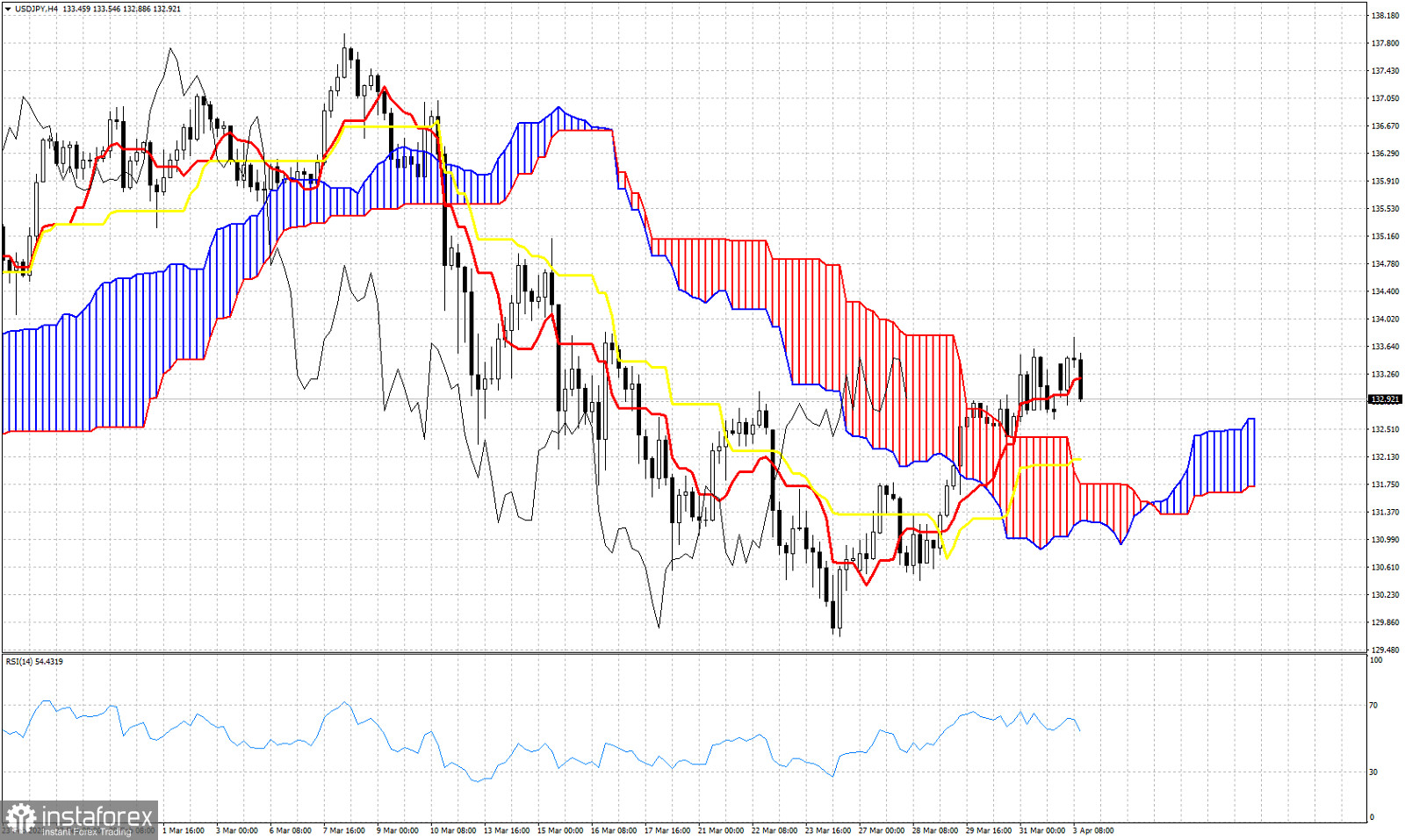

USDJPY is trading around 133. In Ichimoku cloud terms USDJPY is in a bullish trend in the 4hour chart. However there are signs of weakness suggesting that a pull back towards the Kumo is very possible. USDJPY is currently trading below the tenkan-sen (red line indicator). A 4hour candlestick close below 133.20 would imply that price could move even lower towards the kijun-sen (yellow line indicator) at 132.10. The Chikou span (black line indicator) is above the candlestick pattern (bullish). Price only recently broke out and above the Kumo. In cases like this we usually see a back test pull back towards the cloud support. Price usually forms a higher low by testing the cloud once again and confirming support is strong. For now in the near term the Ichimoku cloud indicator is pointing to a possible move towards 132-131.75.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română