EUR/USD

Higher timeframes

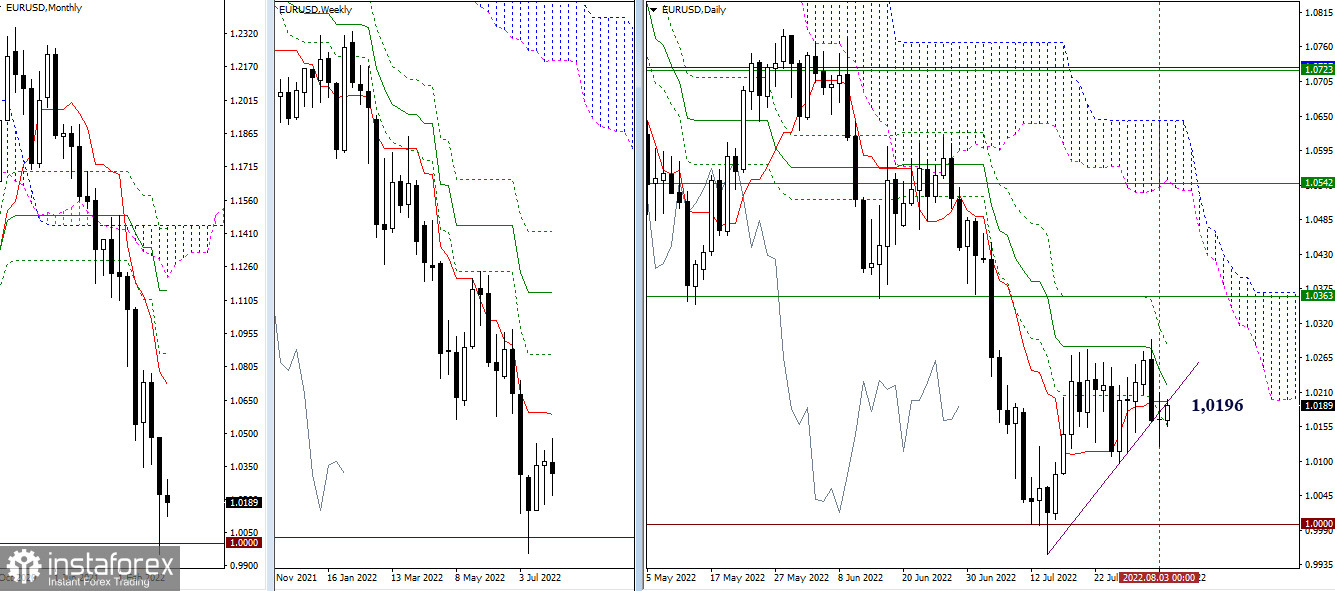

Bears failed to actively continue the decline yesterday. There was a candle of uncertainty, and the pair remained in the zone of attraction of the daily short-term trend (1.0196). The levels of the daily Ichimoku cross (1.0157 - 1.0196 - 1.0220 - 1.0284), exerting their attraction and influence, may hold back the development of the movement of either side in the near term.

