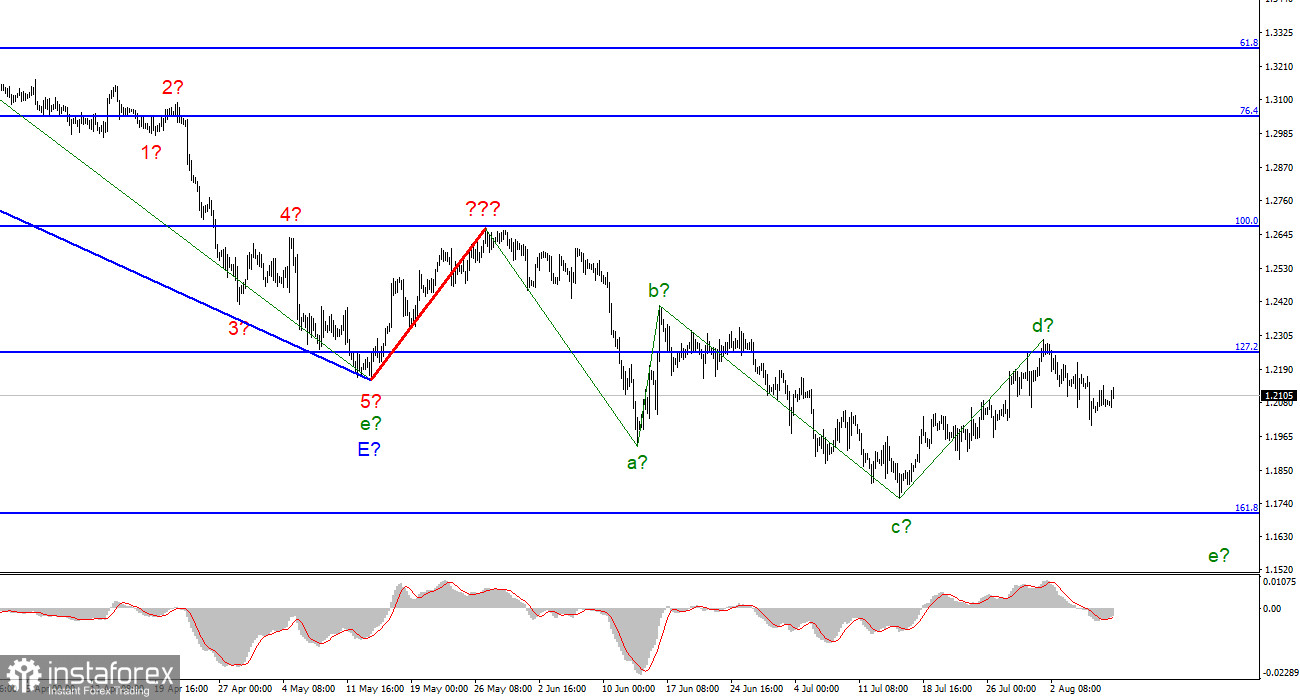

For the pound/dollar instrument, the wave marking at the moment looks quite complicated but does not require any clarifications. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a strongly lengthening trend area. It would be much more appropriate to identify rare corrective waves, after which new clear structures will be built.

At the moment, we have completed waves a, b, c and d, so we can assume that the instrument has moved on to constructing wave e. If this assumption is correct, the quotes' decline should continue in the coming days and weeks. The wave markings of the euro and the pound differ slightly in that for the euro, the downward section of the trend has an impulse form (for now), but the ascending and descending waves alternate almost identically, and at this time, both instruments presumably completed the construction of their fourth waves at the same time. However, there are other minor differences. So far, I still expect a new decline in the British.

The pound is looking for support from the news background, which does not exist

The exchange rate of the pound/dollar instrument increased by 65 basis points on August 8. The Briton this week is undoubtedly more pleasing than the European. I wrote yesterday that the instrument put me in a stupor with its increase of 65 points on Monday, but it should be recognized that the British at least moves and adheres to its wave marking. After all, we have an unsuccessful attempt to break through the 127.2% Fibonacci mark. We have a clear five-wave structure that gives us targets for the last fifth wave. There was no news background on Monday and Tuesday, but the market continues to trade the British pound quite actively. This is not a euro currency that has fallen out of favor with the market for a month and refuses to pay attention to it. And as a result, it is unclear whether correction wave 4 has been completed.

