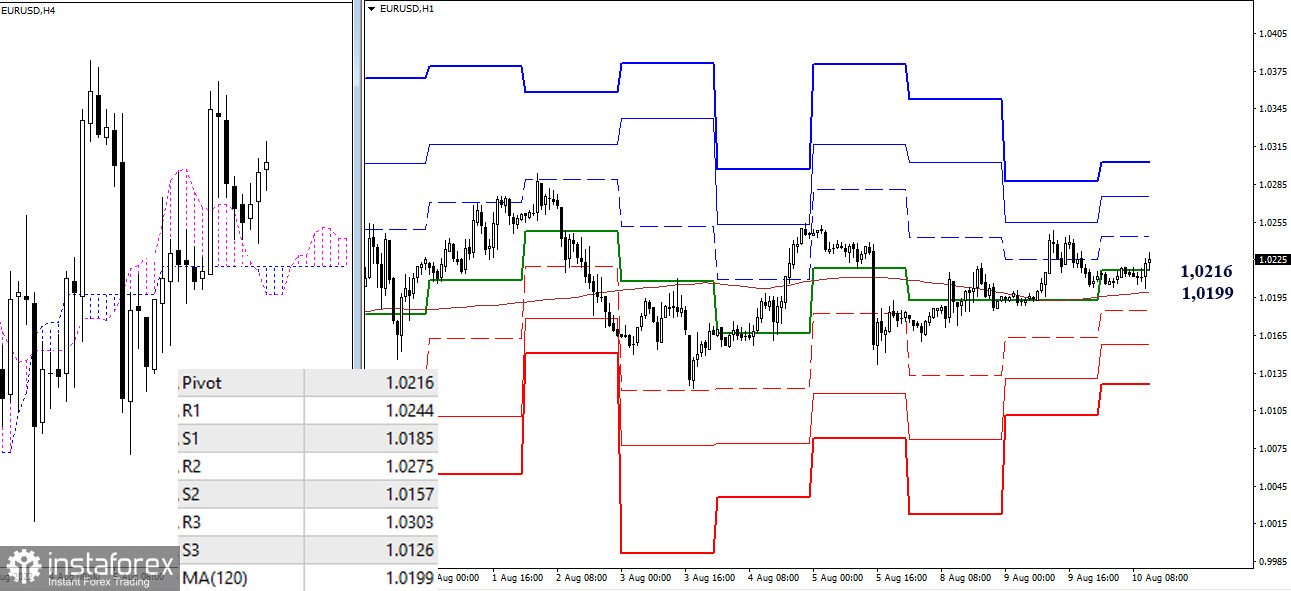

H4 – H1

On the lower timeframes, the main advantage continues to be on the bulls' side, but there is uncertainty, and the pair is in the zone of attraction of the key levels 1.0216 – 1.0199 (central pivot point + weekly long-term trend). The resistance levels 1.0244 – 1.0275 – 1.0303 (classic pivot points) serve as reference points for bulls within the day. The reference points for bears in case of a decline will be the supports 1.0185 – 1.0157 – 1.0126 (classic pivot points).