H4 – H1

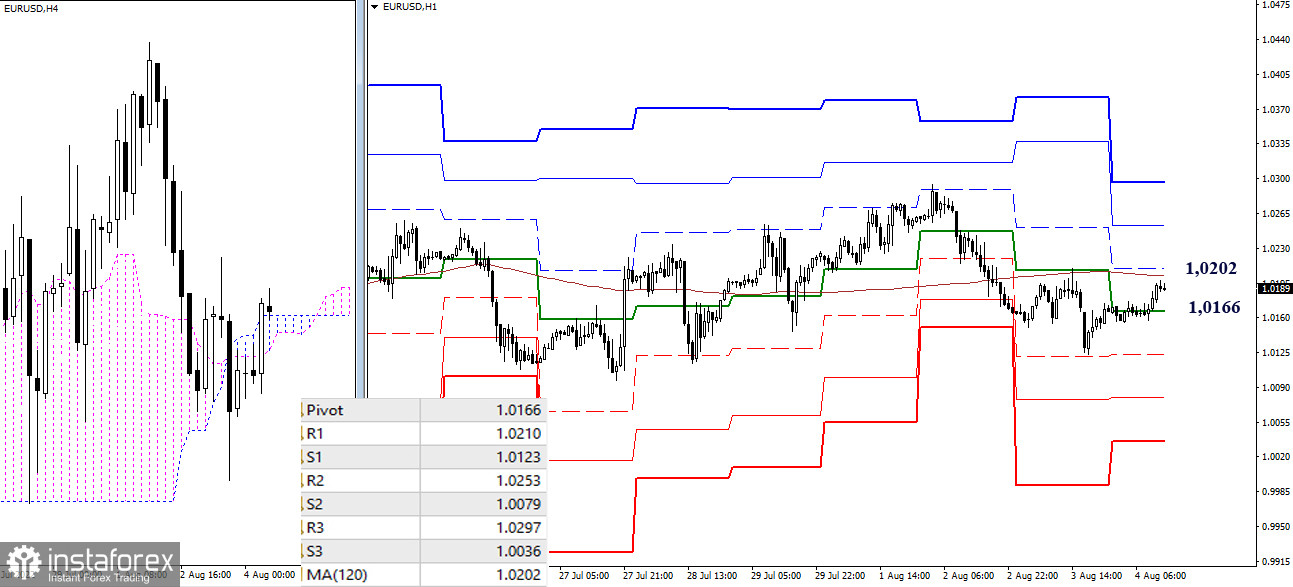

On the lower timeframes, the advantage remains on the side of the bears, but they have now corrected their positions to the weekly long-term trend (1.0202), thus approaching the equilibrium point. Possession of a level determines the presence of advantages. Additional upward targets within the day today can be noted at 1.0210 - 1.0253 - 1.0297 (resistance of the classic pivot points). And the targets for the decline are 1.0166 - 1.0123 - 1.0079 - 1.0036 (classic pivot points).

