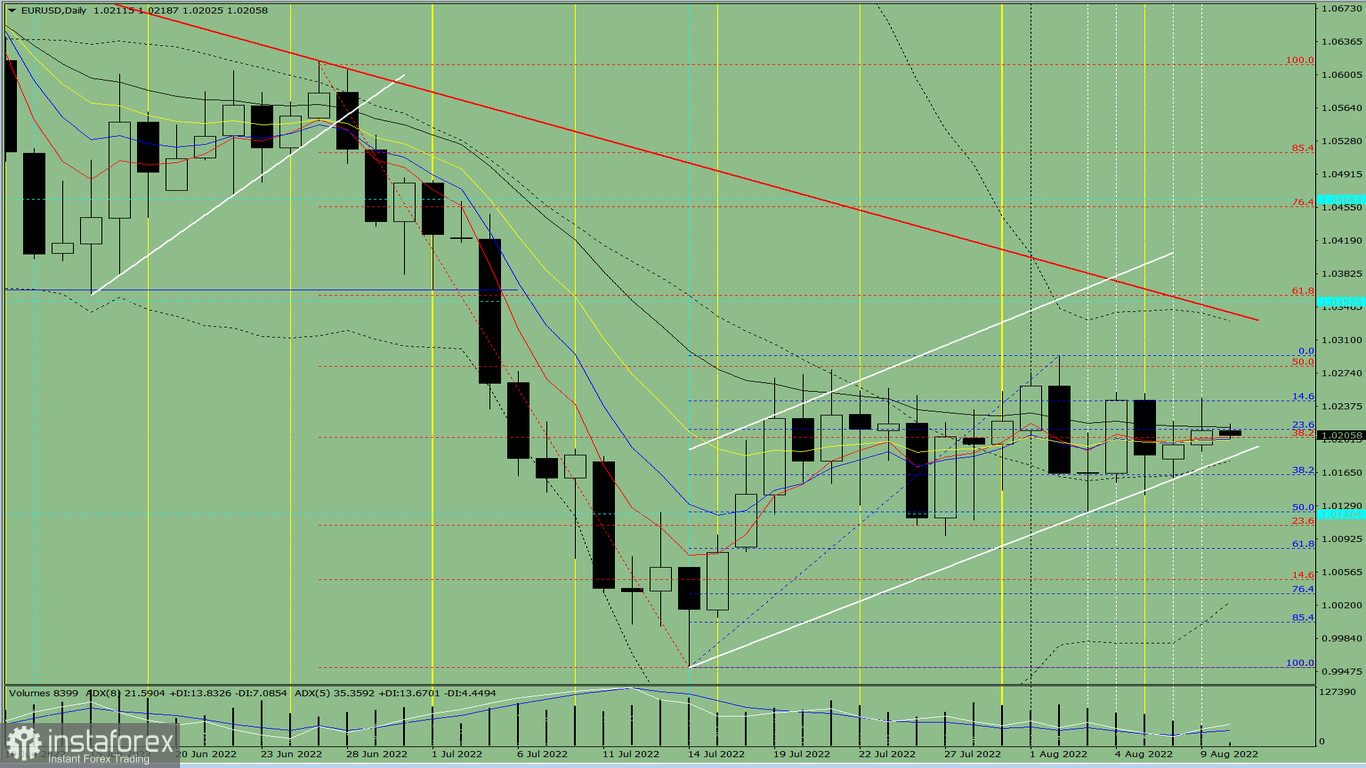

Trend analysis (picture 1)

On Wednesday, EUR/USD could begin a downward move from 1.0211, the closing level of yesterday's daily candlestick, with the target at 1.0181 that coincides with support plotted by the white bold line. Once this level is tested, the price may reverse upwards with the target at 1.0281 that matches the 50.0% Fibonacci retracement plotted by the red dotted line. As soon as this level is reached, the trading instrument will go down again.

Picture 1: daily chart

Complex analysis

Indicator analysis – upFibonacci levels - up Trading volume – upCandlestick analysis – upTrend analysis – upBollinger bands – upWeekly chart - up

Bottom line

Today, the price could begin a downward move from 1.0211, the closing level of yesterday's daily candlestick, with the target at 1.0181 which coincides with support plotted by the white bold line. Once this level is tested, the price may reverse upwards with the target at 1.0281 which matches the 50.0% Fibonacci retracement plotted by the red dotted line. As soon as this level is reached, the trading instrument will go down again.

Alternative scenario

From 1.0211, the closing level of yesterday's daily candlestick, the currency pair might start a move downwards with the target at 1.0163 which matches the 38.2% Fibonacci retracement plotted by the blue dotted line. After this level is tested, the price could change a trajectory upwards with the target at 1.0281 which coincides with the 50.0% Fibonacci retracement plotted by the red dotted line.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română