***

GBP/USD

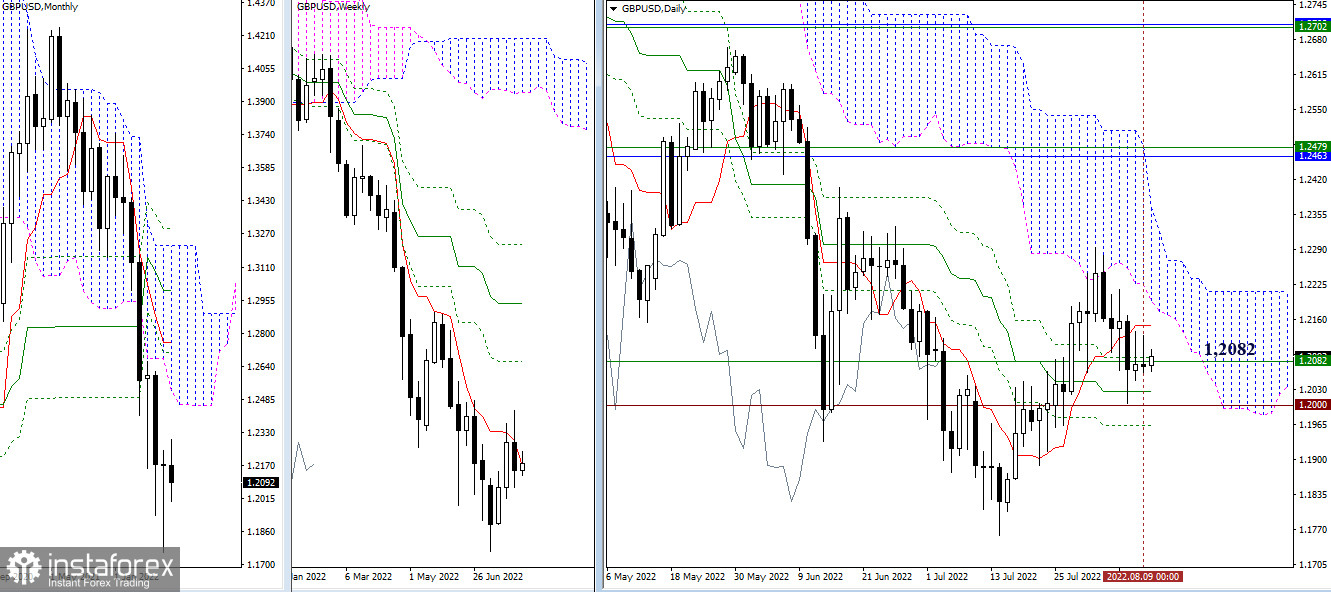

Higher timeframes

Over the past day, the situation has also not undergone significant changes. The pound market continues to consolidate in the area of the weekly short-term trend (1.0282). For bears, it is important to overcome the support (1.2026 – 1.2000) and liquidate the daily golden cross (1.1963) in the near future. For bulls, the following reference points are important: 1.2148 (daily short-term trend) – 1.2195 (lower limit of the daily cloud) – 1.2293 (maximum extremum).

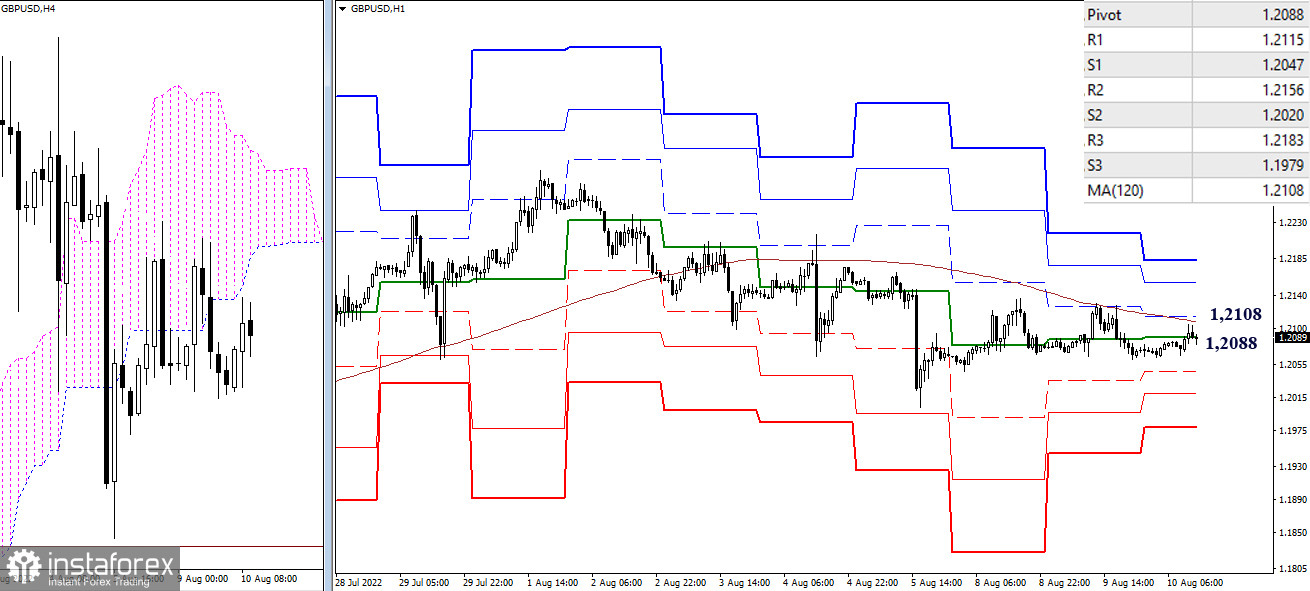

H4 – H1

The pair continues to work below the weekly long-term trend (1.2108), keeping the location in the zone of attraction of the central pivot point of the day (1.2088). Positioning below key levels favors bears. Their reference points today can be noted at 1.2047 – 1.2020 – 1.1979 (support of the classic pivot points). Consolidation above 1.2108 will change the current balance of power. Intraday reference points, in this case, will be 1.2115 – 1.2156 – 1.2183 (resistance of classical pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română