***

GBP/USD

Higher timeframes

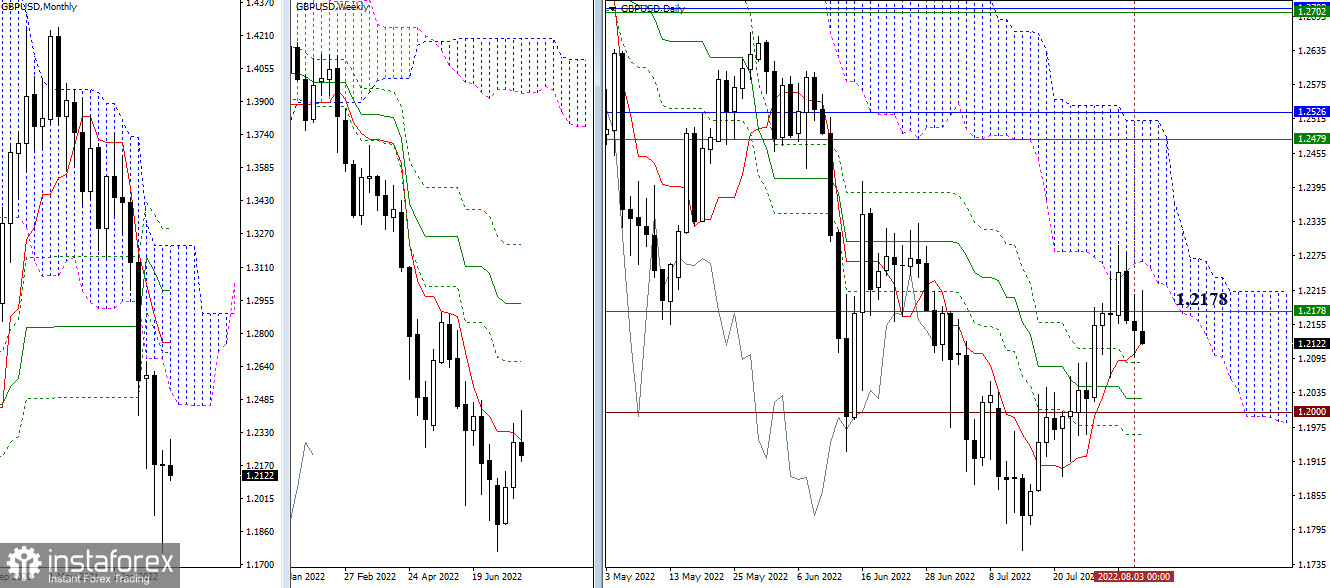

The pair met support yesterday in the zone of the daily short-term trend (1.2104), as a result, it returned to the zone of influence of the weekly short-term trend (1.2178). It is now important for bulls to go above 1.2266–93 (the lower limit of the daily cloud + the nearest high). For bears, the departure from 1.2178 and the breakdown of the daily short-term at 1.2127 will be important. Further attention will be directed to 1.2000 - 1.2026 (psychological level + daily medium-term trend).

H4 – H1

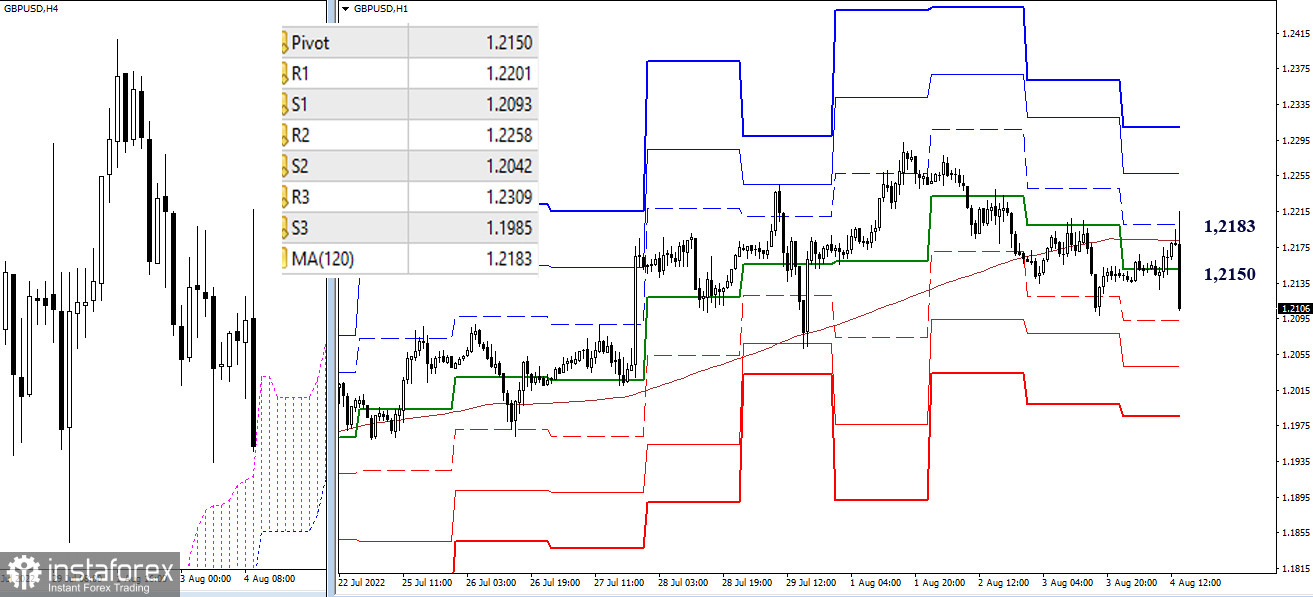

Bears have executed a corrective rise, tested the key level—the weekly long-term trend (1.2183) and have updated the correction low by now. The downward targets within the day today are 1.2093 - 1.2042 - 1.1985 (support of the classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română