As much as I would like to draw readers' attention to something else, the next report this week will be American inflation. To be honest, news and reports from the USA are starting to get a little boring since the market has focused about 80% of its attention on them. Most of the reports from Britain and the European Union do not cause any reaction, and I wonder why they pay attention to them. However, tomorrow the fate of British statistics may also befall the US inflation report. Now no one can say what to expect from this indicator. Analysts are divided into several "regiments" at once, and everyone insists on their opinion. Many are no longer sure that inflation will continue to rise, as the Fed has already raised the rate to 2.5%. Sometimes it has to earn against the rise in prices. But at the same time, the Bank of England showed last week that 9% inflation is not so much, maybe much more.

General conclusions

The wave pattern of the pound/dollar instrument suggests a further decline. I now advise selling the instrument with targets near the estimated mark of 1,1708, which equates to 161.8% Fibonacci, for each MACD signal "down." An unsuccessful attempt to break through the 1.2250 mark indicates that the market is not ready to continue buying the British pound.

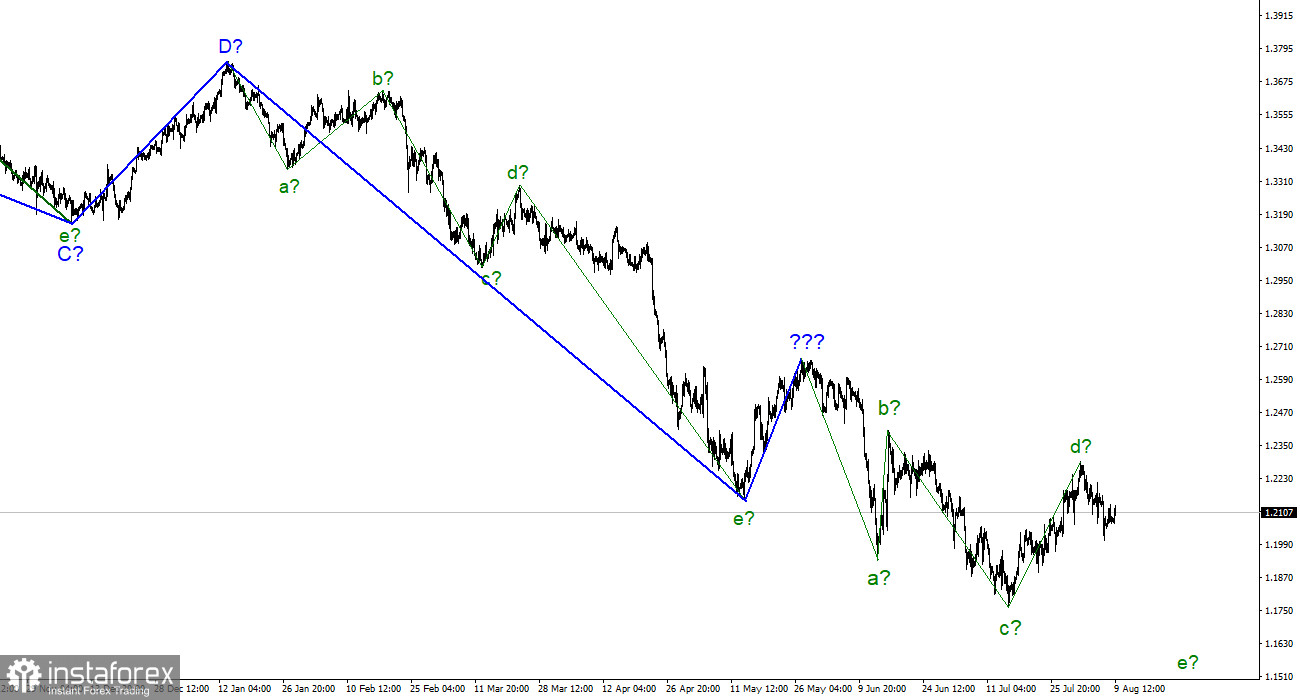

The picture is similar to the euro/dollar instrument at the larger wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română