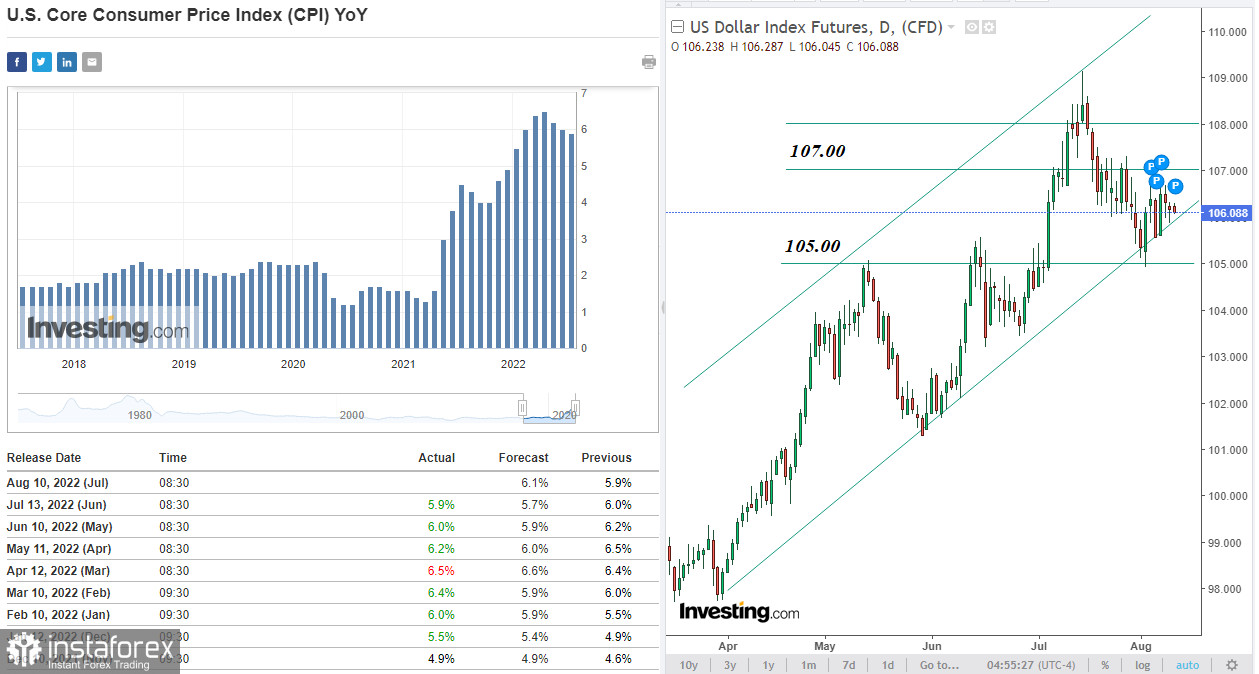

Having found itself under some pressure in the past two days due to the lack of necessary drivers, today the dollar is also weakening, and the dollar index (DXY) is slightly decreasing on the eve of the publication (at 12:30 GMT) of key US inflation data for the Fed.

As expected, the consumer price index (CPI), which is a key indicator for assessing inflation and changes in consumer preferences, will be released in July with a value of +0.2% and +8.7% (in annual terms).

Core CPI (food and energy excluded from this indicator for a more accurate estimate) will be released at +0.5% and +6.1% (on an annualized basis), which indicates continued inflationary pressure in the US economy.

Theoretically, the data should strengthen the dollar better than the forecast, since they will indicate the need for further actions on the part of the Fed to curb high inflation.

Many economists believe that today's Bureau of Labor Statistics inflation report "could be an important catalyst for the next leg of the US dollar rally if it beats market expectations." In their opinion, "the market is underestimating the resilience of US inflation, the Fed's determination to fight it, and the necessary tightening required to achieve lower inflation."

All this is true, and it is difficult to disagree with this. However, it is impossible to call the current situation in the American and most of the global economies normal. Moreover, the continuing growth of inflation in the US speaks of the low effectiveness of the actions taken by the Fed so far. Therefore, the reaction of the market to this publication can be completely unpredictable. Instead of the expected growth, the dollar may decline.

Returning to the DXY index, we can then say that the breakdown of the local support level of 105.00 can become a "catalyst" not for growth but, on the contrary, for the fall of the dollar.

But so far, the market is set for further growth of the dollar, especially since data from the US labor market published last Friday (in July, the number of new jobs in the non-farm sector of the US economy increased by 528,000, and the unemployment rate fell to 3.5%) provide the Fed with space for further tightening of monetary policy. And this, in turn, should help strengthen the national currency of the United States, which is the dollar.

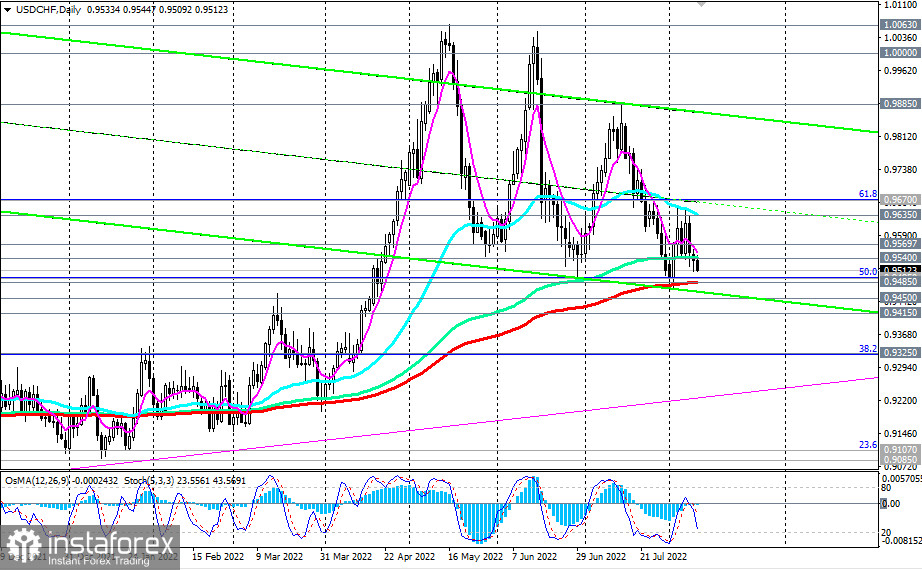

In this regard, I would like to pay attention to the USD/CHF pair, which has come close to the key support level of 0.9485. From this level, either a good bounce and resumption of the positive dynamics of the pair is possible, or its breakdown with risks of further decline to the next key level of 0.9450, the breakdown of which, in turn, may lead to a break in the long-term bullish trend of USD/CHF.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română