Gold is a fairly simple asset. It likes a weak dollar, low rates, and any kind of turmoil in the financial markets. In this regard, the peak of the USD index amid expectations of a slowdown in the Fed's monetary restriction process, falling debt rates due to fears of an impending recession, and Nancy Pelosi's visit to Taiwan allowed gold to mark a more than 4% rally from July lows. Everything seems logical if it were not for speculators and fans of a physical asset.

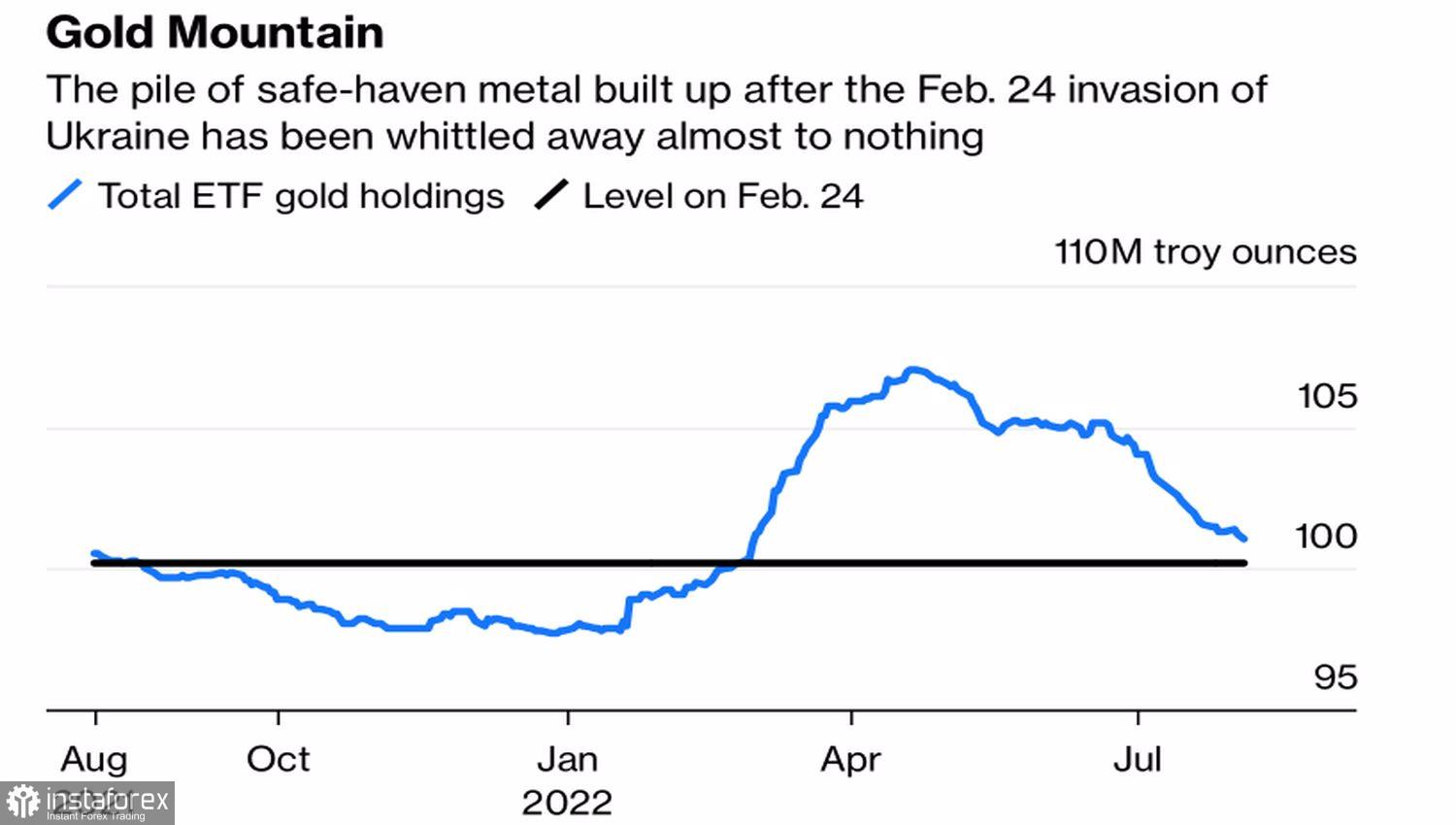

The hatred of the precious metal toward the dollar is understandable: futures are denominated in US currency, so its rally is a reason to sell XAUUSD. Any turmoil in the financial markets or the global economy and politics contributes to the flight of capital to safe-haven assets. First of all, in US Treasury bonds. Rising prices for them reduce profitability, which increases the attractiveness of gold. All this takes place in the second half of the summer. However, stocks of specialized exchange-traded funds, instead of growing, are declining. They completely nullified their own achievements related to the armed conflict in Ukraine.

Gold ETF stock dynamics

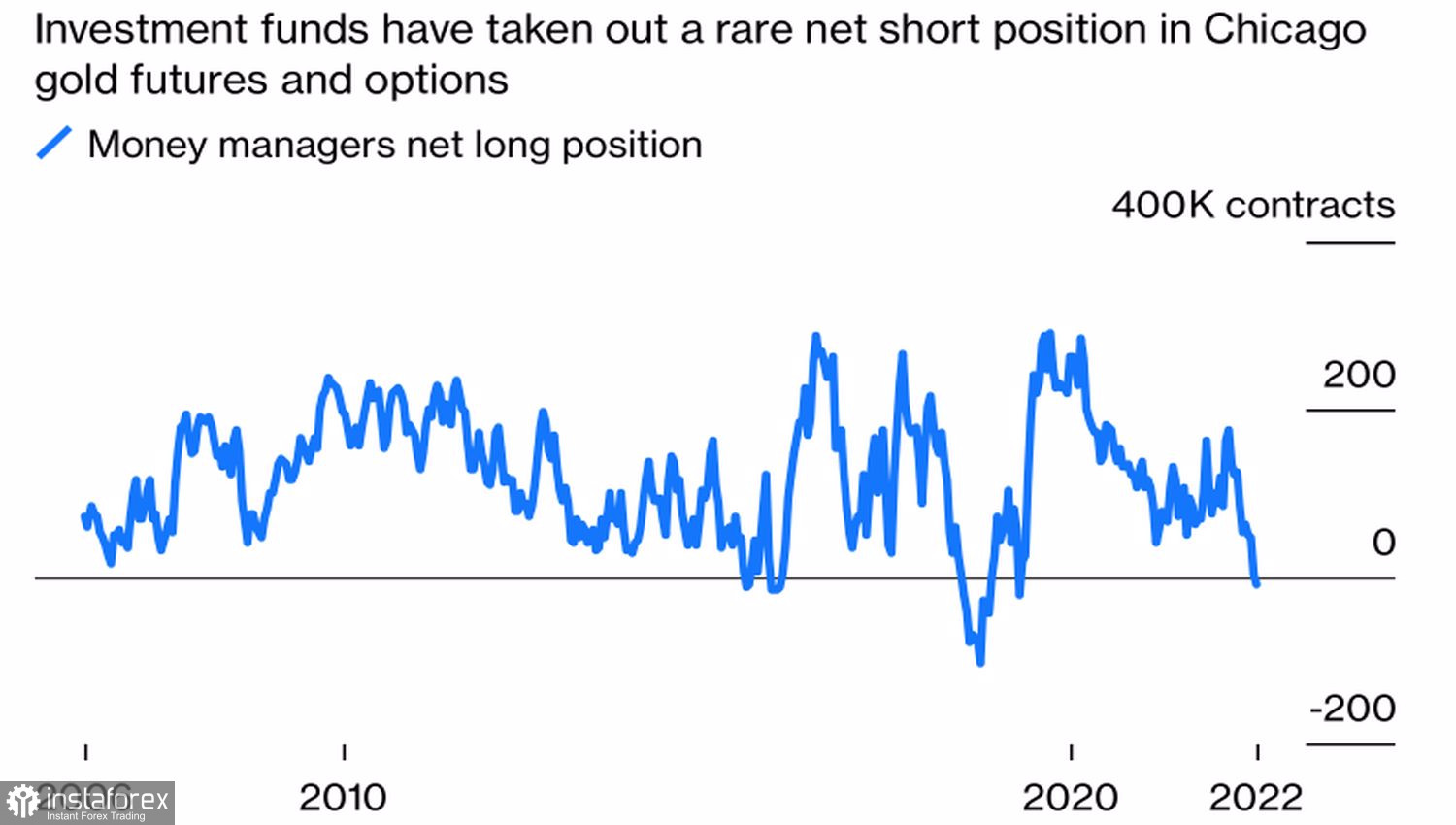

The situation in the futures market looks no less mysterious. There, asset managers who had been acting as net buyers of precious metals for decades suddenly decided to switch to the side of net sellers. They are holding on to their short positions with their teeth, making it doubtful that the XAUUSD rally is sustainable.

Dynamics of speculative positions in gold

Of course, this cannot go on indefinitely. Someone has to give in. Either prices go down, or speculators get rid of their shorts, and investors start building up ETF stocks. The release of US inflation data for July may give a hint. The acceleration of consumer prices above the 8.7% expected by Bloomberg experts could provoke a rally in the dollar and US Treasury yields, which will be a real blow to gold. On the contrary, a slowdown in CPI below 8.5% will return its quotes above $1,800 per ounce.

However, the XAUUSD rally does look vulnerable. It is doubtful that US inflation will slow down to 6% or lower anytime soon. As long as it remains at elevated levels and the labor market is strong as a bull, the Fed has every reason to continue aggressively raising the federal funds rate. CME derivatives expect it to rise by 75 bps in September with a probability of almost 70%. If the Fed continues to tighten monetary policy at the same pace as before, gold will get caught with its pants down.

Technically, on the precious metal's daily chart, the $1770–1780 per ounce area is a kind of red line. Here are the upper limits of the fair value range and the downward trading channel, moving averages, as well as the pivot point. In this regard, only a drop in quotes below $1770 can be the basis for selling gold. On the contrary, a rebound from this level is a reason to buy it.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română